Imagine owning shares in a public company and being able to trade them at 3 a.m. on a Sunday, use them as collateral for a quick loan, or transfer them instantly to a friend across the world—all without traditional brokers, paperwork delays, or market closing hours. This isn’t science fiction anymore. It’s the vision Superstate is turning into reality, and their recent $82.5 million funding round signals that Wall Street and blockchain are no longer separate worlds.

Superstate, founded by Robert Leshner (the same mind behind the pioneering DeFi protocol Compound), has raised $82.5 million in a Series B round to build tools that bring regulated stocks and fundraising directly onto blockchains like Ethereum and Solana. Led by Bain Capital Crypto and Distributed Global, the round drew support from major names including Haun Ventures, Brevan Howard Digital, Galaxy Digital, and others.

Superstate Secures 82.5 Million to Move SEC-Registered Equity …

This cash injection will fuel Superstate’s push to make “onchain” equity issuance a practical option for companies and everyday investors. In simple terms, the company wants to let businesses issue shares as digital tokens on public blockchains—fully compliant with U.S. securities laws—while giving holders real ownership rights, not just digital receipts.

Superstate raises $14 million in Series A to modernize investing …

Who Is Superstate and What Do They Already Do?

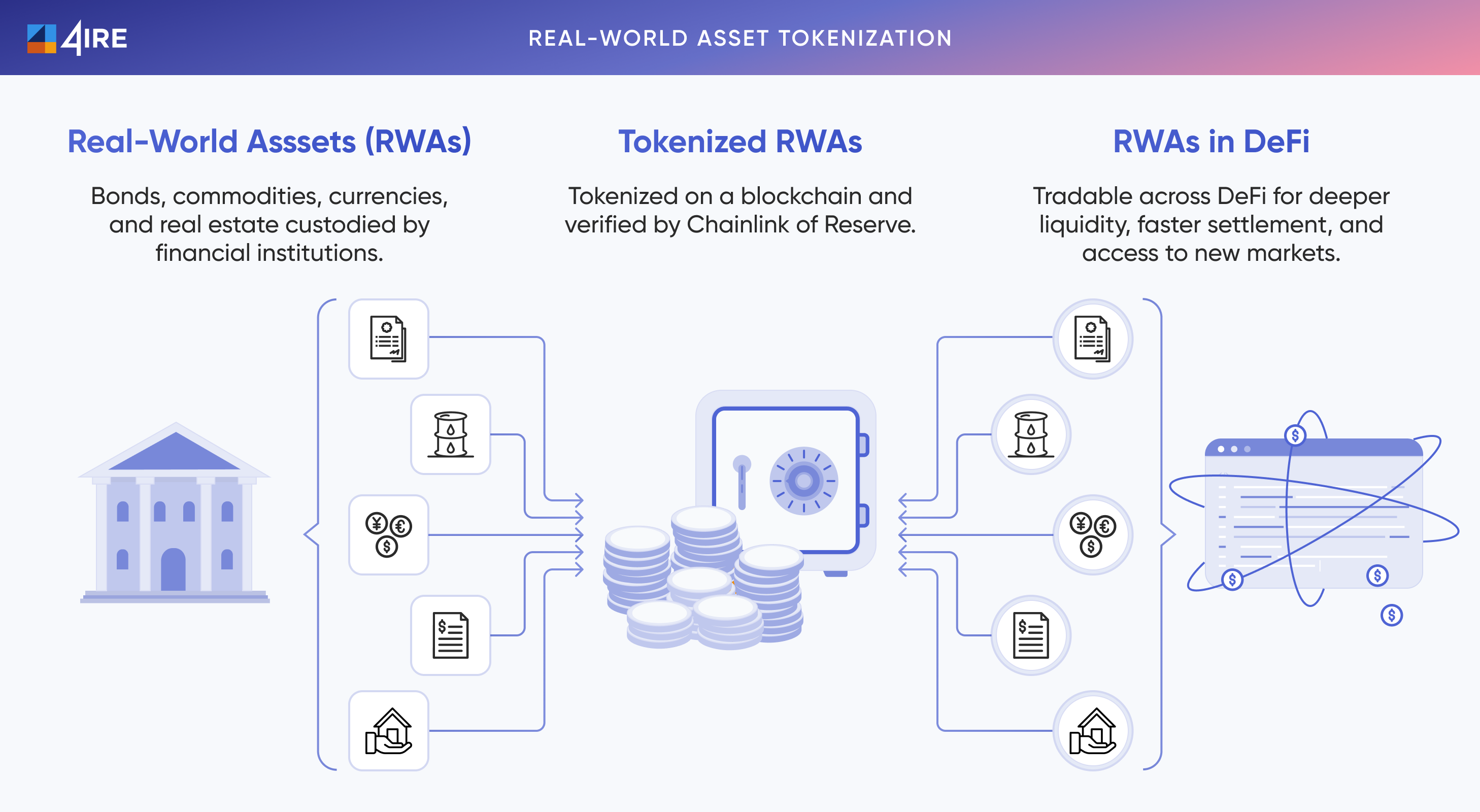

Superstate specializes in tokenization—the process of turning real-world assets into digital tokens that live on a blockchain. Think of it like converting a paper stock certificate into a secure, programmable digital version that can move instantly and interact with other crypto tools.

The company already runs two successful tokenized funds: the USTB Short Duration U.S. Government Securities Fund (holding nearly $830 million in assets) and the USCC Crypto Carry Fund (around $440 million). These funds generate yield from real assets while offering daily pricing and easy access for crypto users. Superstate is also an SEC-registered transfer agent and investment adviser, which means they handle the legal side of ownership records properly—no shortcuts.

They’ve already tokenized shares for public companies such as Galaxy Digital, SharpLink Gaming, Forward Industries, and Exodus Movement. These aren’t synthetic copies; they’re official shares that give holders voting rights, dividends, and more.

Real World Asset Tokenization 2026: Complete Guide to RWA Benefits …

Breaking Down the $82.5 Million Raise

