Cryptocurrency prices can feel like a rollercoaster, with coins like Bitcoin or Ethereum jumping or dropping 20% in a single day. This is called volatility, and it’s a big part of crypto investing. For beginners, understanding crypto volatility is crucial to making smart decisions in 2025. This guide explains what volatility is, why it happens, and how to handle it, all in simple terms to help you invest with confidence.

What is Crypto Volatility?

Volatility measures how much a cryptocurrency’s price changes over time. High volatility means prices swing dramatically—up or down—in short periods. For example, Bitcoin might be $50,000 today and $45,000 tomorrow. Unlike stable assets like bonds, crypto is one of the most volatile investments, which creates both opportunities and risks for beginners.

Why It Matters: Volatility can lead to big profits if you buy low and sell high, but it can also cause losses if prices crash unexpectedly.

Why Do Crypto Prices Swing So Much?

Crypto’s wild price movements are driven by several factors. Here’s what causes volatility in 2025:

1. Market Sentiment and Social Media Hype

Crypto prices are heavily influenced by what people think and say, especially on platforms like X or Reddit. A single tweet or post can trigger massive buying or selling.

Examples:

- A positive tweet from a crypto influencer can spike a coin’s price.

- Negative news, like a scam report, can cause a sell-off.

Tip: Don’t follow hype blindly. Check price trends on CoinGecko for reliable data.

2. Low Market Liquidity

Many cryptocurrencies, especially altcoins, have smaller markets than stocks. This means a few large trades can drastically move prices.

Example: If someone sells $500,000 of a low-volume coin, its price might drop 30% if there aren’t enough buyers.

Tip: Stick to high-liquidity coins like Bitcoin or Ethereum for more stable trading.

3. Regulatory Changes

Government policies or bans can shake the crypto market. Uncertainty about regulations in 2025 keeps prices unpredictable.

Examples:

- A country banning crypto trading can crash prices.

- Pro-crypto laws, like legalizing Bitcoin payments, can boost prices.

Tip: Stay updated on regulations via Cointelegraph.

4. Speculative Trading

Many crypto investors trade for short-term gains, not long-term value. This speculation fuels rapid price swings as traders buy and sell.

Example: Traders might buy Ethereum at $2,000 and sell at $2,200 in days, amplifying volatility.

Tip: Practice trading strategies on TradingView demo accounts.

5. Blockchain Events and Technology

Network upgrades, hacks, or events like Bitcoin’s halving can impact prices. Positive updates increase confidence, while issues cause drops.

Example: Ethereum’s 2022 upgrade reduced energy use, boosting its price. A major hack could tank a coin’s value.

How Volatility Impacts Beginners

Volatility affects new investors in two main ways:

- Opportunities: Buying during a dip can lead to profits if prices recover.

- Risks: Sudden crashes can cut your investment in half, especially if you panic-sell.

Common Beginner Mistakes:

- Buying at a price peak due to FOMO (fear of missing out).

- Selling during a dip out of fear, missing later recoveries.

- Investing in volatile altcoins without research.

Learning to handle volatility helps you avoid these traps and invest smarter.

Tips to Navigate Crypto Volatility Safely

Here are practical strategies to manage price swings and protect your investments in 2025.

1. Start with a Small Investment

Volatility is less scary when you risk only what you can afford to lose. Small investments let you learn without stress.

How to Do It:

- Invest $10–$50 in Bitcoin or Ethereum on Coinbase.

- Keep essential funds in a savings account, not crypto.

- Avoid borrowing or using credit to invest.

Example: Losing $20 in a crash won’t hurt, but losing $2,000 could.

