Imagine a world where cutting-edge university research doesn’t just sit in papers but powers real financial tools that anyone can use. That’s the spark behind the recent Ripple and UC Berkeley collaboration, which could reshape how cryptocurrencies like XRP fit into everyday business and investing. As blockchain tech evolves from hype to practical solutions, this partnership might just be the catalyst XRP needs for a serious comeback.

What Is UDAX and Why Does It Matter?

The University Digital Asset Xcelerator, or UDAX, isn’t your typical startup incubator—it’s a targeted program designed to turn academic blockchain ideas into working products on the XRP Ledger. Launched in late 2025 as a pilot with UC Berkeley, it brings together nine early-stage teams focused on areas like tokenized assets, decentralized finance (DeFi), and creator economies. Over six weeks, participants get hands-on help from Ripple engineers, university experts, and venture capitalists to refine their projects and prepare for real-world launch.

This isn’t just about education; it’s about creating tangible value. For instance, one startup in the cohort, WaveTip, went live on the XRP mainnet, while another tokenized over $1.5 million in assets. According to Ripple’s official announcement, the program aims to “bridge the gap between early-stage ideas and market readiness,” potentially expanding XRP’s use in enterprise settings.

Ripple XRP crypto currency themed banner. Ripple coin or XRP icon …

Think of UDAX as a launchpad that speeds up innovation. For everyday folks interested in crypto, this means more user-friendly apps built on XRP could emerge, making things like cross-border payments or asset trading simpler and cheaper.

The Roots of the Partnership: Building on Years of Collaboration

Ripple and UC Berkeley didn’t team up overnight. Their relationship dates back to 2018 through the University Blockchain Research Initiative (UBRI), a global program funding research at over 50 universities. UC Berkeley, known for churning out more venture-backed founders than any other school, has been a key player, receiving grants for studies on blockchain’s role in financial inclusion and digital payments.

In 2025, Ripple upped the ante with a $1.3 million donation in their stablecoin, RLUSD, to establish the Center for Digital Assets at Berkeley. This center focuses on advancing tech like stablecoins and DeFi, directly feeding into UDAX. The partnership leverages Berkeley’s academic muscle—think rigorous testing and ethical innovation—with Ripple’s practical expertise in building scalable blockchain systems.

For the average person, this collab demystifies crypto. It’s not just tech jargon; it’s about creating tools that could make global money transfers as easy as sending a text, potentially driving more people to use XRP without needing a finance degree.

$1.3M gift from Ripple launches new Berkeley Center for Digital …

Potential Impacts: Could UDAX Spark XRP’s Next Big Surge?

XRP has had its ups and downs, but UDAX could change that by fostering real utility. The pilot alone saw startups boost their product readiness by 67% and attract VC interest, signaling stronger institutional adoption. If more programs like this roll out, we might see XRP powering everything from tokenized real estate to insurance products, expanding its market beyond speculation.

Experts note that academic-backed initiatives like this can lead to “demand shocks” for tokens like XRP, as new use cases draw in businesses and investors. Historically, XRP’s market cap has grown with partnerships—jumping from under $10 billion in 2017 to peaks over $100 billion. With UDAX, Ripple is betting on organic growth through innovation, which could stabilize prices and attract long-term holders.

For regular investors, this means watching for signs like increased XRPL transactions or new apps. If UDAX scales globally, XRP might not just grow—it could become a go-to for efficient, low-cost blockchain ops.

Ripple XRP market cap 2013-2025| Statista

Hurdles to Overcome: Not All Smooth Sailing

Of course, no crypto story is without challenges. Regulatory hurdles, like ongoing SEC scrutiny of XRP, could slow progress. Market volatility might also deter startups from fully committing. Plus, while UDAX focuses on enterprise solutions, widespread adoption depends on user trust and integration with existing financial systems.

A balanced view from industry reports suggests that while programs like UDAX are promising, true growth requires broader ecosystem support, including clearer laws and more developer tools. For everyday readers, this means tempering excitement—UDAX is a step forward, but XRP’s path to “major growth” will likely involve gradual wins rather than overnight booms.

The Road Ahead: Why This Could Be a Game-Changer for XRP

In wrapping up, UDAX represents a smart fusion of brains and business that could propel XRP into new territories. By turning university smarts into practical tools, Ripple and UC Berkeley are laying groundwork for sustainable crypto growth. Whether it drives “major” XRP expansion depends on execution, but early signs are encouraging—more startups, more utility, and more eyes on the ecosystem.

If you’re dipping your toes into crypto, keep an eye on XRPL developments. This partnership might just make XRP a household name for reasons beyond price charts.

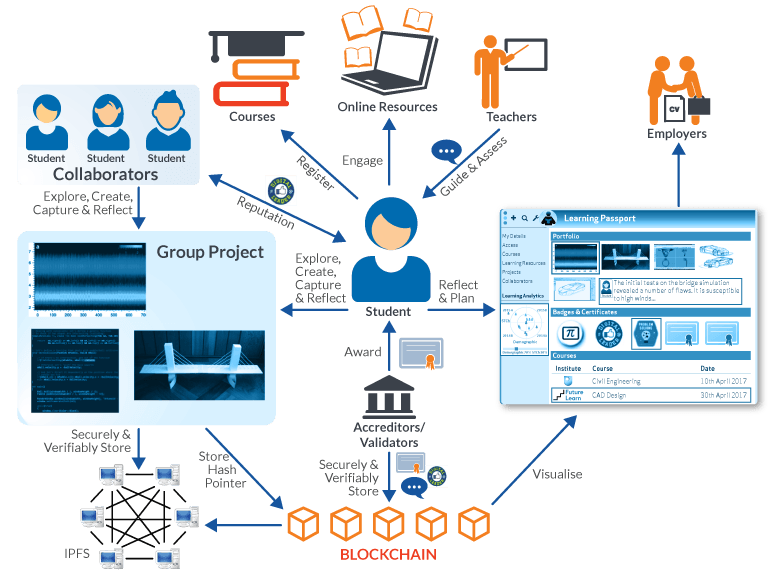

Blockchain in Education – Possible Applications of this Technology …