Ever dreamed of earning Bitcoin while sipping coffee at home, without noisy machines or sky-high electric bills? That’s the promise of cloud mining—renting powerful computers from far-away data centers to mine crypto for you. In 2026, with Bitcoin pushing new highs and mining getting tougher for solo setups, more everyday folks are turning to these services for passive income. But not all platforms are created equal. This guide breaks down the must-know factors for picking a reliable one, then spotlights NAP Hash as a real-world example that’s catching attention for its straightforward approach.

Understanding Cloud Mining Basics

Cloud mining lets you lease “hash power”—the computing muscle needed to solve crypto puzzles and earn rewards—without buying hardware. You sign up, buy a contract, and the provider handles the rest: equipment, electricity, cooling, and maintenance. Rewards (usually Bitcoin) land in your wallet daily or weekly.

It’s appealing for beginners because it’s hands-off and low-entry—some start with just a few dollars. But returns depend on Bitcoin’s price, network difficulty, and the platform’s efficiency. In 2026, post-halving effects and rising difficulty make choosing wisely even more crucial.

What Are Crypto Data Centers? | Tech & Infrastructure

Key Factors to Consider When Choosing a Platform

Picking the right service boils down to trust and practicality. Here’s what to check:

Transparency and Reputation

Look for clear info on company registration, data center locations, and real operations. UK-registered platforms like some newcomers follow stricter rules, building user confidence. Avoid sites with vague details or over-the-top promises—scams still lurk in this space.

Fees and Contract Terms

Compare maintenance fees (often deducted daily), contract lengths (short-term for flexibility, long-term for stability), and payout schedules. Transparent platforms show exact costs upfront, so you can calculate real profits.

Security Features

Strong encryption, two-factor authentication, and insured funds are essentials. Check if withdrawals are fast and unrestricted.

Sustainability and Efficiency

With energy concerns growing, platforms using hydro, wind, or solar power often have lower costs and better long-term stability. This can mean steadier returns as electricity prices fluctuate.

User Experience and Support

A clean dashboard for tracking earnings, mobile apps, and responsive customer help make life easier. Bonus perks like sign-up trials let you test without risk.

QuarryBit | Cloud-based Bitcoin Mining Dashboard by Wil Murillo …

Profitability Tools

Good sites offer calculators to estimate returns based on current conditions. Always factor in Bitcoin volatility—use these to set realistic expectations.

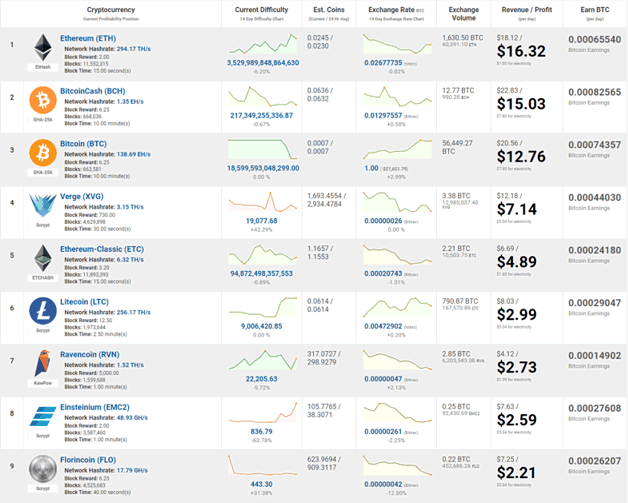

CoinWarz

Risks to Watch Out For

No investment is risk-free. Cloud mining can face scams, sudden fee hikes, or lower-than-expected payouts if Bitcoin dips or difficulty spikes. Platform shutdowns or counterparty issues (them holding your rewards) add uncertainty. Experts recommend starting small and diversifying.

U.S.’ first nuclear-powered Bitcoin mining center to open in Q1

Case Study: NAP Hash in 2026

NAP Hash (often called NAP) stands out this year for its focus on simplicity and reliability. Registered in the UK, it emphasizes regulatory compliance and uses clean energy sources like hydro and solar for efficient operations.