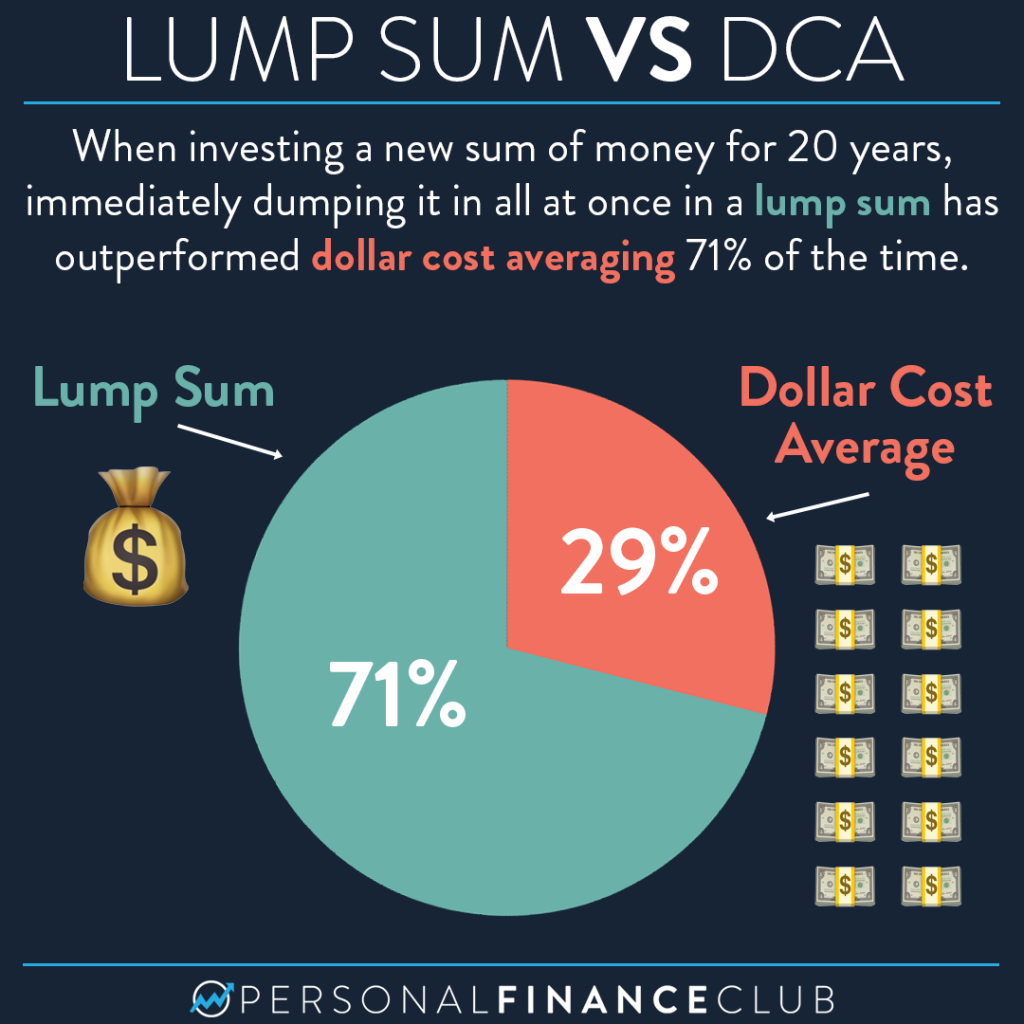

2. Use Dollar-Cost Averaging (DCA)

DCA reduces the risk of buying at a high price by spreading your investment over time.

How to Do It:

- Buy $10 weekly on Kraken regardless of price.

- Average your buy price to handle dips and spikes.

- Stick to the plan for months or years.

Example: Investing $10 weekly in Bitcoin buys more when prices are low, lowering your average cost.

3. Diversify Your Crypto Portfolio

Don’t put all your money in one coin. Diversifying across assets reduces the impact of a single coin’s crash.

How to Do It:

- Invest 60–70% in Bitcoin and Ethereum for stability.

- Add 20–30% in stablecoins like USDC to minimize volatility.

- Limit risky altcoins to 10% of your portfolio.

Example: With $50, buy $30 Bitcoin, $15 Ethereum, $5 USDC. Check prices on CoinGecko.

4. Focus on Long-Term Holding

Volatility matters less if you hold crypto for years. Long-term investing smooths out short-term price swings.

How to Do It:

- Buy coins with strong fundamentals, like Ethereum, on Binance.

- Plan to hold for 1–2 years, ignoring daily fluctuations.

- Store crypto in a secure wallet like Ledger.

Example: Bitcoin dropped 50% in 2022 but later recovered. Long-term holders profited.

5. Avoid Emotional Trading

FOMO or panic can lead to bad decisions, like buying high or selling low. Staying calm is key.

How to Do It:

- Set clear goals (e.g., sell at a 20% gain or hold for a year).

- Check prices weekly, not hourly, on CoinGecko.

- Practice discipline with demo accounts on TradingView.

Example: Panic-selling Ethereum during a dip might mean missing a rebound. Follow your plan.

6. Research Before Buying

Volatile coins with no real value are riskier. Research helps you choose solid investments.

How to Do It:

- Read project whitepapers and verify teams on official websites.

- Check community feedback on CoinDesk or Reddit’s r/cryptocurrency.

- Avoid coins hyped on X without a clear purpose.

Example: Ethereum’s real-world use in smart contracts makes it less risky than unproven altcoins.

Protecting Your Investments from Volatility

Beyond strategy, secure your crypto to avoid losses from scams or hacks:

- Use a Secure Wallet: Store funds in Trust Wallet or Ledger.

- Enable 2FA: Protect exchanges like Kraken with Google Authenticator.

- Avoid Scams: Never share your seed phrase or click suspicious links.

- Minimize Fees: Use low-fee platforms like Binance to save money.

Example: In 2024, phishing scams stole millions. Offline storage with Ledger prevents this.

How to Start Investing Despite Volatility

Ready to invest in crypto? Follow these steps to navigate volatility safely:

- Choose a Trusted Exchange: Sign up on Coinbase or Kraken.

- Start Small: Invest $10–$50 in Bitcoin or Ethereum.

- Use DCA: Buy small amounts weekly to average prices.

- Secure Your Funds: Move crypto to Trust Wallet or Ledger.

- Stay Informed: Follow Cointelegraph for market updates.

Tip: Join Reddit’s r/cryptocurrency for tips on handling price swings.

Conclusion

Crypto volatility is a challenge, but it’s manageable with the right approach. By understanding why prices swing, using DCA, diversifying, and staying calm, you can invest wisely in 2025. Start with a trusted platform like Coinbase, secure your funds with a Ledger wallet, and learn from CoinDesk. With these steps, you’ll navigate volatility and build confidence as a beginner investor!