Announced on January 22, 2026, this Series B takes Superstate’s total disclosed funding past $100 million since launching in 2023. The money will accelerate development of their Opening Bell platform, which lets companies issue new tokenized shares directly to investors. Settlement happens in stablecoins, transfers are peer-to-peer, and everything updates automatically on the blockchain.

Ethereum and Solana Could Hit New All-Time Highs If US Crypto Law …

Robert Leshner has emphasized the real-world impact: tokenized stocks could let investors borrow against their holdings for big purchases—like a car or house—while staying invested. He predicts retail investors will flock to this once they see the flexibility it brings.

Why This Matters for Everyday People

Traditional stock markets run on old systems: limited hours, high fees for intermediaries, and slow settlement (often T+2 days). Superstate’s approach flips that.

- 24/7 access: Trade tokenized shares anytime, anywhere.

- Lower costs: Fewer middlemen mean potentially cheaper transactions.

- Global reach: Anyone with an internet connection and a compatible wallet can participate (subject to local rules).

- DeFi integration: Use your shares as collateral to earn yield or borrow—without selling.

This trend is already gaining traction. BlackRock’s tokenized fund BUIDL has grown rapidly since 2024, showing big institutions are on board. The broader tokenized Treasury market jumped from under $200 million in early 2024 to nearly $7 billion by late 2025.

Stock Tokenization : What You Need to Know Now

How Tokenization Actually Works (No Tech Jargon Needed)

- A company decides to issue or convert shares to tokens.

- Superstate handles the legal compliance (SEC rules, ownership tracking).

- Shares become digital tokens on Ethereum or Solana.

- You hold them in a crypto wallet, trade them freely, or plug them into DeFi apps.

- Everything is transparent on the public blockchain—no hidden ledgers.

The result? Faster fundraising for companies, more options for investors, and a bridge between old finance and new tech.

Institutional Crypto Adoption Accelerates: Wall Street’s Pivotal …

What’s Next? A More Open Financial Future

Superstate’s roadmap includes launching Direct Issuance Programs in 2026, expanding partnerships, and making tokenized equities everyday collateral in DeFi. If successful, this could democratize investing by cutting barriers and unlocking new ways to build wealth.

The convergence of traditional finance and blockchain isn’t hype—it’s happening now. Superstate’s latest funding shows serious players are betting big on a world where your stocks are as easy to move as your digital cash.