Picture this: You’re at a casino, but instead of betting your own chips, you borrow a stack from a friend with the promise to pay it back—plus interest. A big win feels like striking gold, but a loss? It could leave you digging out of a deeper hole than you started with. That’s leverage in a nutshell for everyday investors: a tool that amps up potential rewards but cranks up the stakes if things go sideways. In this guide, we’ll break down how to spot those sneaky missteps in risk calculations and fix them before they cost you big, all in plain language for anyone dipping their toes into trading or investing.

What is Leverage and Why It Matters

At its core, leverage lets you control a larger investment with a smaller amount of your own money. Think of it like using a mortgage to buy a house—you put down 20% and borrow the rest, hoping the property value rises to multiply your gains. In trading, this often means borrowing from a broker to amplify positions in stocks, forex, or crypto. For beginners, it’s appealing because it can turn a modest account into something with more punch, but the flip side is that losses get magnified too.

Why does this matter for the average person? In volatile markets like today’s, leverage can help grow savings faster, but without proper handling, it leads to quick wipeouts. Understanding the basics sets the stage for avoiding traps that snare even seasoned traders.

What is Leverage in Trading? The Complete Guide | IG International

Common Pitfalls in Leverage Calculations

Many folks jump into leveraged trades without crunching the numbers right, leading to avoidable headaches. Let’s unpack the most frequent slip-ups that can turn a smart move into a costly error.

Overleveraging: The Silent Account Killer

This tops the list—using too much borrowed power relative to your own funds. A classic example: With 50:1 leverage, a mere 2% market dip can erase your entire stake. New traders often chase big wins by maxing out, ignoring how small price swings can trigger margin calls, where your broker demands more cash or closes your position at a loss.

Underestimating Volatility and Market Swings

Markets aren’t steady rivers; they’re wild oceans. Miscalculating how much an asset might fluctuate—say, during economic news—can blindside you. High leverage in choppy conditions amplifies every wave, turning minor dips into major disasters.

Neglecting Emotional and Psychological Factors

It’s not just math; it’s mindset. Leverage can fuel greed or fear, prompting rash decisions like “revenge trading” after a loss. Without a clear head, you might overlook basic risk rules, compounding errors.

These pitfalls aren’t rare; they’re everyday hazards that visual aids can make clearer.

Common Mistakes To Avoid When Trading The Cup And Handle Pattern …

Spotting the Signs of Risk Miscalculations

Catching these issues early is like checking your car’s brakes before a long drive—it saves trouble down the road. Start by monitoring your effective leverage ratio regularly; if it’s creeping higher than your comfort zone, that’s a red flag. Look for patterns in your trading journal: Frequent margin warnings or positions closing unexpectedly signal overexposure.

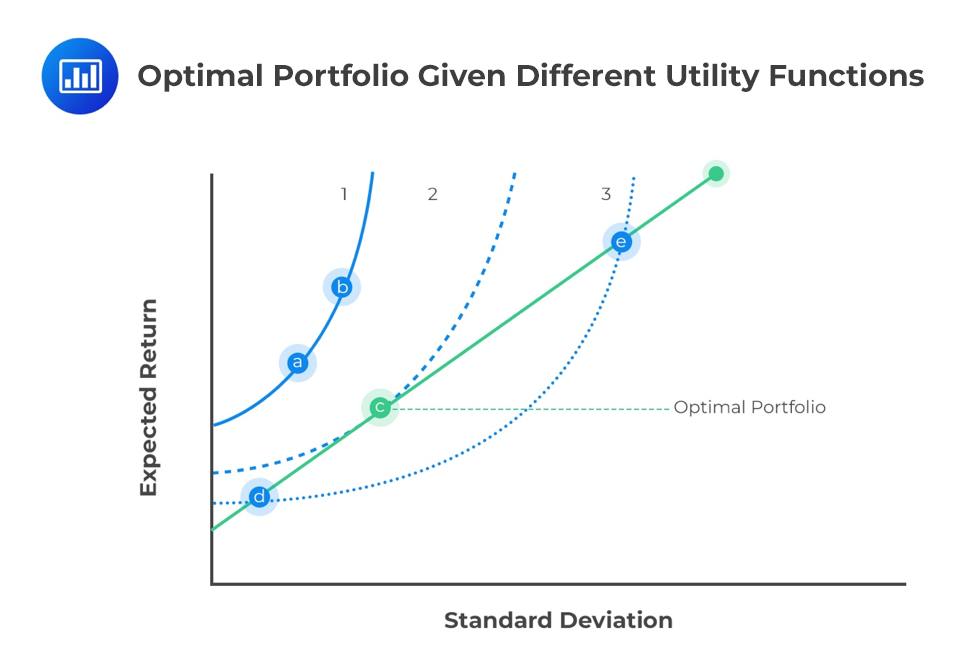

Also, pay attention to your emotional state—if stress from potential losses keeps you up at night, you’re likely misjudging risks. Tools like value-at-risk (VaR) calculations can quantify how much you might lose in worst-case scenarios, helping you see imbalances before they bite. Graphs of past performance versus leverage use often reveal where things went off track.

Optimal Portfolios in Portfolio Management | CFA Level 1

Strategies to Correct and Mitigate Risks

The good news? These miscalculations are fixable with straightforward habits. Here’s how to turn the tide.

Set Strict Risk Limits Per Trade

Adopt the 1% rule: Never risk more than 1% of your account on a single trade. This caps losses and keeps leverage in check. Calculate it simply: If your account is $10,000, limit risk to $100 per position.

Use Protective Tools Like Stop-Loss and Take-Profit

These are your safety nets. A stop-loss automatically sells if prices drop to a set level, preventing runaway losses. Pair it with take-profit to lock in gains. In leveraged setups, adjust them based on volatility to avoid premature triggers.

Diversify and Rebalance Regularly

Don’t put all eggs in one basket. Spread across assets to buffer against single-market crashes. Rebalance quarterly to maintain your target leverage, avoiding unintended creep.

Visual step-by-step plans can make implementation easier for anyone starting out.

Risk Management in Trading: Everything that you should know

Real-Life Lessons from Leverage Gone Wrong

History is full of cautionary tales. Take the 2008 financial crisis: Many investors overleveraged in housing, assuming endless growth, only to face massive foreclosures when values plummeted. Or crypto traders in 2022 who maxed leverage during a bull run, losing everything in the crash. The fix? Those who survived used conservative leverage and quick adjustments, turning potential ruin into recovery stories.

Building a Safer Path Forward

Mastering leverage isn’t about avoiding it altogether—it’s about wielding it wisely to enhance your financial journey without the pitfalls. By recognizing common miscalculations, spotting warning signs, and applying simple corrections, you can trade with confidence. Remember, the goal is steady growth, not overnight riches. Start small, learn from each step, and consult pros if needed. With these tools, leverage becomes an ally, not an adversary.