Imagine a world where your personal data stays hidden while AI algorithms crunch numbers on it, or where blockchain trades happen at lightning speed without crashing under pressure. That’s the thrilling intersection of AI and cryptocurrency unfolding right now. As we step into 2026, technologies like Zero-Knowledge Proofs (ZKP), Solana, and Hyperliquid aren’t just buzzwords—they’re reshaping how we handle privacy, speed, and trading in a digital economy. Whether you’re a curious beginner dipping your toes into crypto or someone eyeing the next big trend, this guide breaks it down simply, highlighting why these stand out in the AI-crypto mashup.

What Are Zero-Knowledge Proofs (ZKP)?

Zero-Knowledge Proofs, or ZKP, are like a magic trick in cryptography: they let you prove something is true without revealing any details about it. Think of it as showing you’re over 21 at a bar without flashing your full ID— the bartender knows you’re legal, but not your birthday or address.

In the crypto world, ZKP powers privacy-focused transactions on blockchains, making sure sensitive info stays secret during trades or verifications. But its real game-changer is in AI: ZKP enables “privacy-preserving computation,” where AI models can analyze encrypted data without exposing it, tackling big issues like data bias and ownership in centralized AI systems. This is huge for sectors like healthcare or finance, where AI needs to process personal info securely.

Looking ahead to 2026, projects like the ZKP token are building full ecosystems around this, using tools like zk-SNARKs for decentralized AI compute. Analysts see it as a high-ROI play, with potential for 1000x returns thanks to its focus on real utility over hype. It’s not just theory—ZKP is already integrating with AI for verifiable outputs, like confirming an AI model’s results without sharing the raw data.

A Zero-Knowledge Proof: Improving Privacy on a Blockchain | Altoros

Exploring Solana: The Speed Demon of Blockchains

Solana is a blockchain designed for one thing: blistering speed. Unlike slower networks that choke during high traffic, Solana handles thousands of transactions per second at pennies per pop, making it ideal for everyday use like gaming or payments.

In crypto trends for 2026, Solana shines in tokenization—the process of turning real-world assets like stocks or bonds into digital tokens. It’s already grabbing a slice of the stablecoin market, with projections that it could process billions in value if tokenization hits $4 trillion. On the AI side, Solana’s low costs and high throughput make it perfect for “agentic commerce,” where AI agents autonomously handle transactions, like bots trading or paying for services without human input.

Despite past outages, a 2025 upgrade has boosted its reliability, positioning Solana as a top pick for AI-crypto hybrids. Investors like it for its ecosystem revenue, which hit nearly $3 billion last year, signaling strong growth potential.

Diving Deep into Solana and Blockchain | by Prapti Sharma | Medium

Hyperliquid: Revolutionizing Perpetual Trading

Hyperliquid is a decentralized exchange (DEX) specializing in perpetual futures—contracts that let you bet on asset prices without expiration dates. It’s like trading stocks on steroids, but fully on-chain and non-custodial, meaning you control your funds.

In the 2026 crypto narrative, Hyperliquid leads the “perp DEX” wave, capturing massive trading volumes (over $26 billion daily) with sub-second executions and deep liquidity. Its HYPE token fuels the ecosystem, with buybacks from protocol fees driving value. While not directly AI-focused, it ties into the sector by enabling leveraged trades on AI-related assets, like tokenized GPUs or compute tokens, amid the AI boom.

Hyperliquid’s edge? It runs on its own L1 blockchain optimized for trading, outpacing rivals with $854 million in 2025 fees alone. As AI agents need fast, cheap micropayments, Hyperliquid could become a go-to for machine-to-machine economies.

