Ever wondered if you could own a slice of professional investment funds—like money market or stock portfolios—directly on a super-fast blockchain, without the usual Wall Street delays or high minimums? On January 28, 2026, WisdomTree made that a reality by expanding its regulated tokenized funds to the Solana blockchain. This isn’t a small test; it’s a full rollout of their entire lineup, opening doors for everyday investors and big institutions alike to access real-world assets (RWAs) on one of the quickest networks out there.

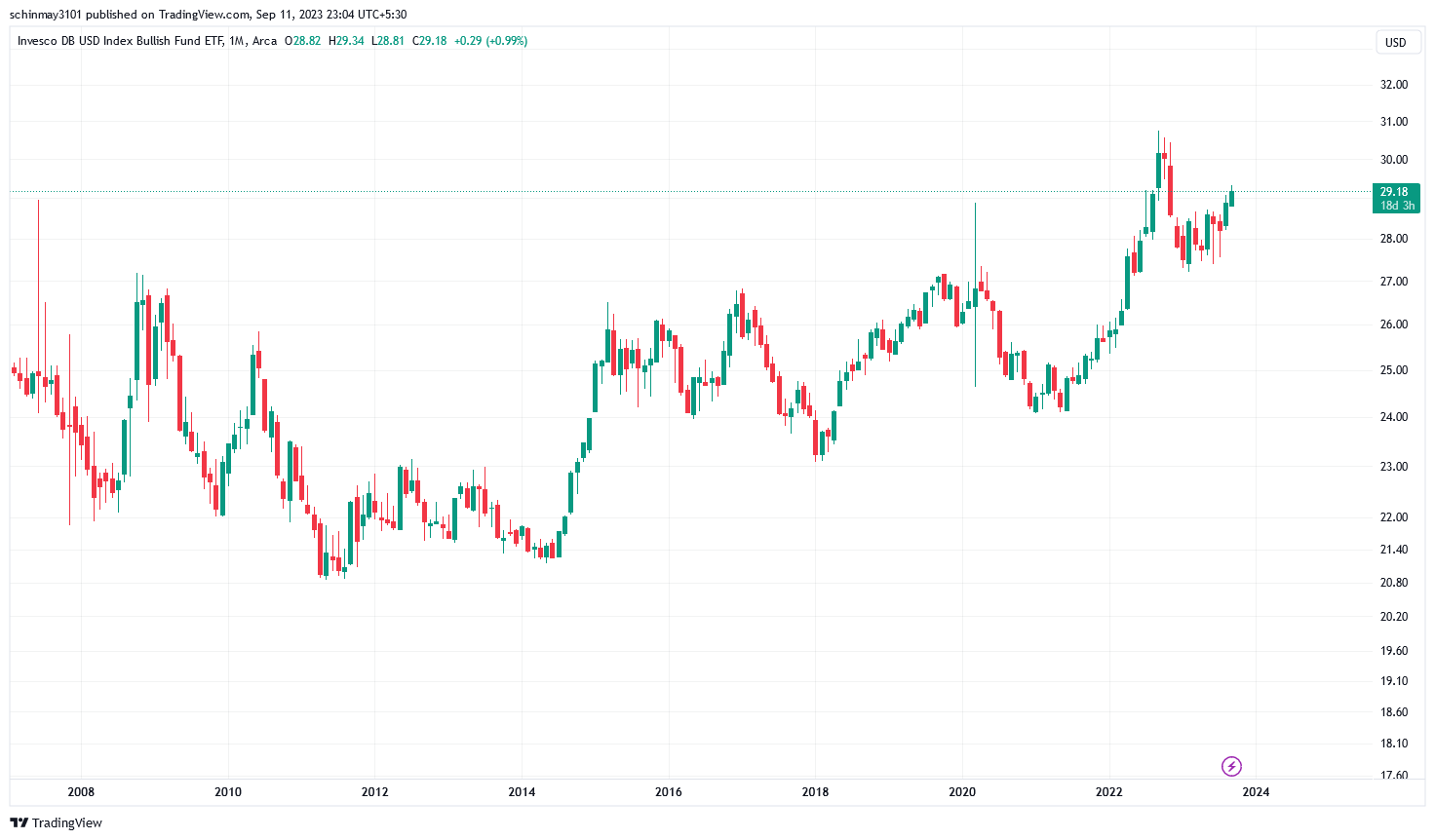

Top 6 Forex Currency ETFs To Invest In 2026

What WisdomTree Just Announced

WisdomTree, a major asset manager handling over $100 billion and famous for its ETFs, announced it’s now live on Solana through its WisdomTree Connect (for institutions) and WisdomTree Prime (for retail) platforms. Users can mint, trade, hold, and manage the company’s complete set of tokenized funds directly on Solana.

This includes money market funds, equities, fixed income, alternatives, and asset allocation strategies. All existing tokenized products can now be created natively on Solana, with support for stablecoins like USDC and PYUSD for easy buying and conversions (WisdomTree Press Release, January 28, 2026).

