Have you ever chased the thrill of a new meme coin launch, only to watch the hype fizzle out overnight? In the fast-paced world of crypto, trends shift like sand dunes, and right now, Solana’s once-booming launchpads are taking a backseat while BNB Chain revs up the engine. This isn’t just market noise—it’s a rotation that’s catching traders off guard and opening doors for fresh opportunities. We’ll explore the numbers behind Solana’s dip, BNB’s rise, and what it all signals for the average crypto enthusiast looking to stay ahead.

Understanding Crypto Launchpads: The Basics

Launchpads are like digital catapults for new tokens, especially meme coins—those fun, viral projects often inspired by internet jokes or trends. Platforms such as Pump.fun on Solana or Four.meme on BNB Chain let anyone create and launch a token with minimal hassle, drawing in crowds eager for quick gains. For beginners, think of them as online fairs where ideas turn into tradable assets overnight, fueled by community buzz and low entry barriers.

These tools democratize crypto creation, but they’re volatile. High activity means more launches, fees, and excitement; a slowdown spells trouble for the ecosystem’s vibe. Data from Dune Analytics shows how these platforms track daily launches and revenue, giving us a window into chain health.

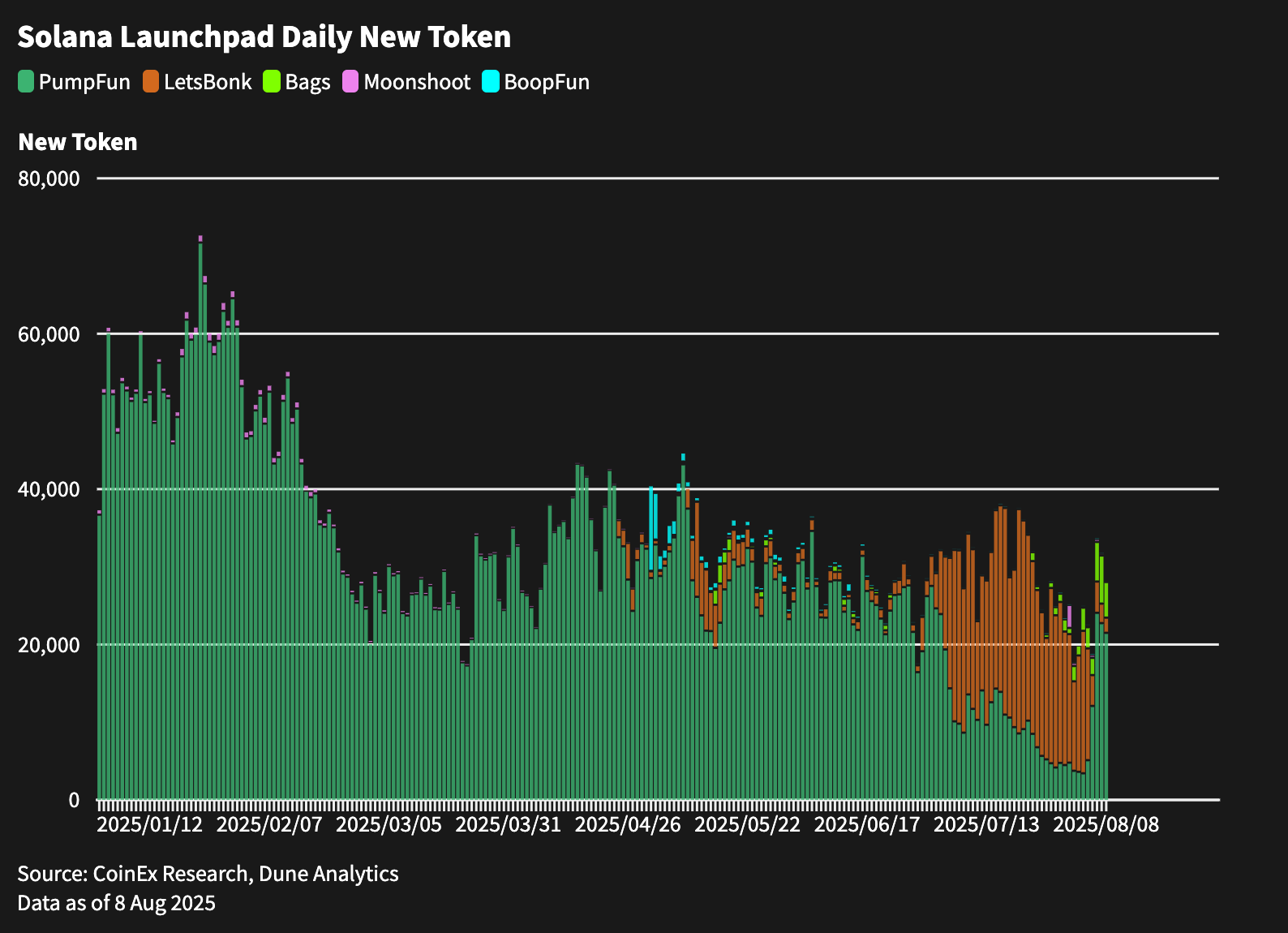

The Sharp Decline on Solana: Unpacking the 73% Crash

Solana was the meme coin kingpin earlier this year, with daily token launches hitting highs of 20,000 to 40,000. But by October 8, 2025, that number plummeted to around 10,500—a staggering 73% drop from peak levels. Revenue followed suit, dipping below $600,000 from a previous $2.4 million average. Platforms like Pump.fun, which once dominated with thousands of daily creations, now see reduced user engagement amid broader market jitters.

What triggered this? A mix of factors, including a recent $19 billion market crash that liquidated positions and scared off casual participants. Over-saturation played a role too—too many similar projects led to fatigue, as noted in community discussions on X. For everyday users, it’s like a party winding down after the initial rush; fewer people show up when the novelty wears thin.

