You wake up one morning, check your wallet, and the $42,000 you had in Sahara AI (SAHARA) is now worth $1,800. That actually happened to thousands of people between August and November 2025. In just 90 days, SAHARA crashed more than 95% from its all-time high of ≈$1.95 to under $0.09. No hack, no exploit—just a brutal, textbook unraveling.

This isn’t another “crypto is risky” story. It’s a real-world autopsy of how a heavily hyped AI-blockchain project went from Binance Launchpool darling to near-zero in record time. Here are the five forces that crushed it—explained plainly, with receipts.

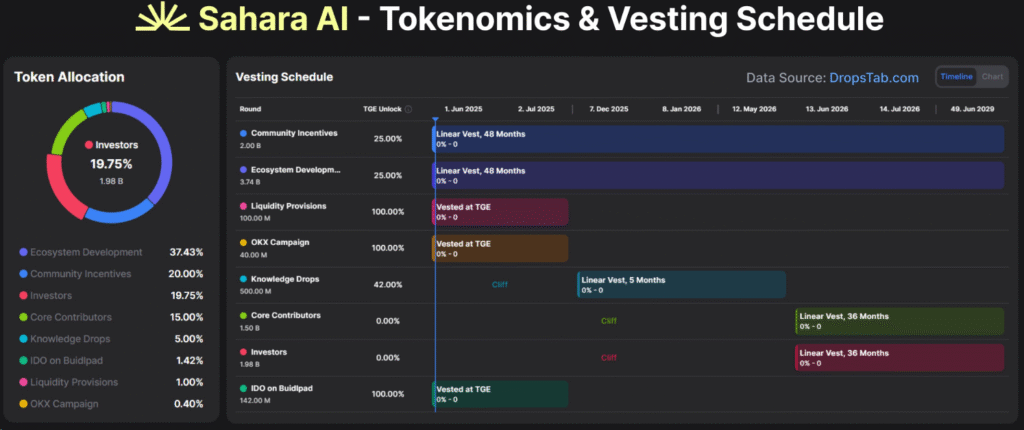

1. Insane Token Unlock Tsunami Right After Launch

Sahara AI raised $43 million from Pantera, Binance Labs, Polychain and others. The pitch: “decentralized AI marketplace with real revenue.” Reality: Only 9% of the 10 billion total supply was circulating at TGE (August 2025). The rest? A brutal cliff + linear schedule that started dumping 40–60 million tokens every single week starting October 2025.

TokenUnlocks.app data shows:

- October 2025: ~380 million tokens unlocked (~$350 m at then-price)

- November 2025: another ~420 million tokens That’s almost 8% of total supply hitting the market every 30 days while daily trading volume never exceeded $35 million.

No project survives that kind of sell-pressure when the fully diluted valuation (FDV) was still $18 billion at $1.80.

2. Zero Real Revenue or Product Adoption

Everyone talked about “collaborative AI economy,” “royalties for dataset owners,” and “decentralized compute.” In practice, the mainnet launched with:

- One demo chatbot

- Less than 1,200 daily active users

- Under $8,000 in weekly protocol revenue (DefiLlama, Nov 2025)

For comparison, Bittensor (TAO) — another AI token — was doing $1.2 million weekly revenue at the same time and still got hammered. Sahara had almost nothing to justify a $6 billion market cap peak.

Investors realized the “AI narrative” was just that — a narrative, not a product people actually used.

3. Massive VC & Team Dumping on Retail

On-chain analysis from Lookonchain and Arkham Intelligence revealed the ugly truth:

- Binance Labs wallet moved 28 million SAHARA to exchange within 10 days of unlock

- Pantera’s tagged wallet sold 19.4 million tokens in batches under $1.20

- The team/early contributor cluster transferred 112 million tokens to OKX and Binance between Oct 20 – Nov 15

Retail buyers who aped the Launchpool at $1.60–$1.90 were literally the exit liquidity for tier-1 VCs who got tokens at $0.08–$0.12 in the seed round.

4. Broken Tokenomics: 62% to Insiders, No Meaningful Burn

Official breakdown (from Sahara whitepaper):

- Team & Advisors: 20%

- Investors: 22.5%

- Ecosystem/Incentives: 19.5%

- Community & Launchpool: only 11%

Even worse — there is no aggressive fee-burn mechanism. Trading fees on the platform are tiny (0.05%), and 100% of them go to “ecosystem treasury,” not token buyback. Result: supply kept inflating while demand collapsed.

Compare this to projects like Hyperliquid (97% of fees buy & burn) or GMX (real revenue share). Sahara had none of that.

5. Lost Trust + Death Spiral Psychology

Once the first 70% drop happened in October, the feedback loop kicked in:

- Influencers who shilled at $1.80 went silent

- Telegram went from 180k members to 34k (most bots anyway)

- Every new unlock triggered another 15–25% daily crash

- Liquidation cascades on perps wiped out leveraged longs

By mid-November, SAHARA was trading on pure panic. The few remaining holders were either bag-holding or trying to exit at any price.

Current stats (Nov 30, 2025):

- Price: $0.087

- Market cap: ~$89 million

- FDV: still $870 million with 90% of tokens yet to unlock

- 24h volume: $11 million (mostly sell)

Final Reality Check

Sahara AI didn’t collapse because of a black-swan event. It collapsed because of five predictable, avoidable factors hit at once:

- Catastrophic unlock schedule

- No real product or revenue

- Coordinated VC/team selling

- Terrible tokenomics design

- Complete loss of community trust

If you’re reading this and thinking “this sounds familiar,” it should. Worldcoin, Aptos, Sui, and now Sahara — the 2024–2025 “high-FDV Launchpool meta” has a near-perfect failure rate once the charts turn red.

Learn the pattern, protect your capital, and always zoom out to the unlock calendar before you FOMO.