The move is part of WisdomTree’s multi-chain approach, building on earlier efforts to bring regulated finance onto blockchains. Maredith Hannon, Head of Business Development for Digital Assets at WisdomTree, said: “Bringing our full suite of tokenized funds to Solana reflects our continued focus on regulated real-world assets across the onchain ecosystem” (The Defiant, January 28, 2026).

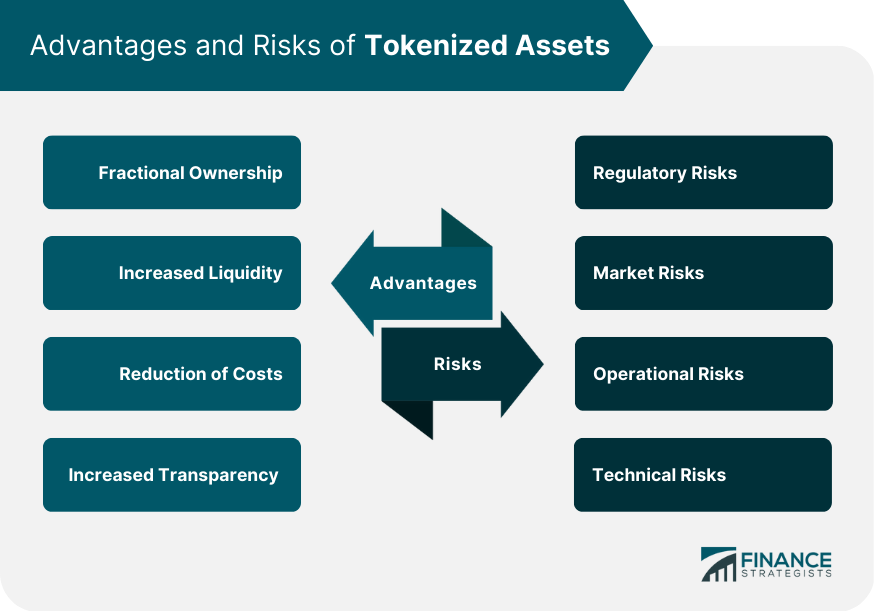

Tokenized Assets | Meaning, Types, Pros, Cons, How They Work

How Tokenized Funds Work in Plain English

Tokenized funds turn traditional investments into digital tokens on a blockchain. Instead of buying shares through a broker with paperwork and waiting days for settlement, you get blockchain tokens that represent ownership in the fund.

On Solana, this means:

- Fast and cheap transactions — Solana handles thousands per second at fractions of a cent in fees.

- Direct access — Retail users on WisdomTree Prime can fund with USDC, buy tokens without traditional banks, and store them in personal wallets.

- Institutional perks — Big players using WisdomTree Connect can mint and manage positions on-chain with full custody options.

These tokens stay backed by real assets (like government securities or stocks), keeping things regulated and trustworthy. It’s like having ETF-like exposure but with blockchain’s 24/7 trading and transparency.

Tokenized real estate: Gamechanger or fad?

Why Solana? Speed Meets Real Finance

Solana stands out for its high performance—low costs and quick finality make it ideal for frequent trades or payments tied to funds. WisdomTree’s choice highlights growing confidence in public blockchains for serious money management.

This fits a bigger trend: tokenized RWAs have exploded, crossing major milestones as institutions seek efficiency. WisdomTree’s tokenized assets grew dramatically in 2025, showing demand for these products (Solana Foundation News, January 28, 2026).

For regular folks, it lowers barriers—start small, hold in your wallet, and potentially earn yields without old-school restrictions.

Best Solana Launchpads | IDO, NFT, And Meme Coins

Benefits for Everyday Investors and Pros

Regular users get easier entry into diversified funds. Imagine topping up with stablecoins, grabbing a tokenized money market fund for steady returns, or holding equity exposure—all on-chain and self-custodied.

Institutions benefit from faster settlements, reduced middlemen, and compliance baked in. The expansion supports broader adoption of RWAs, where traditional assets meet DeFi perks like programmability.

Experts see this as validation: regulated players like WisdomTree choosing Solana signals the network’s readiness for mainstream finance (CoinDesk, January 28, 2026).

Best Solana DEXs | Top Decentralized Exchanges

What’s Next and Why It Matters

With the integration live, expect growing liquidity as more users mint and trade these funds on Solana. WisdomTree’s stock even jumped after the news, reflecting market excitement.

This step bridges old-school investing with blockchain, making professional-grade funds more accessible, efficient, and global. For anyone curious about crypto beyond memes—whether in Singapore or anywhere—this shows how real finance is evolving on fast chains like Solana.

It’s not just another announcement; it’s proof that tokenized assets are moving from experiment to everyday tool. Keep watching—more traditional giants may follow suit soon.