Have you ever wished for a digital dollar that holds its value steady amid crypto’s wild swings, but wondered if it’s truly safe? Enter the U.S. Federal Reserve’s latest move: a groundbreaking set of rules under the GENIUS Act that’s putting stablecoins under the spotlight. Signed into law in July 2025, this framework aims to blend innovation with investor protection, potentially transforming how we use digital money for everyday transactions. Join us as we demystify these changes, from the basics to the big picture, and see why this could be a game-changer for your wallet.

Stablecoins 101: The Basics Everyone Should Know

Stablecoins are like the reliable anchors in the stormy sea of cryptocurrencies. Unlike Bitcoin’s price rollercoasters, stablecoins peg their value to stable assets—often the U.S. dollar—to keep things predictable. Popular ones like USDT or USDC let people send money quickly across borders, earn interest, or even pay for coffee without worrying about sudden drops.

But here’s the catch: Without clear rules, risks like mismanaged reserves have led to past scares. That’s where regulation steps in, ensuring these digital dollars are as trustworthy as your bank account. As of mid-2025, the stablecoin market tops $200 billion, showing their growing role in finance.

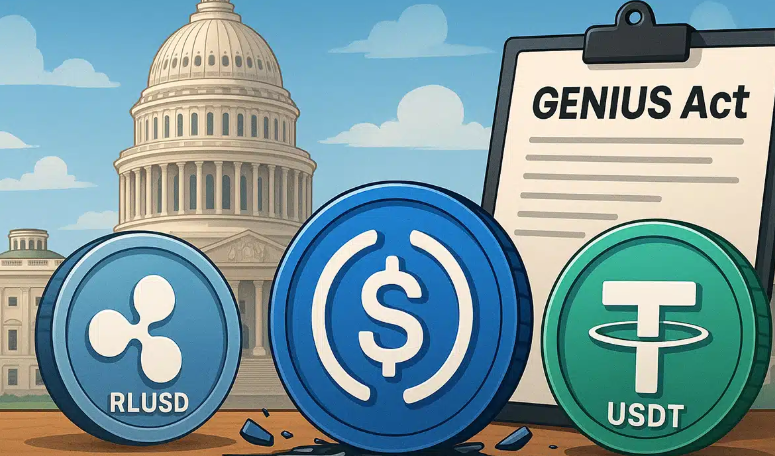

Unveiling the GENIUS Act: A Federal First

The Guiding and Establishing National Innovation for U.S. Stablecoins (GENIUS) Act marks America’s debut in federal stablecoin oversight. Passed by Congress on July 17, 2025, and signed by the President the next day, it focuses on “payment stablecoins”—those used for transactions rather than speculative trading.

This law doesn’t ban stablecoins; instead, it sets guardrails to promote safe growth. Only approved entities, like banks or licensed firms, can issue them, preventing fly-by-night operations. The Act integrates with existing banking laws, giving the Fed a central role in supervision to maintain financial stability.

Core Requirements for Issuers

Under GENIUS, stablecoin creators must back every token 1:1 with high-quality reserves, such as cash or U.S. Treasury bills. No more vague promises—these assets get audited regularly, with public reports to build trust. Liquidity rules ensure issuers can handle mass redemptions, like a bank run but in digital form.

Custodians holding these reserves face strict standards too, including bankruptcy protections so users’ funds stay safe even if a company falters. This setup draws from traditional finance but adapts to blockchain’s speed.

The Fed’s Pivotal Role in Oversight

The Federal Reserve isn’t just watching from the sidelines—it’s front and center. As the nation’s central bank, the Fed will approve federal charters for stablecoin issuers and monitor systemic risks. In an August 2025 speech, Fed Governor Christopher Waller hailed the Act as a “crucial step” for integrating stablecoins into payments without destabilizing the economy.

This involvement means stablecoins could link seamlessly with Fed services like real-time payments, making cross-border transfers cheaper and faster. For non-banks, state-level options exist, but federal oversight adds a layer of uniformity across the U.S.

How This Affects Everyday Users and the Market

For the average person, these rules could mean more confidence in using stablecoins for remittances or online shopping. No longer the Wild West—expect clearer disclosures on risks and fees, plus easier ways to convert back to fiat money. Market-wise, experts predict a surge in adoption, with stablecoins potentially handling trillions in transactions by 2030.

On the flip side, smaller issuers might struggle with compliance costs, leading to consolidation among big players. Globally, this U.S. move could influence regulations elsewhere, like the EU’s MiCA, fostering a more interconnected digital economy.

Looking Ahead: Challenges and Opportunities

While the GENIUS Act is a solid foundation, implementation will take time—regulators have until early 2026 to finalize details. Challenges include balancing innovation with security, especially as tech evolves with AI and DeFi integrations.

For curious readers, this framework opens doors: Stablecoins might soon power everything from salaries to charitable donations. If you’re exploring crypto, start with regulated options and stay informed via official Fed updates. This isn’t the end of crypto’s story—it’s a new chapter toward mainstream acceptance.

In closing, the Fed’s embrace of stablecoins via the GENIUS Act signals a maturing market, where reliability meets cutting-edge tech. Whether you’re a saver, sender, or spender, these rules could make digital money a staple in your financial toolkit. Curious about jumping in? Share your thoughts below!