If you’ve dipped your toes into cryptocurrency, you’ve probably heard the term HODL. It’s a popular strategy among crypto investors, but what does it mean, and how can you use it? This beginner-friendly guide will explain HODL, why it’s effective for long-term investing, and how to start—all in plain English. Let’s dive in!

What Does HODL Mean?

HODL is a crypto slang term that stands for “Hold On for Dear Life.” It means buying cryptocurrency and holding onto it for the long term, regardless of market ups and downs. The term originated in 2013 from a typo in a Bitcoin forum post, where a user wrote “I AM HODLING” instead of “holding” during a market crash.

HODLing is about staying patient and believing in the future value of your crypto, like Bitcoin or Ethereum, rather than selling when prices dip.

Why HODL Crypto?

Cryptocurrency prices can be volatile, with wild swings that scare off new investors. HODLing is a strategy that works for beginners because it focuses on the big picture. Here’s why it’s effective:

1. Avoids Market Timing

Predicting crypto price movements is tough, even for experts. HODLing means you don’t need to guess when to buy or sell—you just hold and wait for long-term growth.

2. Benefits from Long-Term Growth

Cryptos like Bitcoin and Ethereum have shown significant growth over years, despite short-term dips. HODLing lets you ride out volatility for potential big gains.

3. Reduces Emotional Stress

Constantly checking prices can lead to panic-selling or impulsive buys. HODLing encourages you to stay calm and stick to your plan, ignoring daily market noise.

4. Simple for Beginners

HODLing doesn’t require advanced trading skills or constant monitoring. It’s a straightforward way to invest in crypto with minimal effort.

How to HODL Crypto: A Step-by-Step Guide

Ready to HODL? Follow these simple steps to start your long-term crypto investing journey:

Step 1: Choose Your Cryptocurrency

Focus on established cryptocurrencies with strong track records, like Bitcoin (BTC) or Ethereum (ETH). These are less risky for long-term holding due to their widespread adoption and history.

Step 2: Pick a Trusted Exchange

Buy your crypto on a reputable cryptocurrency exchange like Coinbase, Binance, or Kraken. These platforms let you purchase crypto with dollars or other currencies and are user-friendly for beginners.

Step 3: Set a Budget

Decide how much you can afford to invest without affecting your finances. Crypto is volatile, so only invest money you’re comfortable holding for years, even if prices drop.

Step 4: Buy and Store Safely

Purchase your chosen crypto and transfer it to a secure digital wallet. For HODLing, consider a hardware wallet (like Ledger or Trezor) to keep your crypto offline and safe from hacks. Always protect your private key.

Step 5: Stay Patient and Ignore the Noise

Once you’ve bought your crypto, commit to holding it for the long term—think years, not months. Avoid checking prices daily, and don’t let market dips shake your confidence. HODLing is about patience.

Tips for Successful HODLing

To make HODLing work, keep these tips in mind:

- Use Dollar-Cost Averaging (DCA): Invest a fixed amount regularly (e.g., $50 monthly) to average out your purchase price and reduce risk.

- Research Your Crypto: Understand the fundamentals of Bitcoin, Ethereum, or other coins you HODL to build confidence in their long-term potential.

- Stay Informed: Follow crypto news to know about major developments, but don’t let short-term headlines sway your strategy.

- Diversify (Optional): HODL more than one crypto (e.g., Bitcoin and Ethereum) to spread risk, but keep it simple as a beginner.

Risks of HODLing Crypto

HODLing is a solid strategy, but it’s not risk-free. Here’s what to watch out for:

- Price Volatility: Crypto prices can crash and take years to recover. Be prepared to hold through downturns.

- Security Risks: Protect your wallet and private key. Use two-factor authentication (2FA) on exchanges and consider hardware wallets.

- Regulatory Changes: Governments may introduce crypto regulations that affect prices or usage. Stay updated.

- Scams: Avoid fake platforms or “guaranteed profit” schemes. Only use trusted exchanges and wallets.

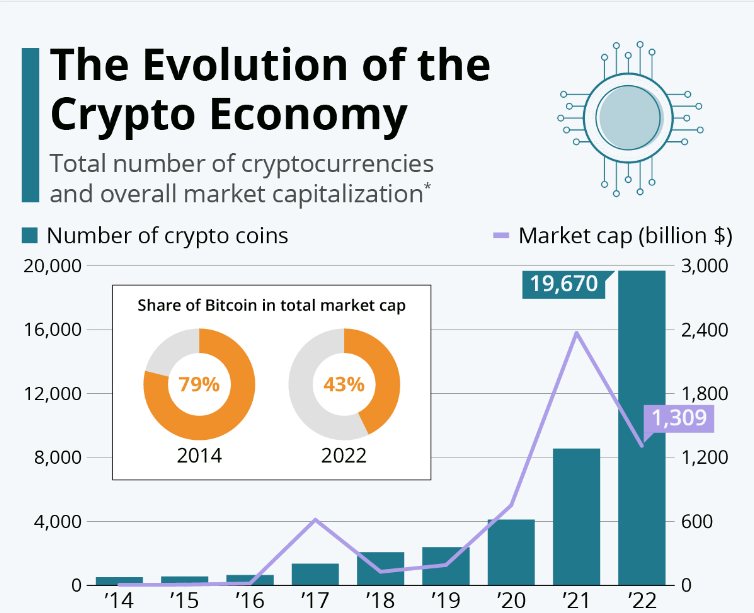

Why HODL in 2025?

In 2025, cryptocurrencies are more mainstream, with companies like Tesla and PayPal embracing them and countries like El Salvador using Bitcoin as legal tender. Despite volatility, the long-term outlook for cryptos like Bitcoin and Ethereum remains strong due to growing adoption and innovation. HODLing lets you tap into this potential without the stress of day trading.

Conclusion

HODLing is a simple, beginner-friendly way to invest in cryptocurrency for the long term. By buying and holding through market ups and downs, you can focus on the big picture and avoid emotional pitfalls. Choose trusted cryptos, store them safely, and stay patient—your HODL journey could pay off in 2025 and beyond!

Have questions about HODLing or crypto? Drop them in the comments, and let’s keep the conversation going!