Cruising a crypto superhighway, where trades zip through at lightning speed, guided by smart navigation. In June 2025, Solana’s swap volume hit $5.5B monthly, driven by meta-aggregators like Jupiter and Titan, per themerkle.com. For crypto beginners in Vietnam and beyond, this guide breaks down why Solana’s DeFi is booming, how meta-aggregators supercharge swaps, and what it means for your wallet, like finding the fastest route in a bustling digital city!

What’s Behind Solana’s Swap Volume Surge?

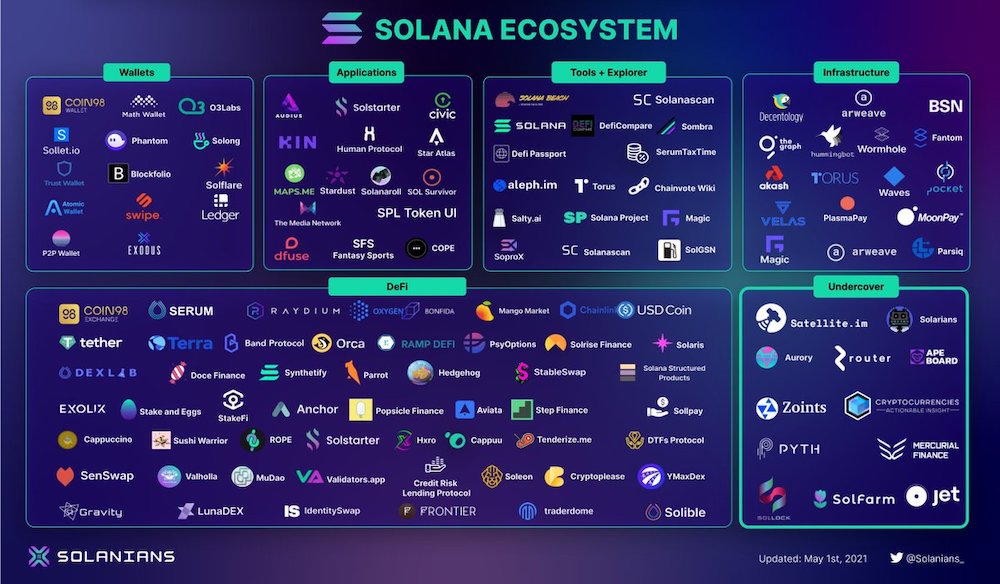

Solana, a $86B Layer 1 blockchain, handles 1.3M daily transactions, per cointelegraph.com, with $12B in DeFi TVL, per defillama.com. Its swap volume soared to $5.5B in June 2025, up 41% from Q1’s $4.6B, per messari.io, thanks to meta-aggregators optimizing trades, like GPS systems finding the quickest paths on a superhighway.

1. Meta-Aggregators Take the Wheel

Meta-aggregators like Titan and Kamino route trades across DEXs (e.g., Raydium, Orca) and other aggregators, slashing fees and slippage, per themerkle.com. Titan’s Talos algorithm handled $35M weekly, per blockworksresearch.com, like a navigation app picking the best route.

2. Jupiter’s Dominance

Jupiter Exchange, with 80% of Solana’s swap volume ($4B monthly), rolled out Juno, a meta-aggregation engine, per themerkle.com. It keeps users on its platform, per @jupiterexchange, like a superhighway tollbooth that’s still the fastest way through.

How Meta-Aggregators Boost Solana’s Swaps

Meta-aggregators act like DeFi traffic controllers, making swaps faster and cheaper by tapping multiple liquidity sources, per blockworksresearch.com, driving Solana’s $5.5B volume, like streamlining a superhighway’s flow.

1. Smarter Trade Execution

Titan’s Talos assesses fees, slippage, and off-chain data via Pyth Network, per themerkle.com, while Kamino Swap’s intents-based system offers zero fees for SOL/USDC trades, per cryptnews.com, like real-time traffic updates avoiding jams.

2. Fierce Competition

1inch’s 60% aggregator market share after its Solana launch, per @Bikkybroz, pushes Jupiter and Titan to innovate, per @blockworksres. This rivalry cuts costs for users, per cointelegraph.com, like competing apps offering better routes.

Impacts on Solana’s Ecosystem

The meta-aggregator boom fuels Solana’s DeFi dominance, but SOL’s $156.91 price faces volatility, per coinmarketcap.com, like a superhighway thriving despite occasional roadblocks.

1. DeFi TVL Growth

Solana’s $12B TVL, second only to Ethereum, grew 18% in Q1 2025, per defillama.com, with Kamino leading at $1.6B, per messari.io, like more cars joining a bustling superhighway.

2. Price and Memecoin Pressure

SOL dropped 29% in 2025, per cointelegraph.com, despite $9.5B in new USDC, as memecoin scams like Libra’s $107M rug pull hurt sentiment, per cryptnews.com.au, like detours slowing superhighway traffic.

Opportunities for Crypto Users

Solana’s swap surge opens doors, like new exits on a superhighway, per thedefiant.io. Here’s how to ride the wave in 2025.

1. Trade with Meta-Aggregators

Use Jupiter or Titan for low-fee swaps on Solana’s DEXs, starting with $10-$20 in SOL, per binance.com, like choosing the fastest tollbooth, per @AlvaApp.

2. Stake SOL

Stake SOL at 7-8% APY on Solana’s network via Coinbase, per coinbase.com, to earn from rising DeFi activity, like collecting superhighway tolls.

Risks to Navigate

Solana’s superhighway has bumps, like regulatory scrutiny and hacks, per coinlive.com, threatening DeFi gains in 2025.

1. Regulatory Uncertainty

SEC delays on Solana ETF approvals, per cryptnews.com, and memecoin scams could trigger crackdowns, per cointelegraph.com, like speed traps on a superhighway.

2. Security and Volatility

$302M in 2025 DeFi hacks, per @AIhackers_, and SOL’s 6.45% monthly volatility, per coincodex.com, add risks, like accidents disrupting superhighway flow.

Tips to Thrive on Solana

Want to speed through Solana’s DeFi? These tips keep you on track, per binance.com, like a savvy driver in 2025.

1. Stay Updated

Follow @solana and CoinGecko for price and aggregator news, per @Bikkybroz. Monitor Jupiter via Nansen, per themerkle.com, like checking superhighway traffic.

2. Diversify Smartly

Spread $10-$20 across SOL, JUP, and stablecoins on Binance, per @blockworksres. Hedge against volatility, like taking alternate superhighway routes.

Will Solana’s Superhighway Keep Accelerating?

Solana’s $5.5B swap volume, powered by meta-aggregators like Jupiter’s $4B share and Titan’s $35M weekly trades, per themerkle.com, cements its DeFi lead, with $12B TVL, per defillama.com. Trade on Jupiter, stake SOL on Coinbase, and track @solana, but watch for $302M hacks, per @AIhackers_, and SOL’s $156.91 volatility, per coinmarketcap.com. Will Solana’s crypto superhighway race to new heights or hit speed bumps in 2025? Buckle up and find out!