Ever wonder if those gut feelings about Bitcoin surging again are backed by real data—or just wishful thinking? Right now, in early 2026, a respected Wall Street firm is flashing a green light that hasn’t appeared in months, hinting at healthier market conditions ahead. VanEck, a major asset manager with deep roots in crypto investing, just announced their proprietary breadth model has turned positive for the first time since April 2025. This isn’t hype; it’s a measured signal that could help everyday investors spot the early stages of a potential bull run. Let’s unpack it simply and see why this matters for anyone holding or eyeing Bitcoin.

VanEck debuts a multi-token crypto-based fund – Cryptonary

What Exactly Is Market Breadth, and Why Does It Matter for Bitcoin?

Market breadth is like checking the health of an entire team, not just the star player. In stocks, it measures how many companies are rising versus falling. For crypto, VanEck applies a similar idea: instead of focusing solely on Bitcoin’s price, their model looks at performance across a basket of top digital assets, like those in their Top 100 Crypto Index.

When breadth is weak, only a few big names (often just Bitcoin) drive gains, which can signal fragility. But when more coins start outperforming Bitcoin, it shows broader participation— a classic sign of building strength and sustainability in uptrends.

Market Breadth: Definition, How it Works, Purpose, and Indicators

In plain speak, positive breadth suggests the rally isn’t fragile; it’s got roots spreading wide, making it more likely to last.

The Big News: VanEck’s Model Flips Bullish in January 2026

On January 5, 2026, Martin Leinweber from MarketVector (VanEck’s index arm) highlighted stabilizing breadth, with more index constituents beating Bitcoin’s returns. Matthew Sigel, VanEck’s Head of Digital Assets Research, amplified it, calling it the firm’s first Bitcoin bull signal in months—and notably, the first since April 7, 2025, which nailed the market bottom last year.

This ties into their MarketVector Crypto Heat Index, a “thermometer” for the market that blends technical and structural data to spot undervalued or overheated conditions. Historically, buy signals from similar setups have preceded solid Bitcoin gains, like median 20.4% returns in 90 days and 76.7% over a year.

For regular folks, this means the crypto market might be shaking off late-2025 weakness, setting up for fresher momentum without relying just on Bitcoin alone.

