Ever wondered how a centuries-old accounting giant like PwC suddenly dives headfirst into the wild world of digital assets? It’s like watching a buttoned-up banker swap their suit for a tech hoodie overnight. As of early 2026, PwC’s bold pivot toward tokenization and stablecoins isn’t just a trend chase—it’s a calculated move driven by regulatory green lights and the promise of reshaping how we handle money and assets in everyday life. This shift could make investing as simple as buying shares in your favorite coffee shop from your phone, all while keeping things secure and efficient.

Decoding Tokenization and Stablecoins

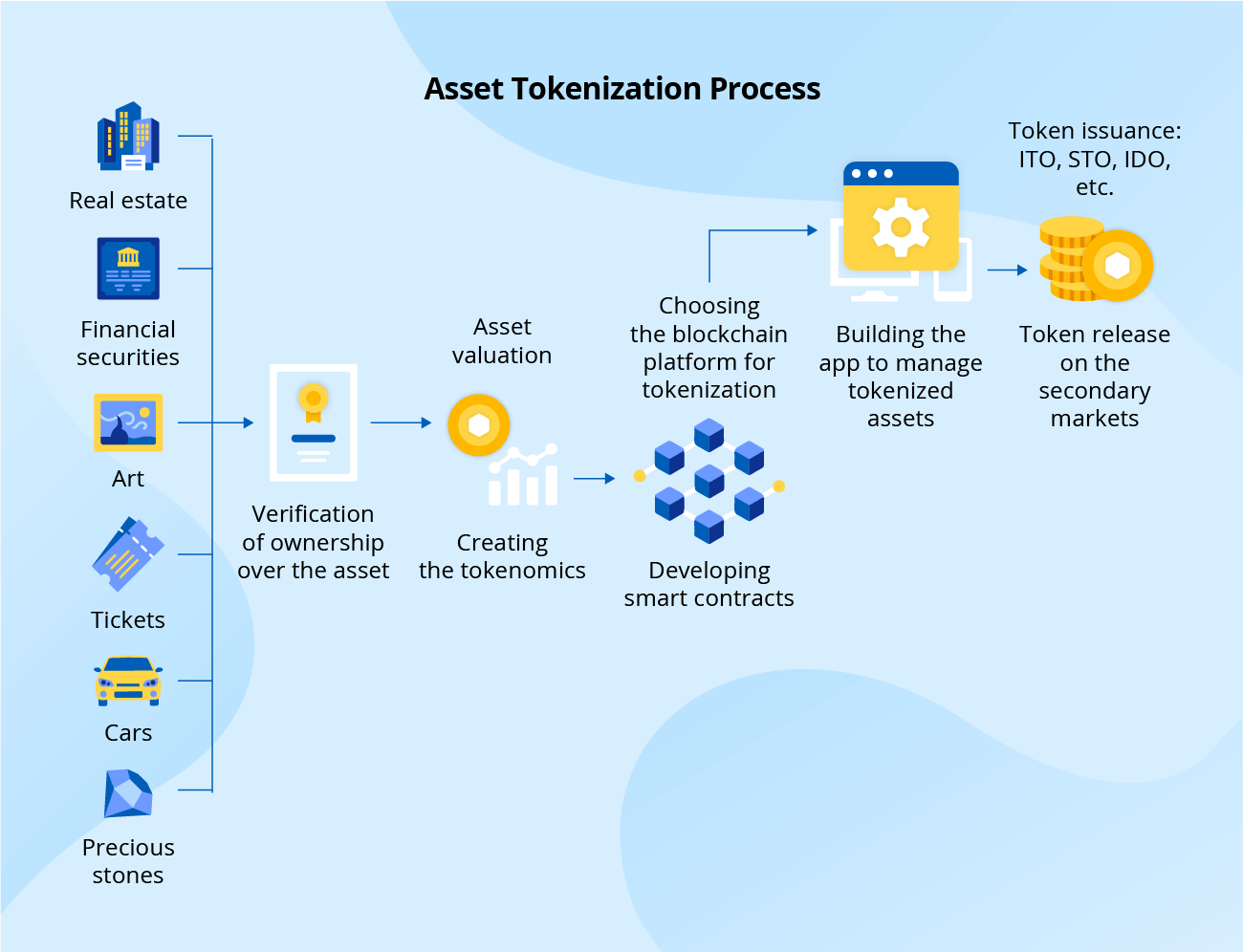

Let’s break it down without the jargon overload. Tokenization is essentially turning real-world stuff—like real estate, art, or even company shares—into digital tokens on a blockchain. These tokens act like virtual certificates of ownership, making it easier to buy, sell, or trade fractions of high-value items that were once out of reach for most folks.

Stablecoins, on the other hand, are cryptocurrencies designed to hold steady value, often pegged to something reliable like the U.S. dollar. Unlike Bitcoin’s rollercoaster rides, they provide a calm harbor for transactions in the crypto storm. Think of them as digital cash that combines the speed of online payments with the stability of your bank account.

The Rise Of Stablecoins: A New Era In Digital Finance

The Regulatory Spark Igniting PwC’s Move

For years, PwC played it safe with crypto, wary of murky rules and potential pitfalls. But the landscape flipped in late 2025 with the passage of the GENIUS Act, a U.S. law that clarified stablecoin regulations and boosted confidence across the board. Under a more crypto-friendly administration, agencies like the SEC have softened their stance, making it less risky for big players to jump in.

PwC’s U.S. CEO, Paul Griggs, highlighted this as a game-changer, noting that the act creates “more conviction” around stablecoins and tokenized assets. This regulatory clarity isn’t just paperwork—it’s unlocking doors for institutions to experiment without fearing legal headaches.

Take advantage of the possibilities offered by blockchain …

Key Reasons PwC Sees Huge Potential

Why the big bet? First off, tokenization democratizes access to investments. Imagine owning a tiny piece of a luxury apartment building without needing millions upfront—fractional ownership makes that possible, lowering barriers and boosting liquidity. PwC envisions this transforming asset management, where everyday investors can tap into markets previously reserved for the wealthy.

