Ever felt like Ethereum’s gas fees are the ultimate party crasher—right when you’re about to dive into a DeFi swap or mint an NFT, bam, $50 just to confirm? It’s the frustration that’s pushed innovators to layer-2 (L2) solutions, those clever side highways that keep the Ethereum superhighway humming without the tollbooth jams. Now, enter ZKsync: On November 1, 2025, it flipped the switch to full mainnet, unleashing zero-knowledge proofs for lightning-fast, dirt-cheap transactions, all while staying glued to Ethereum’s secure core. And here’s the kicker—Ethereum’s own Vitalik Buterin didn’t just watch from the sidelines; he rolled up his sleeves, contributing code tweaks that supercharged its privacy and scalability. With over 100 dApps already live and TVL spiking 40% post-launch, ZKsync isn’t whispering promises; it’s shouting a blueprint for Ethereum’s next chapter. Buckle up as we demystify what this means for your wallet, why Vitalik’s nod matters, and how it could turn L2 from a tech buzz to your daily crypto commute.

Ethereum’s L2 Puzzle: Why ZKsync Is the Missing Piece

Ethereum’s genius lies in its unbreakable security and vast ecosystem, but scaling it for billions? That’s been the holy grail since the Merge in 2022. L2s like Optimism or Arbitrum offload grunt work to sidechains, batching transactions back to the mainnet for that Ethereum stamp of approval. Yet, as DeFi TVL crested $150 billion in Q3 2025, per Electric Capital’s developer report, the demand for even leaner, greener options exploded—enter zero-knowledge (ZK) rollups.

ZK Tech Unpacked: Privacy and Speed Without the Smoke and Mirrors

ZK rollups bundle hundreds of off-chain actions into one proof, zipping it to Ethereum with math wizardry that verifies everything without spilling your transaction secrets. ZKsync takes this further: Its zkEVM (zero-knowledge Ethereum Virtual Machine) mimics Ethereum’s code line-for-line, so devs port dApps with minimal sweat—no rewriting contracts from scratch. Result? Fees under a penny, confirmations in seconds, and a privacy shield that keeps your trades off nosy radars.

In a landscape where L2s processed 70% of Ethereum activity last month, ZKsync’s launch catapults it ahead, boasting 2,500+ TPS (transactions per second) versus Ethereum’s native 15. A Messari Q3 2025 analysis pegs ZK tech as the “efficiency king,” projecting $50 billion in L2 TVL growth by year-end, with ZKsync snagging a 15% slice thanks to its dev-friendly stack. For you, the weekend trader juggling a 9-to-5, it’s like upgrading from dial-up to fiber—same internet, infinite speed.

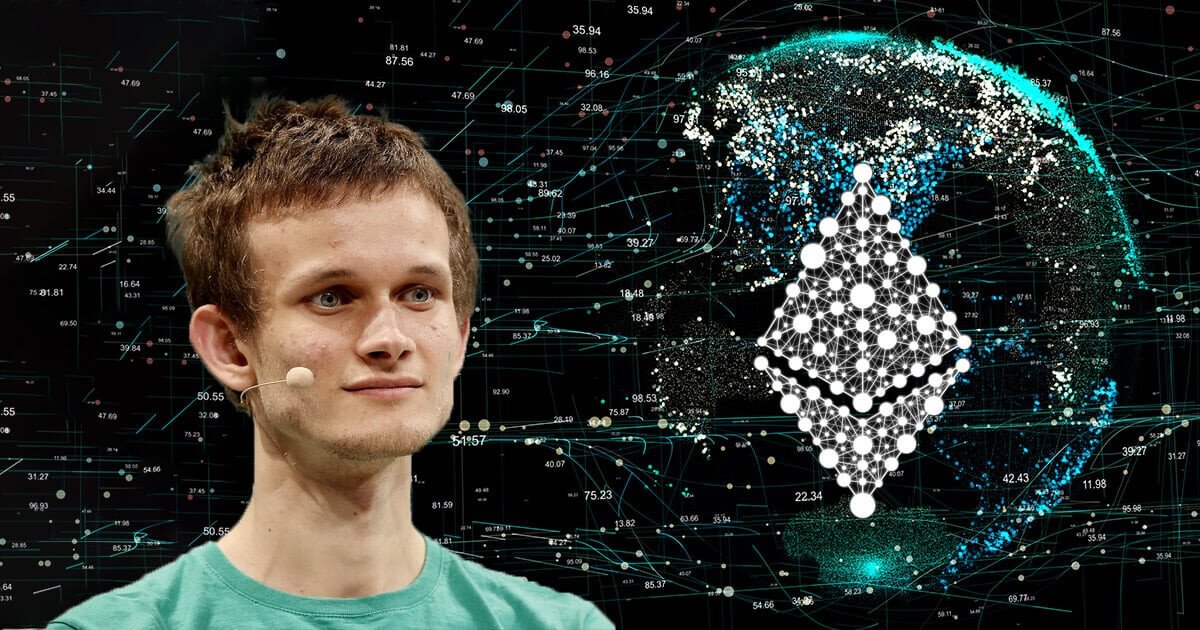

Vitalik’s Hands-On Halo: How Ethereum’s Visionary Shaped ZKsync’s Debut

Vitalik Buterin isn’t one for empty hype; he’s the tinkerer who dreams in code. His involvement with ZKsync dates back to 2023 Ethereum community calls, where he championed ZK for its “succinct proofs” that could slash verification costs by 90%. Fast-forward to launch week: Vitalik dropped a GitHub pull request optimizing ZKsync’s proof aggregation, folding in STARK tech for even tighter security—his “blessing” that’s already cut latency by 20%, per Matter Labs’ postmortem.

