If you’re new to cryptocurrency, you’ve probably heard about digital wallets. They’re essential for storing, sending, and receiving crypto like Bitcoin or Ethereum. But what exactly are they, and how do they work? This beginner-friendly guide explains digital wallets in simple terms, helping you understand their role in crypto and how to use them safely.

What is a Digital Wallet?

A digital wallet (or crypto wallet) is a tool that lets you store, manage, and use your cryptocurrency. It’s not a physical wallet that holds coins—instead, it stores your private keys, which are like passwords that give you access to your crypto on the blockchain, the technology behind cryptocurrencies.

Think of a digital wallet like a keychain: it holds the keys to your digital money, letting you send, receive, or check your balance securely.

How Do Digital Wallets Work?

Digital wallets interact with the blockchain to manage your cryptocurrency. Here’s a simple breakdown of how they work:

1. Storing Your Keys

Your wallet contains two types of keys:

- Public Key: Like an email address, you share it to receive crypto.

- Private Key: Like a password, it lets you spend or send crypto. Keep it secret!

The wallet uses these keys to access your crypto on the blockchain.

2. Sending and Receiving Crypto

To receive crypto, you share your wallet’s public key (or address). To send crypto, you use your private key to sign the transaction, proving you’re the owner. The blockchain records the transaction, and your wallet updates your balance.

3. Interacting with the Blockchain

Your wallet connects to the blockchain network, letting you check your balance or make transactions. It doesn’t store the actual crypto—your funds live on the blockchain, and the wallet just provides access.

Types of Digital Wallets

There are several types of digital wallets, each with different features. Here’s an overview:

1. Software Wallets

Software wallets are apps or programs you install on your phone or computer. They’re convenient for daily use but need good security practices.

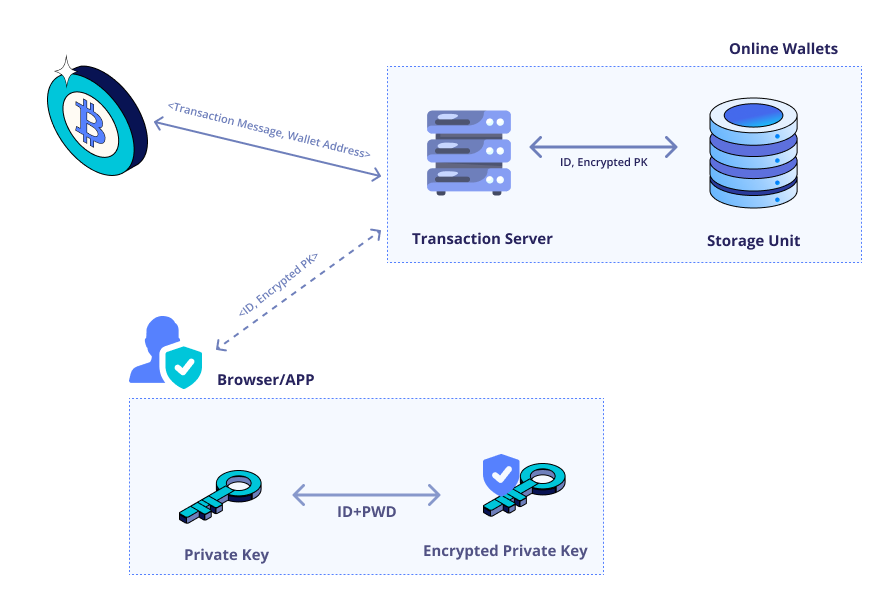

- Hot Wallets: Online wallets (e.g., MetaMask, Coinbase Wallet) connected to the internet. Great for quick transactions but more vulnerable to hacks.

- Desktop/Mobile Wallets: Apps like Exodus or Trust Wallet, stored on your device. Safer than hot wallets but still need protection.

2. Hardware Wallets

Hardware wallets are physical devices, like USB drives, that store your keys offline (e.g., Ledger, Trezor). They’re very secure because they’re not connected to the internet, making them ideal for large amounts of crypto.

3. Paper Wallets

A paper wallet is a printed piece of paper with your public and private keys (often as QR codes). It’s offline and secure but can be lost or damaged, so it’s less common today.

Why Are Digital Wallets Important?

Digital wallets are your gateway to the crypto world. Here’s why they matter:

- Security: They protect your private keys, keeping your crypto safe from thieves.

- Control: Wallets give you full ownership of your funds, unlike banks that can restrict access.

- Access: They let you interact with cryptocurrencies, from buying coffee with Bitcoin to trading NFTs.

- Flexibility: Wallets support multiple cryptocurrencies, so you can manage Bitcoin, Ethereum, and more in one place.

How to Choose the Right Digital Wallet

With so many options, picking a wallet depends on your needs. Here are some tips:

- For Beginners: Start with a user-friendly software wallet like Trust Wallet or Coinbase Wallet. They’re easy to set up and use.

- For Security: If you own a lot of crypto, invest in a hardware wallet like Ledger for offline storage.

- For Convenience: Hot wallets are great for frequent transactions, like buying or trading crypto.

- Check Compatibility: Ensure the wallet supports the cryptocurrencies you want to use (e.g., Bitcoin, Ethereum).

How to Keep Your Digital Wallet Safe

Your wallet’s security is only as strong as your habits. Here’s how to protect it:

1. Guard Your Private Key

Never share your private key or recovery phrase (a set of words to restore your wallet). Store them offline, like in a safe, not on your phone or computer.

2. Use Two-Factor Authentication

If your wallet supports it, enable two-factor authentication (2FA). This adds an extra step, like a code sent to your phone, to access your funds.

3. Beware of Scams

Avoid phishing emails or fake websites asking for your keys. Only download wallets from trusted sources, like official websites or app stores.

4. Back Up Your Wallet

Save your recovery phrase in a secure place. If you lose your device, this phrase lets you recover your wallet and funds.

Common Mistakes to Avoid

Newbies often make these wallet mistakes—steer clear to stay safe:

- Sharing Keys: Giving out your private key or recovery phrase can lead to stolen funds.

- No Backup: Losing your recovery phrase means losing access to your crypto forever.

- Using Unsecure Devices: Don’t install wallets on a hacked or public computer.

- Ignoring Updates: Keep your wallet software updated to fix security vulnerabilities.

Real-World Example: Using a Digital Wallet

Imagine you want to buy a digital artwork (NFT) with Ethereum:

- You set up a software wallet like MetaMask.

- You buy Ethereum on an exchange and send it to your wallet’s public address.

- You connect your wallet to an NFT marketplace and use your private key to sign the purchase.

- The blockchain records the transaction, and the NFT is yours!

Conclusion

Digital wallets are your key to the cryptocurrency world, letting you store, send, and receive digital money securely. Whether you choose a software wallet for convenience or a hardware wallet for safety, understanding how they work is the first step to using crypto confidently. Start small, keep your keys safe, and explore the exciting possibilities of digital finance.