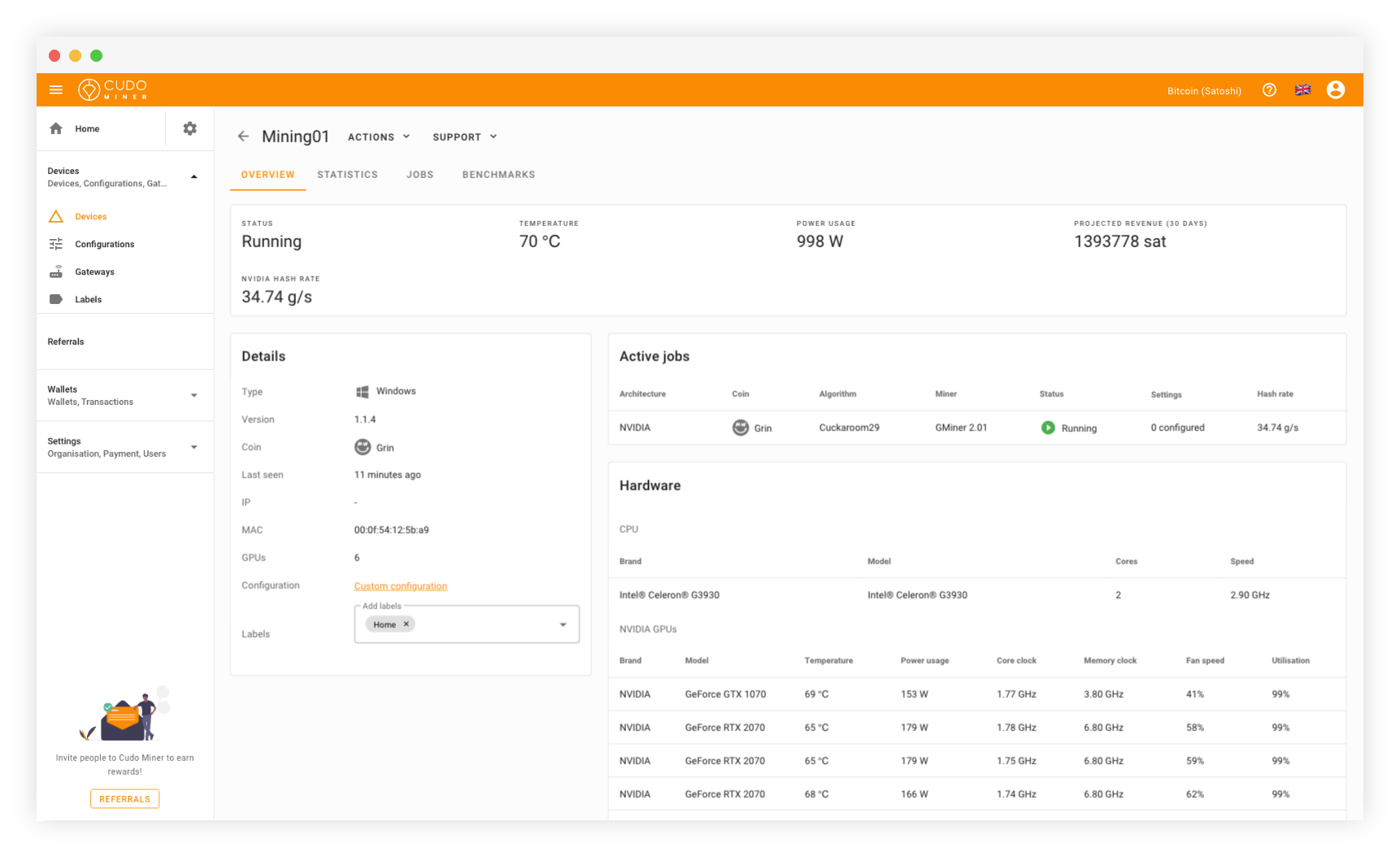

CudoMiner | Bitcoin & Cryptocurrency mining software

Setup is quick: sign up, grab a starter bonus, and choose short contracts (1-30 days) with daily payouts. No hardware hassles—just automated mining and principal returned at the end. Users report steady earnings, with some highlighting it as a calmer alternative amid market swings. Its mobile-friendly dashboard and referral perks add appeal for casual miners.

While results vary with market conditions, NAP Hash’s transparent model and green focus align well with 2026 trends toward sustainable, user-friendly services.

Final Thoughts: Start Smart in 2026

Cloud mining opens crypto rewards to anyone, but success hinges on research. Prioritize transparent, secure platforms with fair terms and real infrastructure. Test with small amounts, monitor performance, and treat it as one piece of a diversified portfolio.

Whether you’re eyeing NAP Hash or comparing options, always do your own checks—read reviews, crunch numbers, and stay updated on Bitcoin trends. With the right choice, cloud mining could become a simple way to grow your holdings in this exciting year ahead.