BNB Chain Steps Up: The Meme Launch Surge

While Solana cools, BNB Chain is heating up, thanks to launchpads like Four.meme. This platform has flipped the script, generating $4.1 million in daily revenue and launching over 47,800 tokens in a single day—outpacing Solana’s figures. BNB’s ecosystem boasts 17 million active users, a 19% jump, and tools like PancakeSwap adding to the momentum.

For non-experts, BNB’s appeal lies in its affordability and Binance backing, making it easier for newcomers to jump in. Recent airdrops worth $45 million to meme traders further fuel the fire, rewarding those hit by crashes and encouraging more activity. It’s like BNB is throwing a new block party just as Solana’s winds down.

Key Drivers Behind the Ecosystem Shift

This rotation isn’t random. Solana’s high fees during congestion and bot-heavy environment have frustrated users, pushing them toward BNB’s smoother, cheaper setup. Influencers like CZ (Binance’s founder) hyping “meme coin season” on X amplify BNB’s visibility.

Broader trends play in: Post-crash recovery favors chains with strong institutional support, like BNB’s ties to Binance. X posts highlight how Solana’s “trenches” (low-cap launches) feel exhausted, while BNB offers fresh excitement. Simply put, traders follow the liquidity and buzz, creating self-fulfilling cycles.

Implications for Everyday Crypto Fans

If you’re holding SOL or eyeing meme coins, this shift means diversifying could pay off. BNB’s surge might boost its price toward $1,300 highs, while Solana risks further dips if activity doesn’t rebound. For casual investors, stick to established projects and avoid chasing every launch—research tools like Dune Analytics can help spot trends early.

This dynamic keeps crypto exciting, reminding us that no chain stays on top forever. As one X user noted, “The market is tired of rinse-and-repeat,” signaling a push for more organic growth.

Future Outlook: Recovery or Continued Rotation?

Solana has bounced back before, with its speed and low costs still attracting builders. If upgrades reduce congestion, launches could spike again. Meanwhile, BNB’s momentum might wane if hype fades, as seen in past cycles.