Cryptocurrency trading is an exciting way to dive into the world of digital currencies like Bitcoin, Ethereum, and more. For beginners, it can seem complex with all the jargon and fast-moving markets, but it’s easier than you think to get started. This guide breaks down the essentials of crypto trading in simple terms, offering step-by-step instructions, safety tips, and strategies to help you trade with confidence.

What is Cryptocurrency Trading?

Crypto trading involves buying and selling cryptocurrencies on an exchange to profit from price changes. Unlike traditional investing, where you might hold assets for years, crypto trading often focuses on shorter-term opportunities due to the market’s volatility. You can trade on platforms like Coinbase or Binance, which act as marketplaces for digital currencies.

The most common type for beginners is spot trading, where you buy or sell crypto at the current market price. More advanced methods, like futures or margin trading, are riskier and best avoided until you gain experience.

Why Trade Cryptocurrency?

Crypto trading is appealing for several reasons:

- High Potential Returns: Crypto prices can soar, offering profit opportunities (though losses are also possible).

- 24/7 Access: The crypto market never closes, so you can trade anytime.

- Low Entry Barrier: You can start with as little as $10 on most exchanges.

- Variety: Thousands of coins, from Bitcoin to altcoins like Solana, give you plenty of choices.

However, crypto trading carries risks due to price volatility, so it’s important to start with a clear plan and only risk what you can afford to lose.

Step-by-Step Guide to Start Trading Cryptocurrency

Ready to trade? Follow these steps to begin your crypto trading journey.

Step 1: Understand the Basics

Before jumping in, learn key trading terms:

- Market Order: Buy or sell crypto instantly at the current price.

- Limit Order: Set a specific price to buy or sell, executed only when the market hits that price.

- Wallet: A digital tool to store your crypto securely.

- Exchange: A platform where you trade cryptocurrencies.

Check out CoinDesk’s Learn section for beginner-friendly resources to build your knowledge.

Step 2: Choose a Trusted Crypto Exchange

An exchange is where you’ll buy, sell, and trade crypto. Here are three beginner-friendly options:

- Coinbase: Simple interface, ideal for beginners, but fees are higher.

- Binance: Offers low fees and a huge coin selection, slightly more complex.

- Kraken: Balances ease of use with strong security and competitive fees.

When choosing, consider fees, security features, and available coins. For a simple start, try Coinbase. For more options, explore Binance.

Step 3: Set Up Your Account

Sign up on your chosen exchange with an email and a strong, unique password. Most platforms require identity verification (KYC) to comply with regulations, so have a photo ID ready. To secure your account:

- Enable two-factor authentication (2FA) using an app like Google Authenticator.

- Verify the exchange’s URL to avoid phishing sites.

- Never reuse passwords from other accounts.

Step 4: Deposit Funds

Add money to your exchange account via bank transfer, debit card, or credit card. Bank transfers are typically the cheapest but may take 1–3 days. Start with a small amount (e.g., $50) to test the platform and minimize risk.

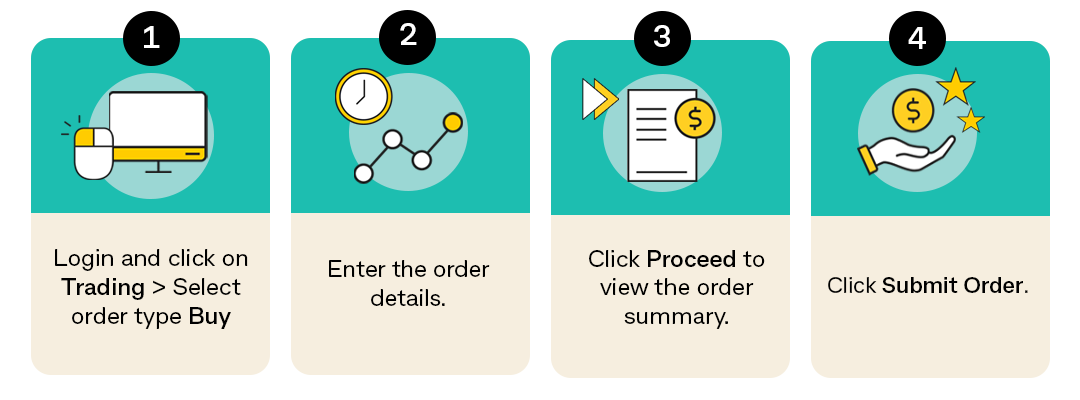

Step 5: Make Your First Trade

Go to the “Trade” or “Buy/Sell” section of the exchange. Select a cryptocurrency (e.g., Bitcoin or Ethereum), choose a market order for an instant trade, or set a limit order for a specific price. Review the transaction fees and confirm. Your crypto will appear in your exchange wallet.

Tip: For safer long-term storage, transfer your crypto to a personal wallet like Trust Wallet or a hardware wallet like Ledger.

Simple Trading Strategies for Beginners

You don’t need to be a pro to trade effectively. Here are two beginner-friendly strategies:

- Buy and Hold (HODL): Buy crypto and hold it for months or years, betting on long-term growth. This is low-maintenance and ideal for beginners.

- Dollar-Cost Averaging (DCA): Invest a fixed amount regularly (e.g., $25 weekly) to spread out your risk and avoid buying at peak prices.

Avoid risky strategies like day trading or leverage trading until you’re more experienced, as they can lead to significant losses.

Tips for Safe and Smart Crypto Trading

Crypto trading is exciting but risky. Follow these tips to trade wisely:

- Only Risk What You Can Lose: Crypto prices are volatile, so never trade with money you need for essentials.

- Research Before Buying: Don’t chase hyped coins—understand their purpose and technology.

- Keep Fees Low: Compare exchange fees to maximize your profits.

- Stay Disciplined: Avoid emotional trading during market highs or lows. Stick to your plan.

- Secure Your Account: Use 2FA, avoid public Wi-Fi, and store large amounts in a personal wallet.

- Beware of Scams: Ignore unsolicited messages or “guaranteed profit” schemes.

Learn more about scam prevention at CoinDesk.

Common Beginner Mistakes to Avoid

Steer clear of these pitfalls to protect your funds:

- FOMO Trading: Buying coins based on social media hype often leads to buying at peak prices.

- Overtrading: Frequent trades rack up fees and increase risk.

- Neglecting Security: Leaving crypto on an exchange or skipping 2FA can expose you to hacks.

- Ignoring Taxes: Keep records of your trades, as crypto profits may be taxable in many countries.

What to Do After Your First Trade

Congratulations on starting your trading journey! Here’s how to keep growing:

- Monitor Your Portfolio: Use apps like CoinGecko or CoinMarketCap to track prices.

- Stay Updated: Follow crypto news on Cointelegraph or join Reddit’s r/cryptocurrency.

- Explore More: Learn about staking, decentralized finance (DeFi), or other crypto opportunities as you gain confidence.

- Review Your Trades: Analyze what works and what doesn’t to improve your strategy.

Conclusion

Starting to trade cryptocurrency is an exciting step into a dynamic financial world. By choosing a trusted exchange, using simple strategies like HODL or DCA, and prioritizing security, you can trade with confidence. Start small, learn from each trade, and only invest what you’re comfortable losing. Ready to begin? Sign up for an exchange like Coinbase or Binance, make your first trade, and join the crypto revolution today!