What is Hyperliquid (HYPE) – A Comprehensive Overview

Comparing ZKP, Solana, and Hyperliquid in the AI-Crypto Landscape

These three aren’t rivals—they complement each other in the AI-crypto puzzle. ZKP handles privacy, Solana provides the speed, and Hyperliquid delivers the trading muscle. Here’s a quick breakdown:

| Aspect | ZKP | Solana | Hyperliquid |

|---|---|---|---|

| Core Strength | Privacy & Verifiable AI | High-Speed Transactions | Perpetual DEX Trading |

| AI Role | Encrypted Data Processing | AI Agent Payments | Leveraged AI Asset Trades |

| 2026 Potential | 1000x ROI via Utility | Tokenization Boom | $50–$123 Price Surge |

| Key Challenge | Adoption Speed | Past Network Stability | Competition from Zero-Fee Rivals |

In comparisons, ZKP stands out for its privacy-first approach in AI data markets, while Solana excels in scalability for agentic economies. Hyperliquid, meanwhile, dominates perps but faces threats from emerging DEXs. Together, they address AI’s needs for trust, efficiency, and financial tools in crypto.

The Intersection of AI and Cryptocurrency: A New Era Unfolds in …

Future Outlook for 2026 and Beyond

By 2026, expect ZKP to lead in decentralized AI privacy, with networks like it hitting $1.7 billion valuations. Solana could surge if AI-crypto convergence accelerates, potentially tripling its market share in stablecoins and RWAs. Hyperliquid might see HYPE climb to $123 if perp volumes explode, but watch for rivals eating into its 69% market dominance.

Overall, the AI-crypto sector could redefine finance, with these technologies at the forefront. Keep an eye on regulatory shifts—they’ll make or break adoption.

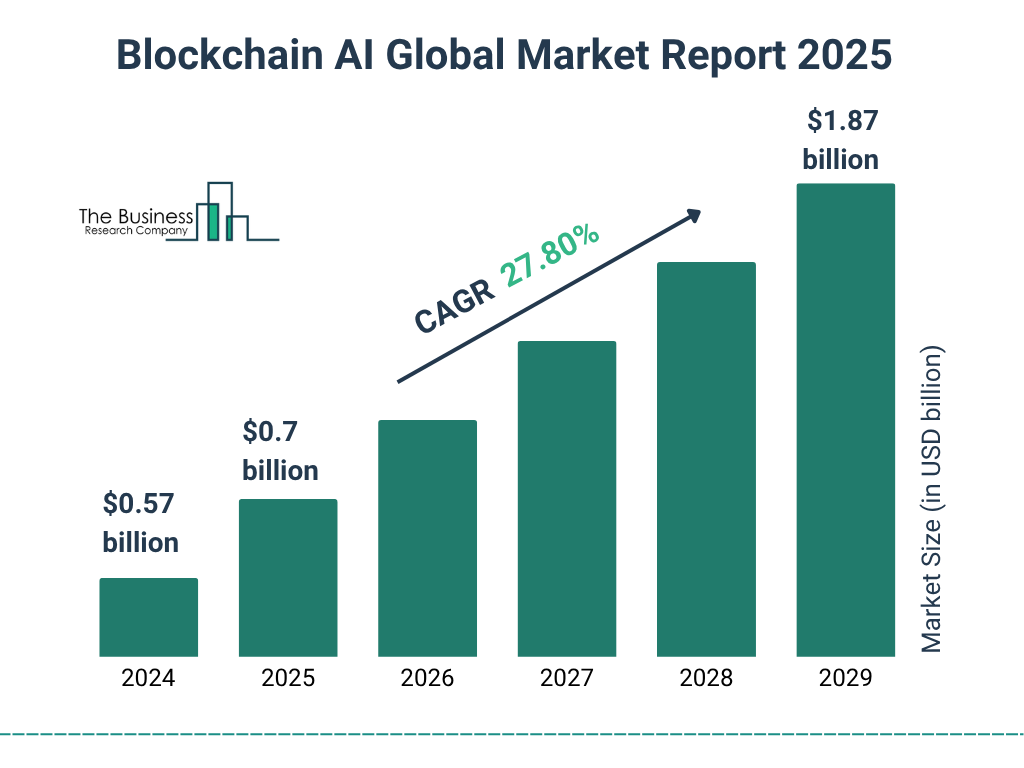

thebusinessresearchcompany.com

Blockchain AI Market Report 2025-2034 |Trends

In a nutshell, ZKP, Solana, and Hyperliquid offer accessible entry points into the AI-crypto revolution. They’re not just tech—they’re tools for a more private, fast, and tradable future. Dive in with research, and who knows? You might spot the next big wave early.