If you’re new to cryptocurrency, terms like “public key” and “private key” might sound confusing. But don’t worry—these are just the tools that keep your crypto safe. This beginner-friendly guide explains what public and private keys are, how they work, and why they’re crucial for your cryptocurrency security, all in simple terms.

What Are Public and Private Keys?

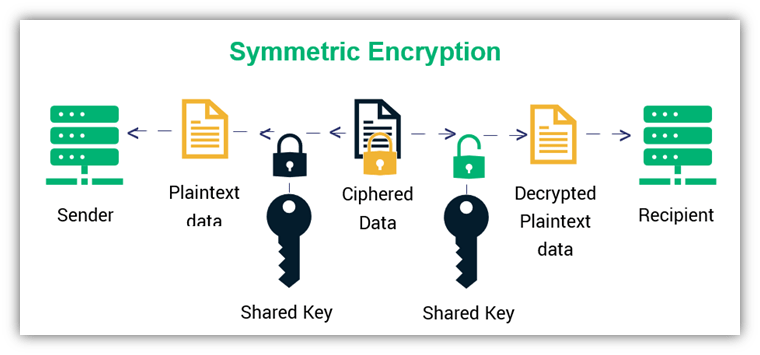

Public and private keys are the backbone of cryptocurrency security. They’re like a digital lock and key that protect your money on the blockchain, the technology behind Bitcoin and Ethereum. Together, they ensure only you can access and spend your crypto.

- Public Key: This is like your email address. You share it with others so they can send you crypto.

- Private Key: This is like your password. You keep it secret because it gives full control over your crypto.

These keys are long strings of letters and numbers, created using cryptography, which makes them super secure.

How Do Public and Private Keys Work?

Public and private keys work together to make crypto transactions safe and private. Here’s how they function, step by step:

1. Your Public Key Receives Crypto

When someone wants to send you cryptocurrency, they need your public key (or a shorter version called an address). For example, you might share your Bitcoin address, which is derived from your public key. The sender uses this to direct the crypto to you on the blockchain.

2. Your Private Key Authorizes Spending

To spend or send your crypto, you use your private key. It acts like a digital signature, proving you’re the owner of the funds. The blockchain checks your private key to confirm the transaction is valid, without ever revealing the key itself.

3. Cryptography Keeps It Secure

Public and private keys are mathematically linked, but it’s nearly impossible to guess one from the other. This is thanks to cryptography, which ensures that even if someone knows your public key, they can’t figure out your private key.

Why Are Public and Private Keys Important?

These keys are what make cryptocurrencies secure and decentralized. Here’s why they matter:

1. Security Without Banks

Unlike a bank account, where the bank handles security, crypto puts you in charge. Your private key ensures only you can access your funds, and the blockchain’s design makes transactions tamper-proof.

2. Privacy

Your public key (or address) is shared, but it’s not tied to your real name, offering some anonymity. Your private key stays hidden, keeping your funds safe from others.

3. Control Over Your Money

With your private key, you have full control over your crypto. No government or company can freeze your funds or block your transactions, which is a big part of crypto’s appeal.

Public vs. Private Keys: Key Differences

Let’s break down the main differences between public and private keys:

- Purpose: Public keys receive crypto; private keys authorize spending or sending.

- Sharing: Share your public key freely; keep your private key secret.

- Access: Public keys are visible on the blockchain; private keys are known only to you.

- Risk: Losing your public key is no big deal; losing your private key means losing your crypto.

Think of it like a mailbox: the public key is the address where people send mail, and the private key is the key to open it.

How to Keep Your Keys Safe

Your private key is the most important part of your crypto security. If someone steals it, they can take your funds. If you lose it, your crypto is gone forever. Here’s how to stay safe:

1. Use a Secure Wallet

Store your keys in a crypto wallet. There are two main types:

- Software Wallets: Apps or programs (like MetaMask) for convenience.

- Hardware Wallets: Physical devices (like Ledger) for extra security.

2. Never Share Your Private Key

Treat your private key like a PIN code. Don’t share it with anyone, and be wary of phishing scams or fake websites asking for it.

3. Back Up Your Keys

Write down your private key or recovery phrase (a set of words that restores your wallet) and store it offline, like in a safe. Avoid storing it on your computer or cloud, where it could be hacked.

4. Use Two-Factor Authentication

If your wallet or exchange supports it, enable two-factor authentication (2FA) for extra protection. This adds a second step, like a code sent to your phone, to access your account.

Common Mistakes to Avoid

Newbies often make these errors with public and private keys:

- Sharing Private Keys: Never give your private key to anyone, even if they claim to be from a trusted platform.

- Losing Keys: Without a backup, losing your private key means losing your crypto forever.

- Storing Keys Unsafely: Saving your private key on a phone or email can expose it to hackers.

- Ignoring Updates: Keep your wallet software updated to protect against new security threats.

Real-World Example: Using Keys in Crypto

Let’s say you want to buy a coffee with Bitcoin:

- You give the coffee shop your public key (Bitcoin address).

- They send a payment request to that address.

- You use your private key to sign the transaction, approving the payment.

- The blockchain records the transaction, and the coffee is yours!

This process happens securely, without a bank, thanks to your keys.

Conclusion

Public and private keys are the heart of cryptocurrency security, letting you send, receive, and protect your digital money. By sharing your public key and guarding your private key, you can safely join the crypto world. Start with a secure wallet, back up your keys, and stay cautious. With these basics, you’re ready to explore crypto with confidence and keep your funds safe.