Have you ever watched a bonfire where the flames grow brighter as more fuel is added? That’s a bit like what’s happening with Polygon right now—in early January 2026, the network’s token burns from transaction fees have skyrocketed to unprecedented levels, sparking excitement among crypto enthusiasts. This surge isn’t random; it’s a sign of bustling activity on the platform, potentially paving the way for a more valuable token ecosystem. If you’re curious about what this means for your investments or just the broader crypto world, stick around as we explore the details in straightforward terms.

Understanding Polygon’s Fee Burning Mechanism

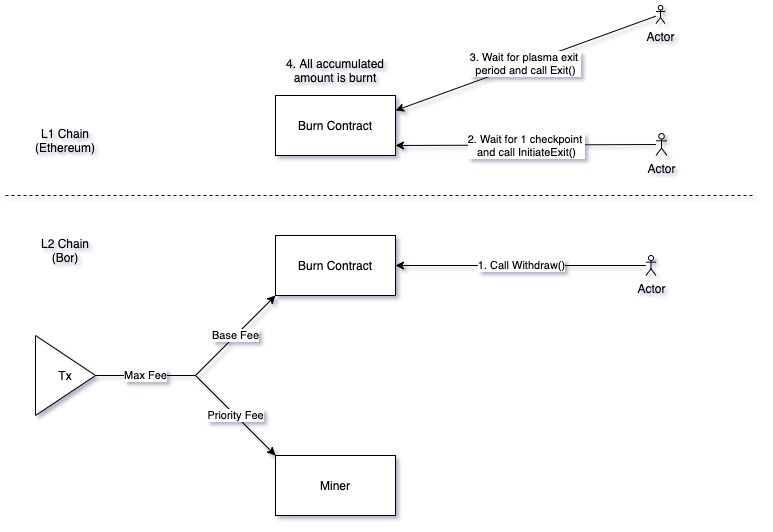

Polygon, often known by its token ticker POL (formerly MATIC), is a popular layer-2 solution built on Ethereum. It helps make transactions faster and cheaper by bundling them off the main chain. A key feature is its fee burning system: a portion of every transaction fee paid in POL gets permanently removed from circulation, or “burned.” This reduces the total supply over time, which can drive up the token’s value if demand stays strong—think of it as shrinking the pie so each slice is worth more.

Introduced to mimic Ethereum’s EIP-1559 upgrade, this mechanism ensures the network remains efficient and rewards long-term holders. Recently, daily burns have hit around 1 million POL, but the real headline is a single-day record of 3 million POL torched, equating to 0.03% of the total supply in one go.

Polygon Network Activates Mechanism to Burn a Portion of …

For everyday users, this means the network is humming with activity, as more transactions equal more fees and thus more burns.

The Record-Breaking Burn: What Sparked It?

On January 5, 2026, Polygon announced via its official X account that its Proof-of-Stake (PoS) chain had achieved an all-time high in daily fees generated, leading directly to that massive 3 million POL burn. This milestone reflects a surge in user demand, with more people using the network for everything from decentralized apps to cross-chain transfers.

Experts point to a combination of factors: renewed interest in layer-2 solutions amid Ethereum’s ongoing scalability challenges, plus Polygon’s own upgrades that make it even more appealing for developers and traders. If this pace holds, projections suggest up to 3.5% of POL’s supply could be burned annually, amplifying deflationary pressures and potentially boosting prices.

14+ Thousand Blockchain Polygon Royalty-Free Images, Stock Photos …

In simpler words, it’s like a busy highway collecting record tolls—the more traffic, the more “fuel” gets burned, signaling a healthy, growing system.

Driving Forces Behind the Surge in Network Activity

Why now? Polygon’s ecosystem is thriving thanks to increased adoption in DeFi protocols, NFT marketplaces, and even real-world applications like gaming. As Ethereum gas fees fluctuate, users flock to Polygon for its low-cost alternatives, ramping up transaction volumes.

Market analysts highlight early 2026’s crypto resurgence, with broader trends like institutional inflows and regulatory clarity encouraging more on-chain activity. Network dynamics, including partnerships and tech improvements, have also played a role, making Polygon a go-to for scalable blockchain solutions.

What Are Layer 2 Scaling Solutions? | Starknet

Picture this: As more builders create apps on Polygon, everyday folks join in, creating a virtuous cycle of usage that fuels these burns.

Implications for POL Holders and the Crypto Market

This burn bonanza could be a boon for POL investors. With supply decreasing while demand rises, basic economics suggests upward price pressure—though crypto’s volatility means nothing’s certain. Current trading around $0.11 to $0.20 shows recovery potential, with some forecasts eyeing $0.45 or higher by year’s end.