Stablecoins add fuel by streamlining payments. They’re already handling billions in daily transactions, rivaling traditional networks, and PwC is advising clients on using them for faster, cheaper cross-border transfers. In a global economy, this efficiency could save businesses time and money, turning clunky processes into seamless digital flows.

Moreover, as tokenization grows—potentially hitting trillions in value by 2030—PwC positions itself as the go-to expert for audits, compliance, and strategy in this new frontier.

Why and How to Perform Asset Tokenization in 2025

Bridging Traditional Finance and Crypto

PwC isn’t stopping at advice; they’re building bridges. By partnering with blockchain specialists and expanding services like wallet management and cybersecurity, they’re helping traditional firms integrate these technologies safely. This hybrid approach ensures that as assets go on-chain, governance and risk controls keep pace, appealing to cautious corporations.

PwC’s Roadmap and Initiatives

In practice, PwC is ramping up its digital assets team, focusing on hyper-engagement in auditing crypto exchanges, stablecoin issuers, and tokenization platforms. They’ve been pitching ideas like using stablecoins to optimize payment systems, drawing from their reports on blockchain’s transformative power.

One standout initiative is their emphasis on tokenized private markets, where assets like bonds or real estate get digitized for better scalability. This not only speeds up settlements but also enhances transparency, reducing fraud risks in complex deals.

Making sense of bitcoin and blockchain technology: PwC

Looking Ahead: A Transformed Financial Landscape

As 2026 unfolds, PwC’s wager could redefine finance, making it more inclusive and innovative. With stablecoins stabilizing volatile markets and tokenization unlocking new opportunities, the firm is betting on a future where digital and traditional worlds merge seamlessly. For ordinary people, this means easier access to diverse investments and smoother global transactions—potentially putting more financial power in your pocket.

Yet, challenges like cybersecurity and evolving regs remain, but PwC’s proactive stance suggests they’re ready to navigate them. In this evolving story, one thing’s clear: The once-distant crypto realm is becoming mainstream, and giants like PwC are leading the charge.