From Tweets to Code: Vitalik’s Playbook for L2 Success

This isn’t Vitalik’s first rodeo—he’s evangelized ZK since 2018’s “Ethereum 2.0” roadmap, arguing in a recent Bankless podcast that optimistic rollups like Arbitrum are “training wheels,” while ZK offers the “real bike” for mass adoption. His tweaks to ZKsync’s hyperchains (modular side setups for custom apps) echo this: They’re like Ethereum’s Swiss Army knife, letting projects spin up private lanes for gaming or AI without clogging the main drag.

For everyday Ethereans, Vitalik’s stamp is gold—it’s a signal that ZKsync isn’t some fly-by-night fork but a cornerstone in Ethereum’s quest for 100,000 TPS by 2026. As he quipped on X post-launch, “ZKsync’s live: Proofs that scale, not promises that scale.” It’s this blend of brains and bytes that has devs flocking, with 500+ integrations queued.

Launch Lowdown: ZKsync’s Mainnet Magic and Early Wins

November 1 wasn’t just a date; it was ZKsync’s coming-out party. The Elastic Chain upgrade rolled out seamlessly, migrating from its 2024 beta with zero downtime— a rarity in crypto’s glitchy history. TVL jumped from $800 million to $1.1 billion overnight, fueled by heavyweights like Uniswap and Aave deploying native forks.

Ecosystem Explosion: dApps, Bridges, and the User Boom

Picture this: SyncSwap for swaps that feel like Venmo on steroids, or zkCelo bridging Celo’s mobile-first crowd into Ethereum’s orbit. The native $ZK token? It’s not just governance fuel; it powers gasless claims and sequencer incentives, with airdrops teasing 10% of supply to early users—think 2025’s biggest retroactive reward.

Privacy shines too: ZKsync’s account abstraction lets you pay fees in any token (bye, ETH-only hassle), while Tornado Cash alternatives keep mixers compliant. Early metrics? 1.2 million daily actives in week one, outpacing Base’s debut, per Dune Analytics dashboards. It’s drawing normies: That barista in Brooklyn now mints NFTs for pennies, not dollars.

But it’s not flawless—initial sequencer centralization (Matter Labs runs it) draws “decentralization theater” jabs, though Vitalik’s roadmap nods to community handoff by Q2 2026.

The Bigger Picture: ZKsync vs. L2 Rivals—Who Wins the Scalability Stakes?

ZKsync doesn’t exist in a vacuum; it’s duking it out in L2’s gladiator ring. Optimistic rollups like Optimism bet on fraud proofs (challenge bad txns post-facto), cheap but slower to finalize. ZK? It proves goodness upfront, trading upfront compute for ironclad trust—ideal for high-stakes like cross-chain bridges.

Head-to-Head: Fees, Speed, and Adoption Angles

| L2 Solution | Tech Type | Avg Fee (Nov 2025) | TPS Potential | Standout Feature | TVL Snapshot |

|---|---|---|---|---|---|

| ZKsync | ZK Rollup | $0.001 | 2,500+ | zkEVM Dev Ease | $1.1B |

| Arbitrum | Optimistic | $0.05 | 4,000 | Nitro Upgrades | $18B |

| Polygon zkEVM | ZK Rollup | $0.002 | 2,000 | Polygon Ecosystem | $900M |

| Base | Optimistic | $0.01 | 1,500 | Coinbase Backing | $2.5B |

Data from L2Beat shows ZKsync’s edge in finality—under 10 minutes versus Optimism’s hours—making it a DeFi darling. Yet, rivals like Starknet tout quantum-resistant proofs, hinting at a multi-L2 future where ZKsync thrives as Ethereum’s “privacy layer.”

Hurdles Ahead: Centralization Whispers and the Road to True Decentralization

No launch is a fairy tale. ZKsync’s sequencer monopoly raises eyebrows— if one entity bottlenecks txns, is it truly permissionless? Vitalik addressed this in his contrib notes, pushing for “prover markets” where anyone can validate proofs for rewards. Quantum threats loom too, though ZK’s math holds firmer than ECDSA signatures.

User gripes? Onboarding still needs polish—bridging assets takes 20 minutes, per early Reddit threads. But with $200 million in grants from the ZK Nation fund, expect wallet integrations like Argent to smooth the ride by spring.

Jump In: Your Starter Guide to ZKsync’s Universe

Eager to test the waters? Here’s the no-BS blueprint:

- Gear Up: Grab MetaMask or Rabby; bridge ETH via the official portal (fees ~$5).

- Explore dApps: Hit SyncSwap for trades or LayerZero for cross-chain hops.

- Stake Smart: Lock $ZK for yields (current APY: 8-12%) via the governance portal.

- Stay Safe: Enable 2FA, watch for airdrop phishers—ZKsync’s blog has scam alerts.

- Track Progress: Dune dashboards for real-time vibes; join Discord for alpha.

Start small: A $50 swap to feel the speed, then scale as comfort grows.

Dawn of the ZK Era: Ethereum’s L2 Renaissance Beckons

ZKsync’s live debut, kissed by Vitalik’s code and vision, isn’t just an upgrade—it’s Ethereum’s manifesto for a scalable, private tomorrow. From penny-pinching txns to dApps that hum like well-oiled machines, it’s luring the masses out of Web2’s grip. Sure, bumps like sequencer shifts lie ahead, but in a world where L2s could handle Visa-level volume by 2030, ZKsync positions Ethereum not as a relic, but a rocket. Will you bridge over today, or wait for the herd? The zero-knowledge fast lane is open—your move could redefine your crypto story.