On a bigger scale, it underscores layer-2 networks’ maturity, helping Ethereum handle global-scale adoption without choking on fees. For newcomers, it’s a reminder that behind the price charts, real utility drives value.

Looking Ahead: Will the Burns Keep Blazing?

As 2026 unfolds, watch for sustained activity. If burns continue at this clip, Polygon could solidify its deflationary edge, attracting more users and capital. Challenges like competition from other L2s remain, but current momentum hints at exciting times.

In the end, this all-time high burn isn’t just a stat—it’s a snapshot of Polygon’s evolution from a sidechain helper to a powerhouse in its own right. Whether you’re trading, building, or just observing, these developments make the crypto space a little less mysterious and a lot more promising.

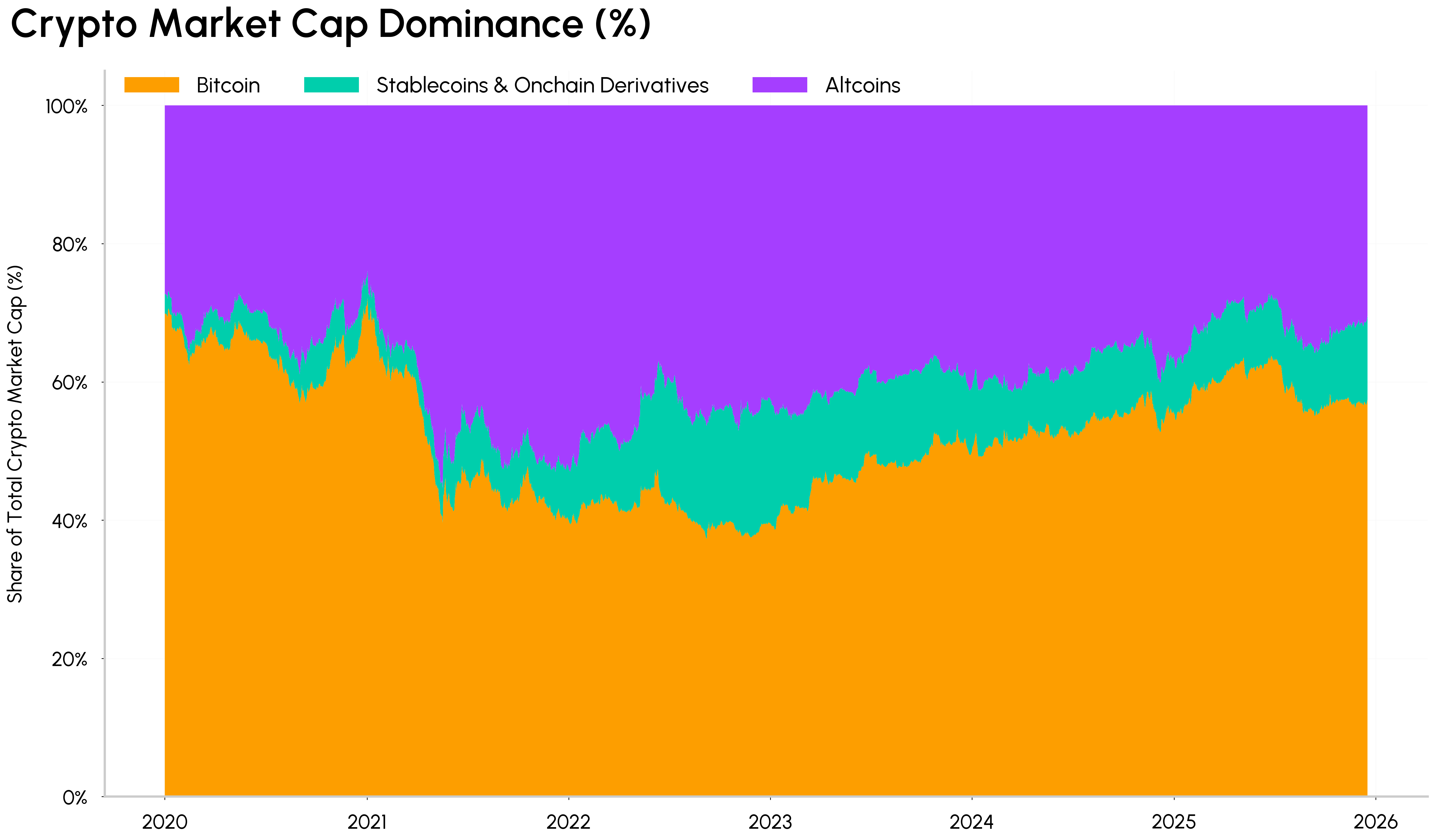

Crypto Trends To Watch in 2026 – by Tanay Ved