Wall Street’s biggest players once viewed cryptocurrency as a risky sideshow. Now, one of the most conservative giants is charging ahead. In late January 2026, Morgan Stanley named longtime executive Amy Oldenburg as its first-ever Head of Digital Asset Strategy—a freshly created role designed to unify and accelerate the bank’s crypto efforts. This move comes hot on the heels of the firm filing for spot Bitcoin and Solana ETFs in early January, plus plans for a proprietary digital wallet later in the year.

For everyday investors, this signals something big: crypto is no longer just for tech enthusiasts. When a $2 trillion+ institution like Morgan Stanley appoints a senior leader to drive ETF launches and more, it means regulated, easy-access crypto products could soon land in retirement accounts, brokerage portfolios, and advisory services. Let’s explore what this leadership change really means and why it matters to regular people dipping toes into digital assets.

Back View of a Man Walking in a Park at Downtown · Free Stock Photo

(Modern corporate building exterior representing a major financial institution like Morgan Stanley—symbolizing the shift from traditional finance to embracing digital assets.)

Who Is Amy Oldenburg and Why Her Appointment Matters

Amy Oldenburg isn’t a newcomer parachuting in from the crypto world. She’s a Morgan Stanley veteran since 2001, with deep roots in traditional finance. Most recently, she led the firm’s Emerging Markets Equity team while quietly advancing digital asset initiatives since late 2021. Bloomberg reported on January 27, 2026, that Oldenburg now heads a new firm-wide digital asset strategy and execution group.

Her insider status gives her credibility with skeptical traditional bankers, while her experience positions her perfectly to bridge old-school finance and blockchain innovation. As reported across sources like The Block and BeInCrypto, this appointment shifts crypto from experimental research to coordinated execution—think product launches, partnerships, and client rollout.

(Insert image here: Professional portrait of a senior female executive in finance—representing Amy Oldenburg’s leadership role in Morgan Stanley’s crypto strategy.)

The ETF Filings: Morgan Stanley’s Direct Play in Crypto

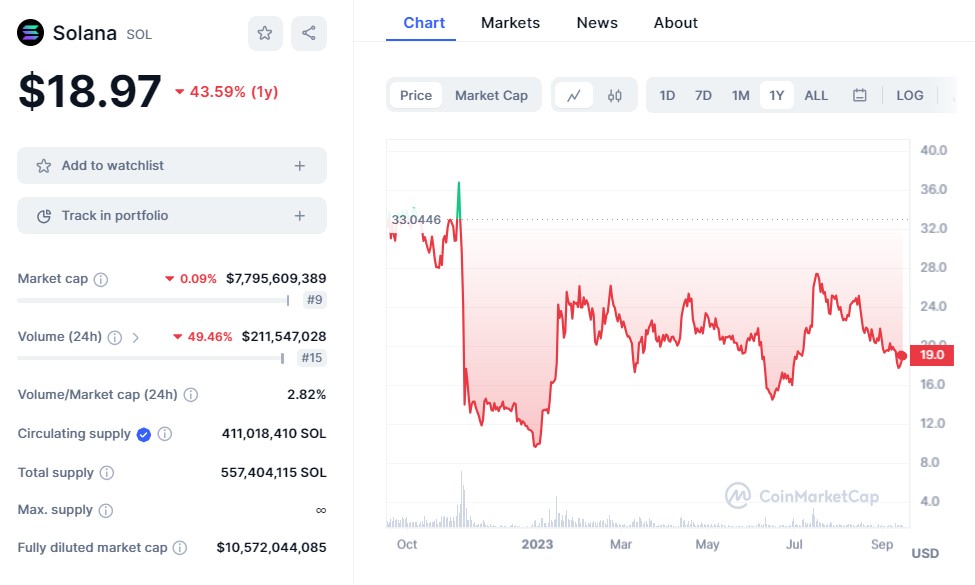

The real spark came earlier in January 2026, when Morgan Stanley Investment Management filed S-1 registration statements with the SEC for spot Bitcoin and Solana ETFs (Reuters, January 6, 2026). Unlike simply offering third-party funds, these would be house-branded products that track the actual prices of Bitcoin and Solana—potentially including staking features for Solana to generate extra yield.

