Ever wondered what happens when a massive digital savings account, stuffed with billions, starts trickling into the wild world of cryptocurrencies? As 2025 draws to a close, that’s the intriguing setup unfolding right now—stablecoins, those steady digital dollars, have ballooned to a staggering $310 billion, poised like runners at the starting line, ready to charge into broader crypto action and potentially ignite fresh market excitement.

Demystifying Stablecoins: Your Crypto Safety Net

Think of stablecoins as the calm anchors in the stormy seas of cryptocurrency. Unlike volatile coins like Bitcoin that swing wildly in value, stablecoins are designed to hold steady, usually pegged 1:1 to real-world assets like the US dollar. Popular ones include Tether (USDT) and Circle’s USDC, which let people trade, save, or send money without the rollercoaster rides. They’re backed by reserves in banks or treasuries, making them a go-to for folks escaping inflation in places like Argentina or just parking cash in crypto wallets.

Stablecoins Explained: Holding USDT & USDC Safely in Trust Wallet …

For everyday users, stablecoins act like a bridge: you convert your fiat money into them via apps or exchanges, then use them for quick, cheap transactions across borders or in decentralized finance (DeFi) apps. No wonder they’ve become crypto’s quiet powerhouse, handling trillions in payments annually without much fanfare.

Hitting the $310B Milestone: A New Peak

As of late December 2025, the total supply of stablecoins has shattered records, reaching an all-time high around $310 billion—a jump of about 70% from the start of the year. Data from tracking platforms shows this surge happened amid growing adoption, with Tether alone commanding over 60% of the market share. By December 27, the market cap hovered at approximately $308.3 billion, inching toward even higher figures as demand persists.

This isn’t a sudden spike; it’s been building steadily. Mid-year reports noted the cap crossing $300 billion for the first time, driven by everything from retail users to big institutions seeking reliable digital cash. Visualizing this growth reveals a steep upward curve, especially in the latter half of 2025, as more people and businesses integrate them into daily finance.

Factors Keeping This Capital on the Sidelines

So why isn’t this $310 billion already flooding into riskier crypto assets? It’s like having a full gas tank but waiting for the right road conditions. Many holders are playing it safe amid market caution—think of it as “dry powder” stored away during uncertain times, ready to deploy when confidence returns. Investors often park in stablecoins during dips, avoiding volatility while keeping funds on exchanges for quick moves.

Geopolitical jitters, regulatory shifts, and even holiday trading lulls contribute to this wait-and-see approach. As one analysis points out, stablecoins represent liquidity that’s historically flowed into Bitcoin and altcoins when sentiment flips positive, turning sidelined cash into market momentum. Right now, much of it sits in wallets or DeFi protocols, earning yields but not yet chasing high-risk gains.

Bitcoin Slips Below $87,000 As Record Stablecoin Supply Signals …

How This Could Ignite Crypto Markets

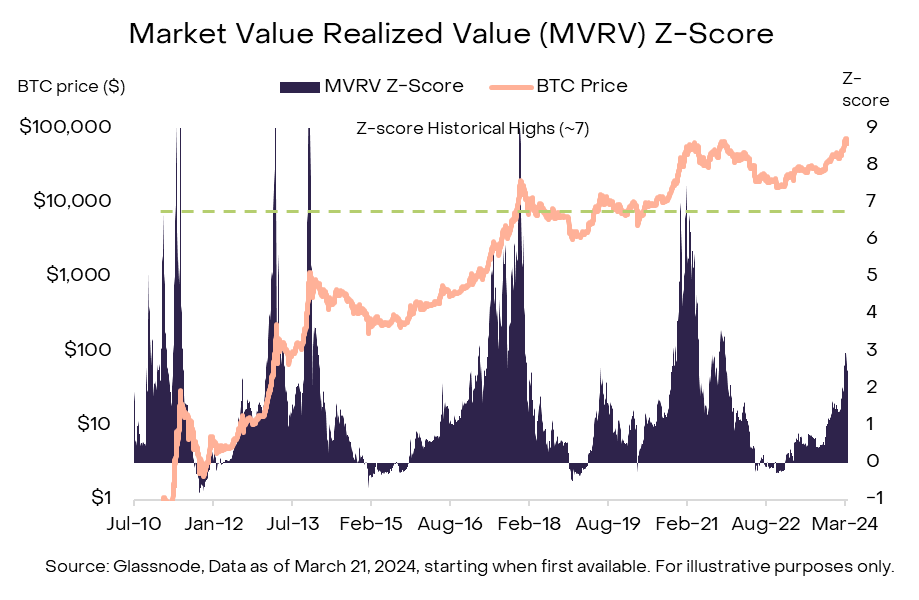

When this capital starts moving, watch out—it could supercharge crypto prices and activity. Historically, stablecoin inflows signal bull runs, as they provide the liquidity needed for big buys in assets like Ethereum or emerging tokens. In 2025 alone, stablecoins have processed over $9 trillion in payments, a massive leap that hints at their role in expanding the ecosystem.

Experts suggest this buildup could lead to a “mega bull year,” with funds rotating into DeFi, NFTs, or even real-world asset tokenization. However, it’s not automatic; investor confidence is key, and without it, issuance alone won’t spark growth. For regular folks, this means potentially higher values for your crypto holdings if the influx happens, but also a reminder to stay diversified amid the hype.

Anatomy of a Bitcoin Bull Market | Grayscale

Insights from Industry Voices

The buzz is real among pros. One report highlights stablecoins as crypto’s first mainstream hit in 2025, evolving from niche tools to essential financial infrastructure. On social platforms, analysts like those from Crypto Town Hall note the $310B cap as a sign of rising on-chain liquidity, perfect for fueling demand in dollar-pegged assets.

Others, such as in fintech discussions, see this as stablecoins absorbing into traditional systems, boosting everything from payments to payroll. Visualizing these conversations, it’s like a roundtable of forward-thinkers mapping out crypto’s next phase.

Cryptocurrency investments, blockchain trends and industry …

In essence, this $310 billion in stablecoins isn’t just sitting idle—it’s a loaded spring, waiting for the right trigger to propel crypto forward. For newcomers and veterans alike, it’s a fascinating watch: keep an eye on flows and sentiment, as they could dictate the market’s next big chapter. Whether it sparks a rally or steadies the ship, one thing’s clear—stablecoins are reshaping money in ways we can all relate to.