Cryptocurrency can seem like a high-stakes game, but you don’t need a fortune to start. With a modest budget, you can build a balanced crypto portfolio that minimizes risks and maximizes potential. This beginner-friendly guide will walk you through practical steps to invest wisely, diversify effectively, and grow your wealth over time—all without breaking the bank.

Why Build a Balanced Crypto Portfolio?

A balanced portfolio spreads your investments across different assets to reduce risk. In the volatile world of crypto, where prices can swing wildly, diversification is key. By investing in a mix of cryptocurrencies, you can protect yourself from major losses while still benefiting from potential gains.

Even with a small budget, a balanced approach helps you avoid the trap of putting all your money into one coin—like betting everything on Bitcoin and hoping for the best. Instead, you’ll learn how to create a portfolio that’s stable, flexible, and growth-oriented.

Benefits of a Balanced Portfolio

- Lower Risk: Spreading investments reduces the impact of a single coin’s crash.

- Steady Growth: Different coins perform well at different times, smoothing out returns.

- Budget-Friendly: You don’t need thousands to diversify effectively.

Step 1: Set Your Budget and Goals

Before you buy any crypto, decide how much you can afford to invest. A good rule is to only use money you’re willing to lose, as crypto is inherently risky. For example, you might start with $100 or $500—whatever fits your finances.

Next, define your goals. Are you investing for long-term growth, like saving for a house in 5–10 years? Or are you aiming for short-term gains to fund a vacation? Your goals will shape your strategy.

Tips for Budgeting

- Start small: Even $10 a month can build a portfolio over time.

- Use dollar-cost averaging: Invest a fixed amount regularly to reduce the impact of price swings.

- Avoid debt: Never borrow money to invest in crypto.

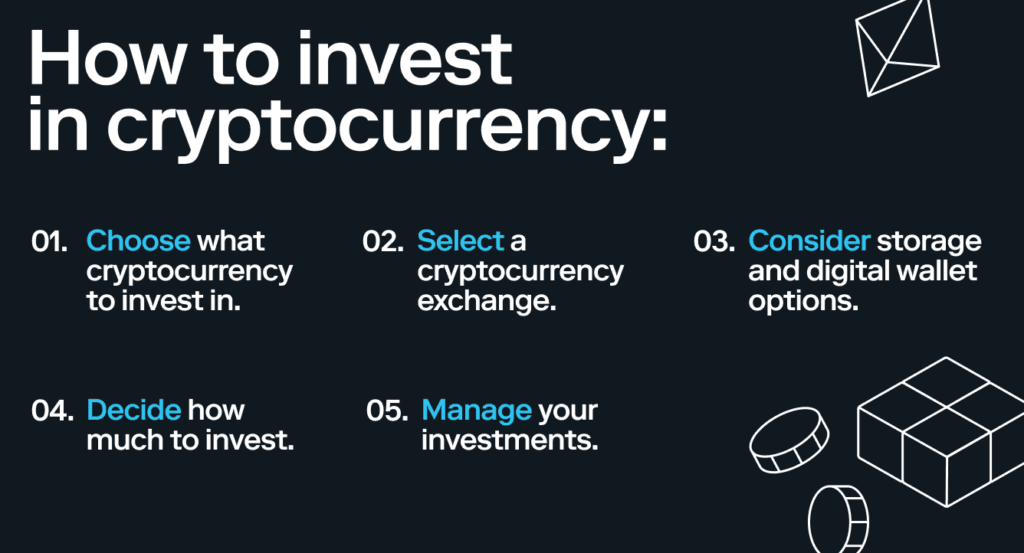

Step 2: Choose the Right Cryptocurrencies

Not all cryptocurrencies are equal. With thousands of coins out there, focus on a mix of established and promising ones to balance stability and growth. Here’s a simple framework for a budget portfolio:

Portfolio Breakdown

- 50% Blue-Chip Coins: Invest in well-known cryptocurrencies like Bitcoin (BTC) and Ethereum (ETH). These are less volatile and act as the backbone of your portfolio.

- 30% Mid-Cap Coins: Look for coins with growing ecosystems, like Solana (SOL) or Polygon (MATIC). These offer higher growth potential but carry more risk.

- 20% High-Risk, High-Reward Coins: Allocate a small portion to newer or niche projects, like meme coins or DeFi tokens. Be cautious, as these are speculative.

Pro Tip: Research each coin’s use case, team, and community. Websites like CoinMarketCap or CoinGecko provide detailed insights.

Step 3: Diversify Across Sectors

Crypto isn’t just about coins—it’s about industries. Diversifying across different crypto sectors reduces your risk if one area struggles. For example:

- Payments: Bitcoin, Litecoin (LTC).

- Smart Contracts: Ethereum, Cardano (ADA).

- DeFi (Decentralized Finance): Chainlink (LINK), Aave (AAVE).

- NFTs/Gaming: Axie Infinity (AXS), Decentraland (MANA).

By spreading your budget across 5–10 coins in different sectors, you create a safety net. If NFTs crash, your DeFi or payment coins might still perform well.

Step 4: Use a Reliable Platform

To buy crypto, you’ll need a trusted exchange or wallet. Popular platforms like Coinbase, Binance, or Kraken are beginner-friendly and support small transactions. Look for low fees, as these can eat into your budget.

For security, consider storing your coins in a software wallet like MetaMask or a hardware wallet if your portfolio grows. Never leave large amounts on an exchange.

Platform Checklist

- Low transaction fees for small purchases.

- Strong security features (e.g., two-factor authentication).

- User-friendly interface for beginners.

Step 5: Monitor and Rebalance Your Portfolio

Crypto markets move fast, so check your portfolio every few months. If one coin grows significantly, it might dominate your portfolio, increasing risk. Rebalance by selling some of the overperforming coin and buying more of the underperforming ones to maintain your target allocation.

Example: If Bitcoin jumps to 70% of your portfolio but your target is 50%, sell some BTC and reinvest in other coins.

Tools for Monitoring

- Blockfolio or Delta for tracking prices.

- Price alerts on exchanges to stay updated.

- News aggregators like CoinDesk for market trends.

Common Mistakes to Avoid

Building a crypto portfolio is exciting, but beginners often fall into traps. Here’s what to watch out for:

- Chasing Hype: Avoid buying coins just because they’re trending on social media.

- Ignoring Fees: High transaction fees can erode your budget.

- Panic Selling: Crypto is volatile—don’t sell during a dip unless it’s part of your strategy.

Final Thoughts

Building a balanced crypto portfolio on a budget is entirely possible with the right strategy. By setting clear goals, diversifying across coins and sectors, using reliable platforms, and staying disciplined, you can grow your wealth over time. Start small, stay informed, and don’t let market volatility shake your confidence.

Ready to dive in? Take your first step today and build a portfolio that works for you!