Ever wondered why big companies sit on piles of cash that just sits there earning almost nothing, while they wait days for payments to clear across borders? Ripple is tackling exactly that problem head-on. In late 2025, the company made headlines with a massive $1 billion acquisition of GTreasury, a top player in corporate treasury software. Fast forward to January 2026, and they’ve launched Ripple Treasury—a powerful new platform that blends old-school cash management with blockchain speed to finally free up that “trapped” money.

This isn’t just another tech upgrade; it’s Ripple’s bold step to bring blockchain efficiency into the heart of Fortune 500 finance, helping businesses earn more on idle funds, pay instantly worldwide, and cut out slow, expensive middlemen. For everyday folks interested in finance and crypto, this could mean ripple effects (pun intended) in how global money moves faster and smarter.

The Big Move: Ripple’s $1 Billion GTreasury Acquisition

Back in October 2025, Ripple bought GTreasury—a company with over 40 years of helping major brands handle their money—for a whopping $1 billion. GTreasury’s software already powers treasury operations for thousands of large firms, managing everything from cash flow to risk and payments.

This deal gave Ripple instant access to the massive corporate treasury world, often valued at over $120 trillion in assets under management. It’s part of Ripple’s 2025 buying spree, which also included prime broker Hidden Road and stablecoin platform Rail, showing they’re building a full toolkit for modern finance.

As Ripple CEO Brad Garlinghouse put it, outdated systems trap capital in delays and high costs—now, combining GTreasury’s expertise with Ripple’s blockchain opens doors to real-time solutions.

Watch Ripple CEO Brad Garlinghouse speak live on SEC legal battle

What Is Ripple Treasury and How Does It Work?

Launched in late January 2026, Ripple Treasury (powered by GTreasury) is a one-stop dashboard for chief financial officers and treasury teams. It handles traditional tasks like forecasting cash, managing risks, and reconciling accounts—while adding blockchain superpowers.

Key features include:

- Instant cross-border payments that settle in seconds using Ripple’s network and RLUSD stablecoin (instead of 3-5 days via old wires).

- No need for pre-funding accounts abroad, freeing up billions in locked cash.

- Yield on idle money by connecting to global repo markets through Hidden Road.

The best part? Crypto is optional—companies skeptical about digital assets can stick to traditional tools while dipping a toe in blockchain benefits later.

According to reports from sources like PYMNTS and DL News, this setup lets treasurers see and move money in real time, reducing friction that has plagued corporate finance for decades.

Unlocking Idle Capital: Why It Matters for Businesses

Corporate treasuries often hold huge sums in low-yield accounts or stuck waiting for settlements. Ripple Treasury changes that by letting firms:

- Earn better returns on short-term cash via repo markets.

- Make 24/7 global payments without banking hour limits.

- Tokenize or use stablecoins like RLUSD for faster, cheaper transfers.

This could activate trillions in “idle” capital worldwide. For example, instead of money sitting idle earning near-zero interest, it can now work harder—boosting profits and efficiency.

Industry analyses highlight how this bridges traditional finance and blockchain, making tools like Ripple’s RLUSD a natural fit for enterprise cash workflows without forcing full crypto adoption.

Benefits for Everyday Investors and the Bigger Picture

You might not run a Fortune 500 company, but this matters. Faster, cheaper global payments could lower costs for imported goods, speed up international business, and make finance more inclusive.

For crypto fans, it spotlights Ripple’s RLUSD stablecoin and XRP’s role in infrastructure—potentially driving more real-world use. As companies adopt these tools, demand for efficient blockchain rails grows, benefiting the ecosystem.

Experts note this positions Ripple as a leader in merging TradFi and crypto, especially post-regulatory clarity.

Looking Forward: The Future of Corporate Finance

With Ripple Treasury now live, expect more big firms to test blockchain for treasury ops. It’s early days, but the $1 billion bet signals confidence that digital assets can solve real pain points in corporate money management.

Whether you’re watching XRP prices, curious about stablecoins, or just interested in how money really moves globally—this development shows finance is evolving fast. Ripple’s push could make “unlocking capital” the new normal for businesses everywhere.

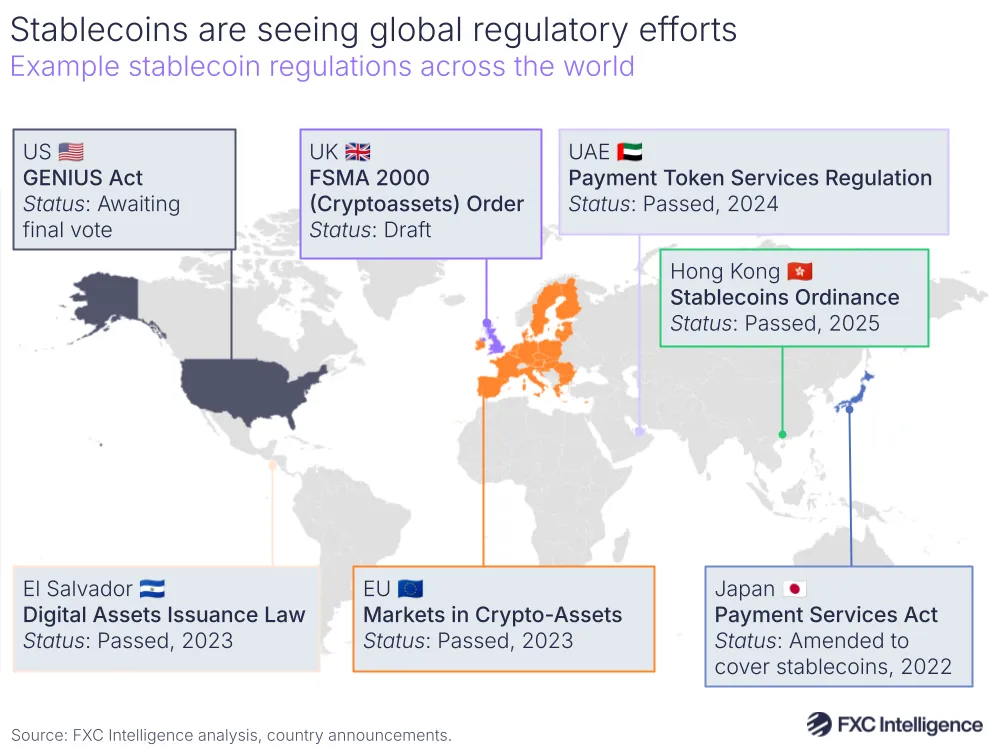

The state of stablecoins in cross-border payments: 2025 primer

What do you think—will corporate treasuries go blockchain in the coming years?