Imagine a blockchain where the majority of its tokens are locked up by everyday users, quietly earning rewards while making the entire system more valuable for everyone. In 2025, Solana achieved something remarkable: with around 75% of its SOL tokens staked, the network’s built-in mechanics and community-driven changes effectively slashed hundreds of millions in potential token dilution, strengthening its economic foundation.

What Does High Staking Really Mean for Solana?

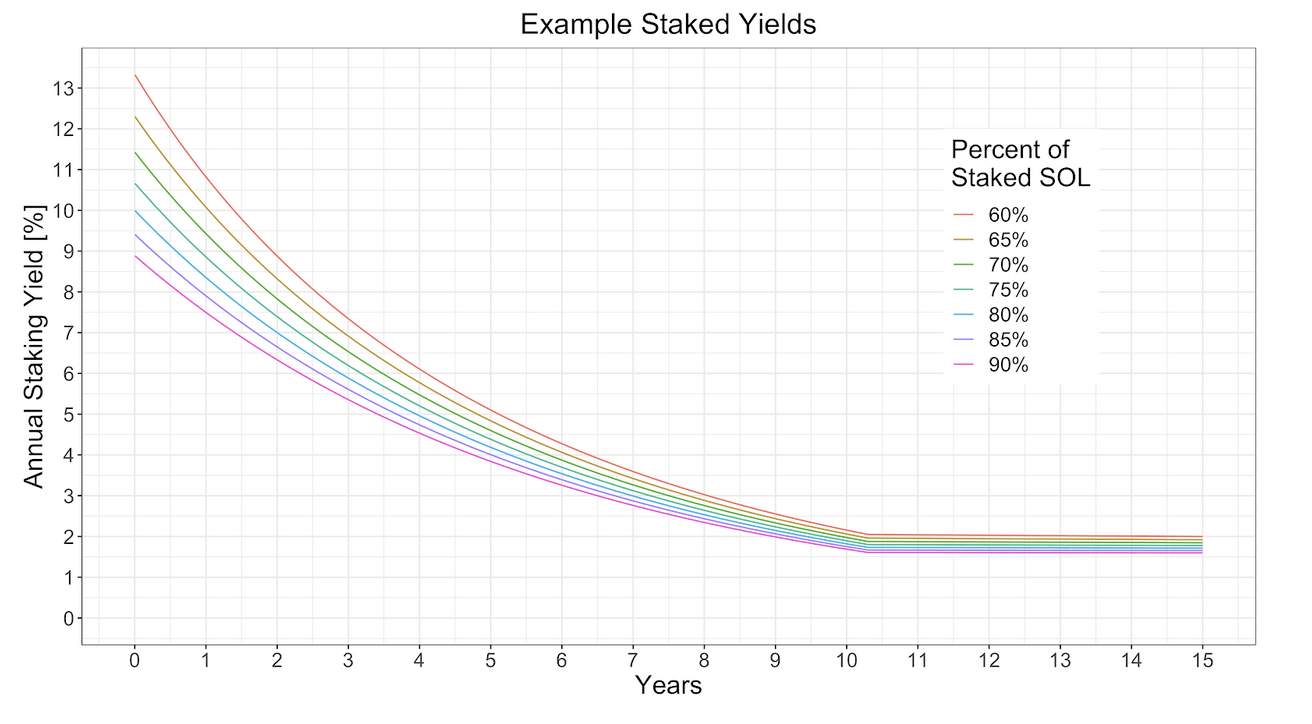

Staking on Solana is straightforward—holders delegate their SOL tokens to validators who secure the network. In return, they earn rewards from newly issued tokens and transaction fees. By late 2025, staking participation hovered around 70-75% of the total supply, a level that’s unusually high compared to many other blockchains.

This massive participation creates a powerful effect: rewards are spread across a huge portion of the supply, meaning non-stakers experience more dilution from new token issuance, encouraging even more people to stake. It’s a self-reinforcing cycle that reduces the amount of SOL freely trading on markets, often leading to tighter supply dynamics.

Staking | Solana

The Role of Fee Burns in Countering Inflation

Solana doesn’t just issue new tokens—it also destroys them. Half of every transaction fee is permanently burned, removing SOL from circulation forever. As the network grew busier in 2025 with more DeFi apps, memes, and real-world uses, these burns added up significantly.

