You’ve probably seen those eye-catching ads promising effortless crypto income—log in, pick a plan, and watch thousands roll in daily without lifting a finger. In 2025, platforms like ZA Miner are fueling this excitement with bold claims of automated cloud mining delivering up to $12,000 or more per day. It sounds like the perfect side hustle for anyone wanting to dip into crypto without the hassle.

But as more people chase these big numbers, real questions emerge about whether the rewards match the reality—or if hidden pitfalls could turn excitement into regret.

Understanding ZA Miner and Its Automated Mining Model

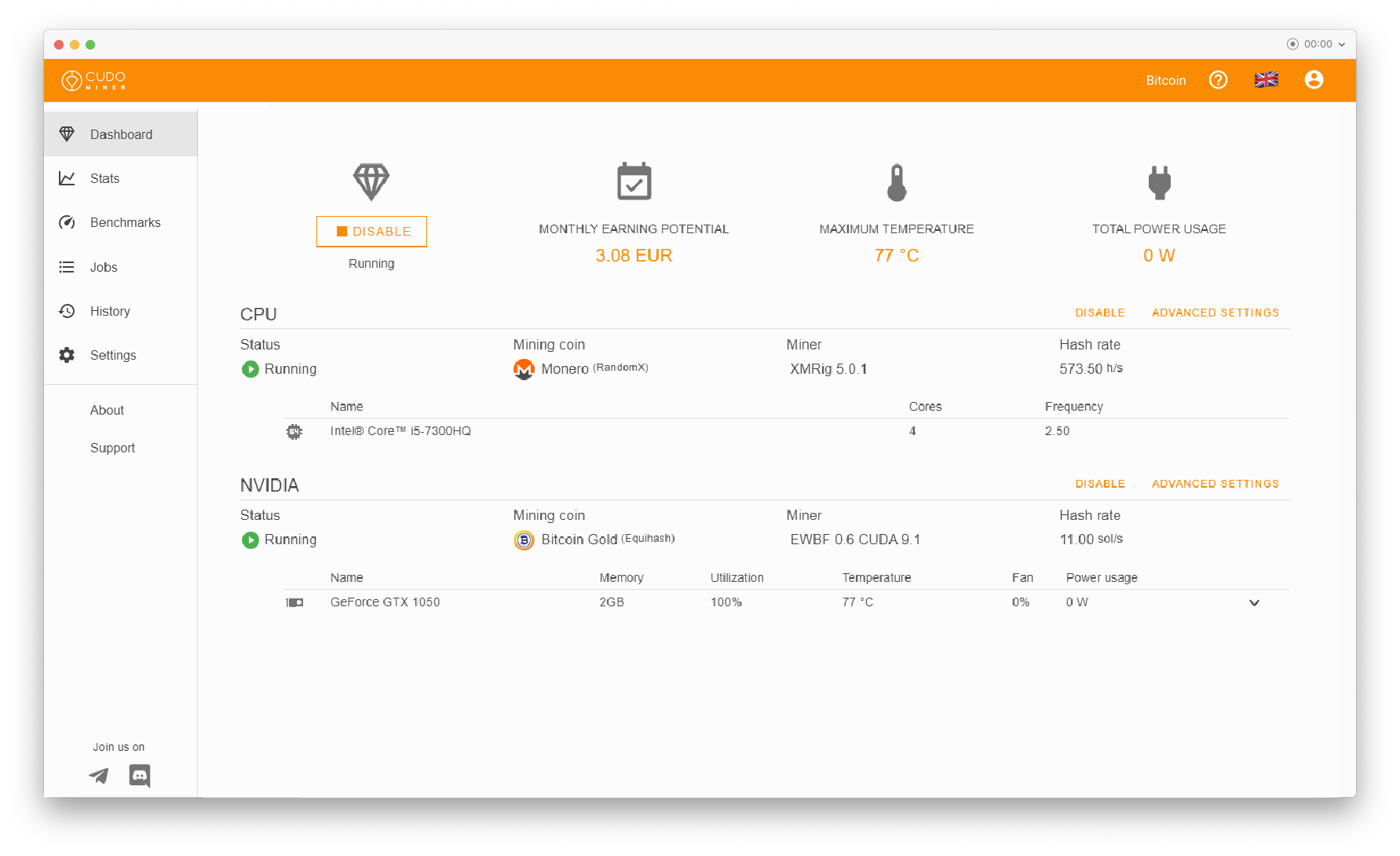

ZA Miner markets itself as an easy-entry cloud mining service, often highlighting AI optimization, renewable energy use, and contracts for coins like Bitcoin, Ethereum, and Dogecoin. Users reportedly start with a free trial bonus, then upgrade to paid plans promising fixed daily payouts that can scale dramatically with larger investments.

The appeal lies in automation: no hardware setup, no electricity worries—just daily earnings credited to your account. Some promotional materials showcase tiers where high-end contracts yield extraordinary daily figures, drawing in newcomers eager for passive income.

The Allure—And Skepticism—Surrounding High Daily Earnings

Claims of $12K (or higher) daily returns grab attention because they suggest life-changing income from crypto mining. In theory, cloud mining rents remote power to earn rewards proportionally.

However, legitimate mining profits depend on volatile elements like coin prices, network difficulty, and operational costs. Fixed, ultra-high guarantees stand out as unusual, as noted by the Federal Trade Commission (FTC), which warns that “only scammers will guarantee profits or big returns” in investments.

Key Concerns Raised by Users and Analysts

Independent feedback reveals patterns that warrant caution.

Withdrawal Challenges and Account Issues

Numerous reports on platforms like Trustpilot describe initial smooth experiences turning problematic—accounts locking, withdrawals requiring extra deposits, or sites becoming inaccessible. These align with common tactics in cloud mining complaints tracked by sources like Chainalysis and CoinLaw.

Unrealistic Return Structures

Heavy reliance on referral commissions and escalating “activation” fees mirrors Ponzi-like setups, where sustainability depends on new user funds rather than actual mining output.

Lack of Transparent Proof

While claims include vast data centers and regulatory compliance, verifiable evidence remains limited, fueling doubts in an industry where opacity often signals risk.

Safer Ways to Approach Cloud Mining or Crypto Earnings

If you’re interested in crypto income, focus on proven strategies.

Vet Platforms Thoroughly

Seek established providers with audited operations and clear profitability tied to market conditions—not fixed highs. Check direct regulator sites for licenses.

Test Conservatively

Begin with the smallest possible amount and prioritize quick withdrawals to verify functionality.

Prioritize Personal Control

Route earnings promptly to a secure hardware wallet you own, reducing platform dependency.

Build a Balanced Approach

Spread efforts across reputable exchanges, staking, or direct holdings rather than concentrating on one service.

Wrapping Up: Informed Choices Over Hype

Automated cloud mining holds potential for convenient crypto exposure in 2025, but platforms touting extreme daily earnings like $12K often come with significant red flags. Insights from the FTC and industry reports highlight that guaranteed massive returns rarely materialize without substantial risks.

Treat crypto ventures like any investment: Research deeply, start modestly, and only risk what you’re comfortable losing. Sustainable gains come from patience and prudence, not promises that seem too extraordinary to be true.