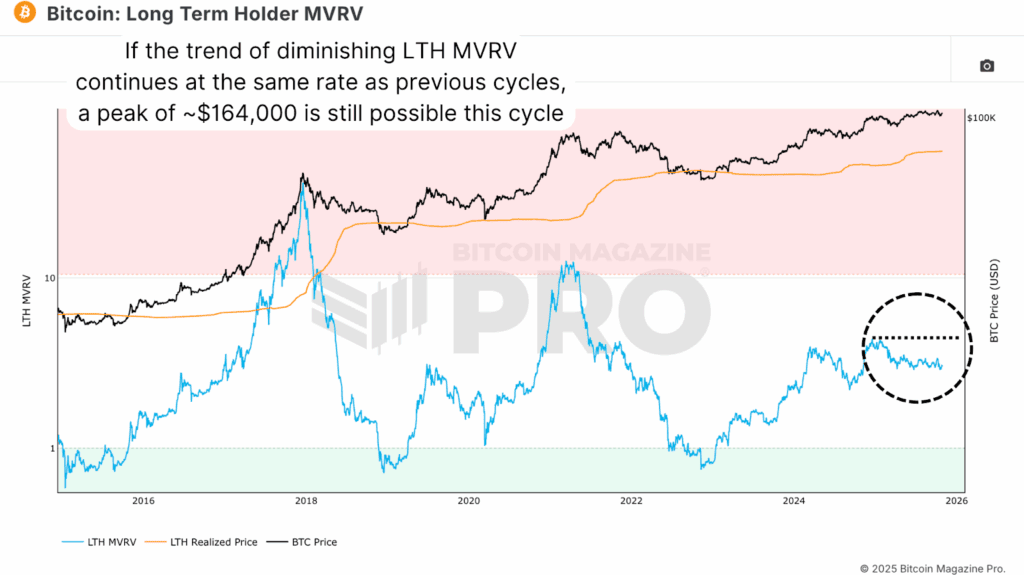

This Bitcoin Price Cycle Data Reveals Next Major Bull Run

Historical Context: Why This Signal Has Worked Before

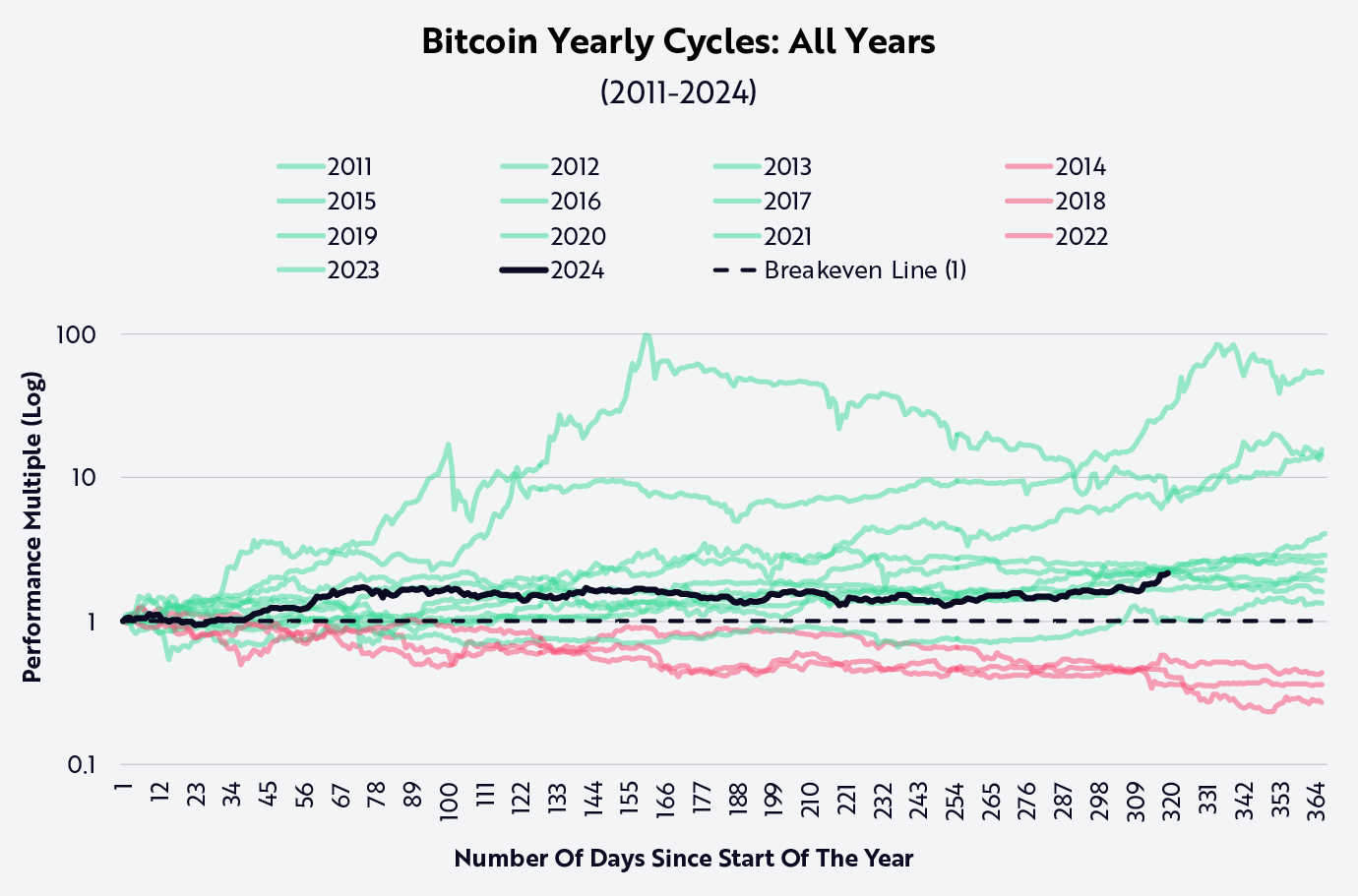

VanEck’s April 2025 signal came amid extreme pessimism and marked a durable low point. Now, with similar traits—moderated volatility, exhausted selling, and conservative investor positioning—the January 2026 flip could foreshadow stabilization turning into growth.

Breadth improving often precedes Bitcoin dominance peaking, hinting at money flowing into altcoins too, which broadens the rally. Past patterns show these shifts lay groundwork for longer recoveries rather than quick pumps that fizzle.

How Everyday Investors Can Use Breadth to Spot Bull Runs

You don’t need fancy tools to apply this thinking. Watch for signs like:

- More altcoins gaining against Bitcoin over weeks.

- Rising trading volumes across the market, not just BTC.

- Sentiment shifting from fear to cautious optimism.

Combine breadth with basics like Bitcoin’s price holding key supports or ETF inflows picking up. VanEck’s signal acts as a contrarian nudge: when most feel burned out (like late 2025), that’s often when foundations rebuild.

1,674 Bitcoin Bull Market Stock Vectors and Vector Art | Shutterstock

Tools like CoinMarketCap dominance charts or free breadth trackers can help you monitor this yourself.

Potential Risks and What to Watch Next

No indicator is foolproof. Crypto remains volatile, influenced by regulations, macro events, and sentiment swings. This signal points to stabilization, not guaranteed moonshots. If breadth weakens again or external shocks hit, gains could stall.

Still, with Bitcoin around $93,000-$94,000 as of early January 2026 and institutional interest growing, positive breadth adds a layer of confidence for patient holders.

Bitcoin Cycles, Entering 2025

VanEck’s breadth model turning positive marks an encouraging milestone—the first real bull whisper since last year’s bottom. It reminds us that strong markets lift many boats, not just one. Whether you’re a longtime HODLer or dipping toes in, understanding breadth can help you navigate cycles with more clarity. Keep watching participation; if it keeps broadening, the next leg up might feel more solid than speculative. Stay informed, manage risk, and enjoy the ride responsibly.