If approved, these ETFs could open crypto exposure to Morgan Stanley’s massive wealth management client base—nearly 19 million people. No need for personal wallets or exchanges; clients could buy shares through familiar accounts, much like stocks or bonds. This mirrors how BlackRock’s Bitcoin ETF became hugely successful, drawing billions in inflows from everyday and institutional investors.

(These charts illustrate Bitcoin and Solana price trends with ETF overlays—highlighting how regulated funds provide straightforward exposure to crypto performance.)

Beyond ETFs: Wallet Plans and Broader Crypto Integration

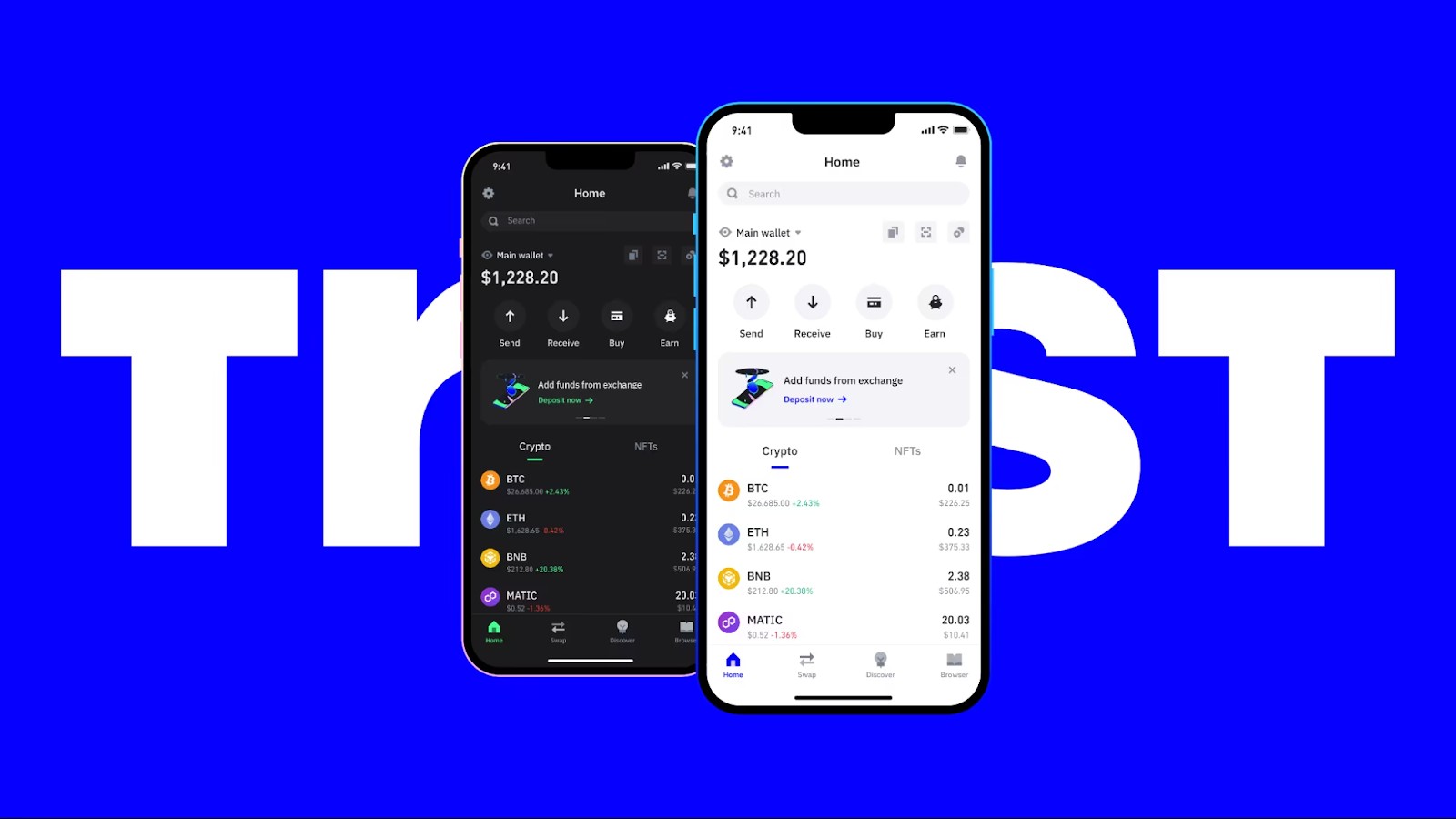

Oldenburg’s role ties together more than just ETFs. Morgan Stanley has announced plans to launch a proprietary digital wallet in the second half of 2026, supporting cryptocurrencies and tokenized assets (as noted in multiple reports, including Incrypted and CoinMarketCap coverage from January 2026). The bank is also expanding crypto trading on its E*TRADE platform, starting with Bitcoin, Ether, and Solana in the first half of the year.