Combined with high staking, this burn mechanism offsets a meaningful chunk of annual inflation. Experts note that during peak activity periods, burns can counter 10-20% or more of new emissions, creating a subtle but real deflationary pressure (source: Galaxy Research reports on Solana tokenomics).

Key Changes That Amplified the Impact in 2025

Throughout 2025, the Solana community debated and advanced proposals to refine token issuance. One notable discussion around accelerating the disinflation rate—dropping new token creation faster toward the 1.5% long-term target—highlighted how high staking levels make the network more efficient.

With 75% staked, the system doesn’t need as many rewards to stay secure, allowing reductions in emissions without risking decentralization. Community analyses estimated that these dynamics, paired with burns, effectively prevented hundreds of millions in value from being diluted away compared to lower-staking scenarios (drawn from on-chain data trackers like Solana Compass and Staking Rewards).

Understanding Solana: A Beginner’s Guide to the High-Performance …

Why Proof-of-Stake and Speed Make This Possible

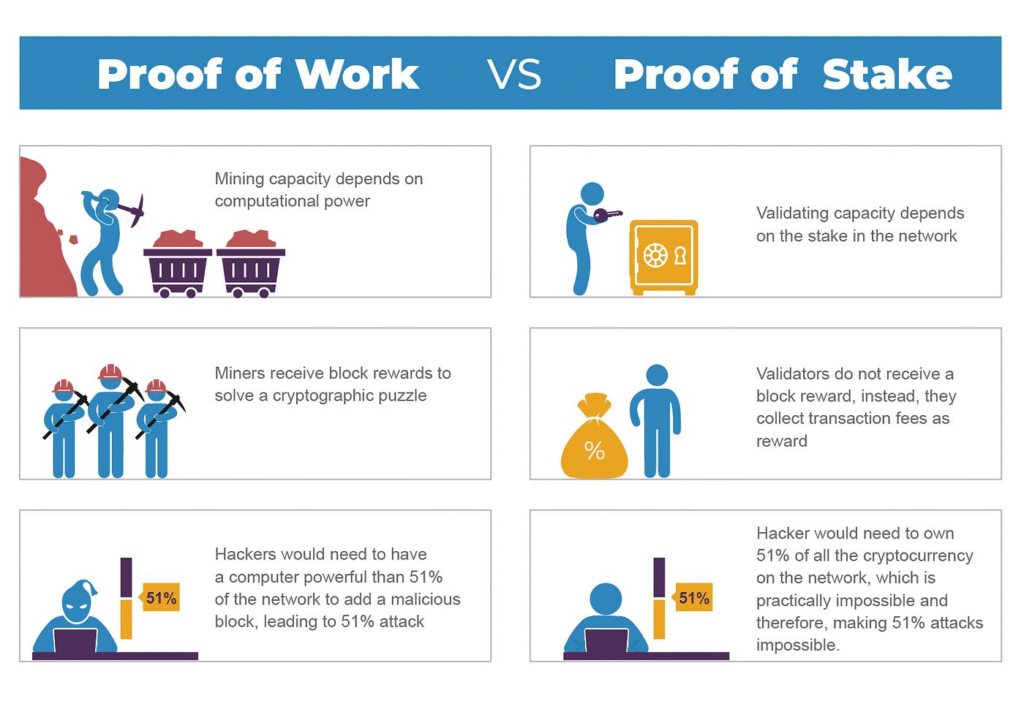

Solana’s proof-of-stake model, enhanced by its unique Proof-of-History timing, allows for lightning-fast transactions at low cost. This efficiency draws massive usage, boosting fee burns while keeping staking attractive.

Unlike energy-heavy alternatives, Solana’s approach rewards participation without wasteful competition, enabling high staking rates that naturally curb excess supply growth.

Looking Ahead: A Stronger Foundation for Users

The combination of 75% staking participation, consistent fee burns, and thoughtful economic tweaks in 2025 has positioned Solana as a more resilient blockchain. For ordinary holders, this means a system where locking up tokens not only earns steady rewards but also contributes to long-term scarcity.

As activity continues to rise, these forces could drive even greater value preservation, making Solana an appealing choice for anyone interested in fast, user-friendly crypto experiences.