These steps create a full ecosystem: easy buying via ETFs, holding and managing via a wallet, and trading on a trusted platform. For ordinary users, it lowers barriers—less worry about security, taxes, or complexity—while keeping the benefits of digital assets like potential growth and diversification.

(Examples of clean, user-friendly crypto wallet interfaces on smartphones—showing how everyday people could manage Bitcoin, Solana, and other assets through Morgan Stanley’s upcoming tools.)

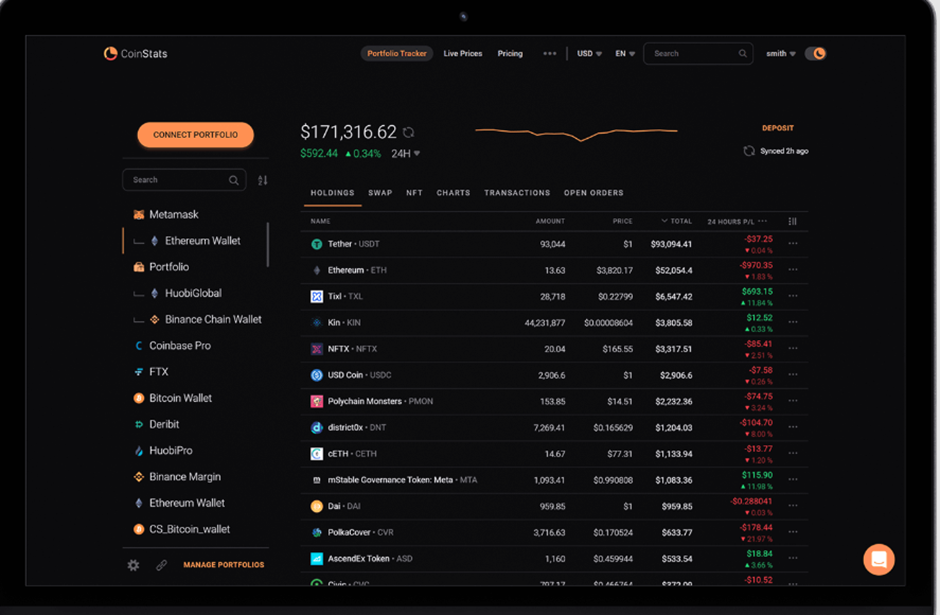

Why This Push Appeals to Everyday Investors

Traditional banks entering crypto changes the game for regular people. Many hesitate because of volatility, hacks, or regulatory uncertainty. Morgan Stanley’s involvement brings:

- Regulated products that feel safer and more familiar.

- Potential inclusion in IRAs, 401(k)s, or advisory portfolios.

- Clear guidance from experts (Morgan Stanley’s Global Investment Committee has suggested 2-4% allocations to crypto for suitable clients).

- Competition that could drive down fees and improve options.

As institutional giants like Morgan Stanley move in, crypto gains mainstream legitimacy—much like how index funds revolutionized stock investing decades ago.

(Realistic views of investors tracking portfolios on devices—depicting how crypto ETFs and holdings appear in familiar apps, making digital assets accessible to non-experts.)

Looking Ahead: What to Watch for in 2026

Oldenburg’s team is already hiring for roles in digital asset strategy, product development, and compliance—signs of serious scaling. ETF approvals could take months, but momentum builds fast in this space. Meanwhile, the bank’s push aligns with broader trends: more stablecoins, tokenized real-world assets, and 24/7 markets.

For anyone curious about crypto but wary of going it alone, this is a milestone. A trusted name like Morgan Stanley stepping up with leadership, ETFs, and tools means digital assets are evolving from speculative bets to structured investment choices. Keep an eye on SEC updates and Morgan Stanley announcements—2026 could mark the year Wall Street truly embraces crypto for the masses.