Ever dreamed of earning Bitcoin without filling your garage with noisy machines or stressing over skyrocketing electric bills? That’s the promise of cloud-based mining—a way to rent powerful computing resources remotely and collect rewards from the comfort of your couch. In 2025, platforms like Fleet Mining are making this more accessible than ever, blending AI smarts with user-friendly tools to help everyday people join the Bitcoin network.

Understanding Cloud-Based Bitcoin Mining

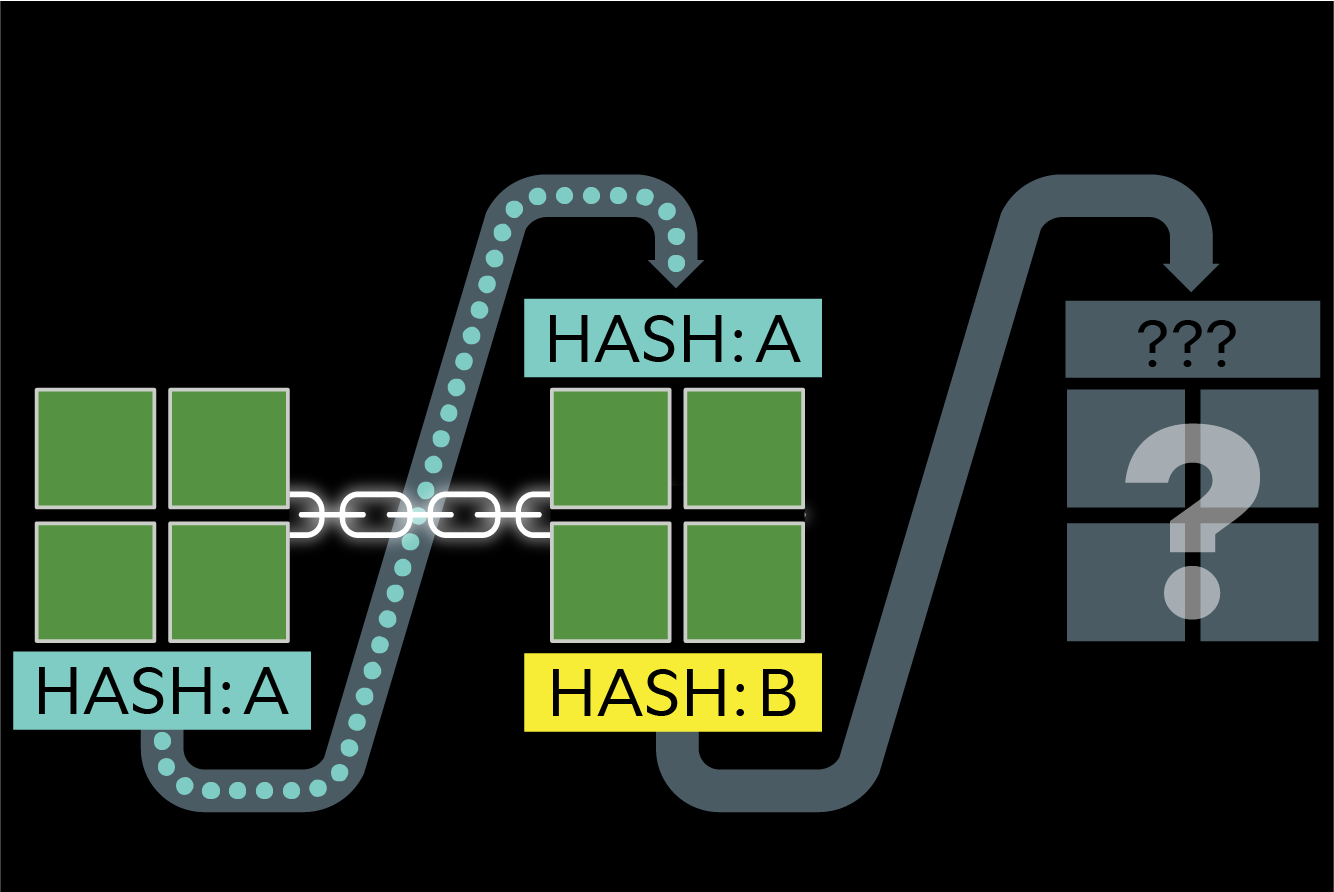

At its core, Bitcoin mining involves solving complex math puzzles to validate transactions and secure the network, earning new BTC as a reward. Traditional mining requires buying expensive hardware (ASIC miners), dealing with heat and noise, and paying high electricity costs.

Cloud mining flips this: You rent “hashrate”—computing power—from large data centers equipped with thousands of machines. These facilities handle everything, from maintenance to cooling, while you get a share of the mined Bitcoin.

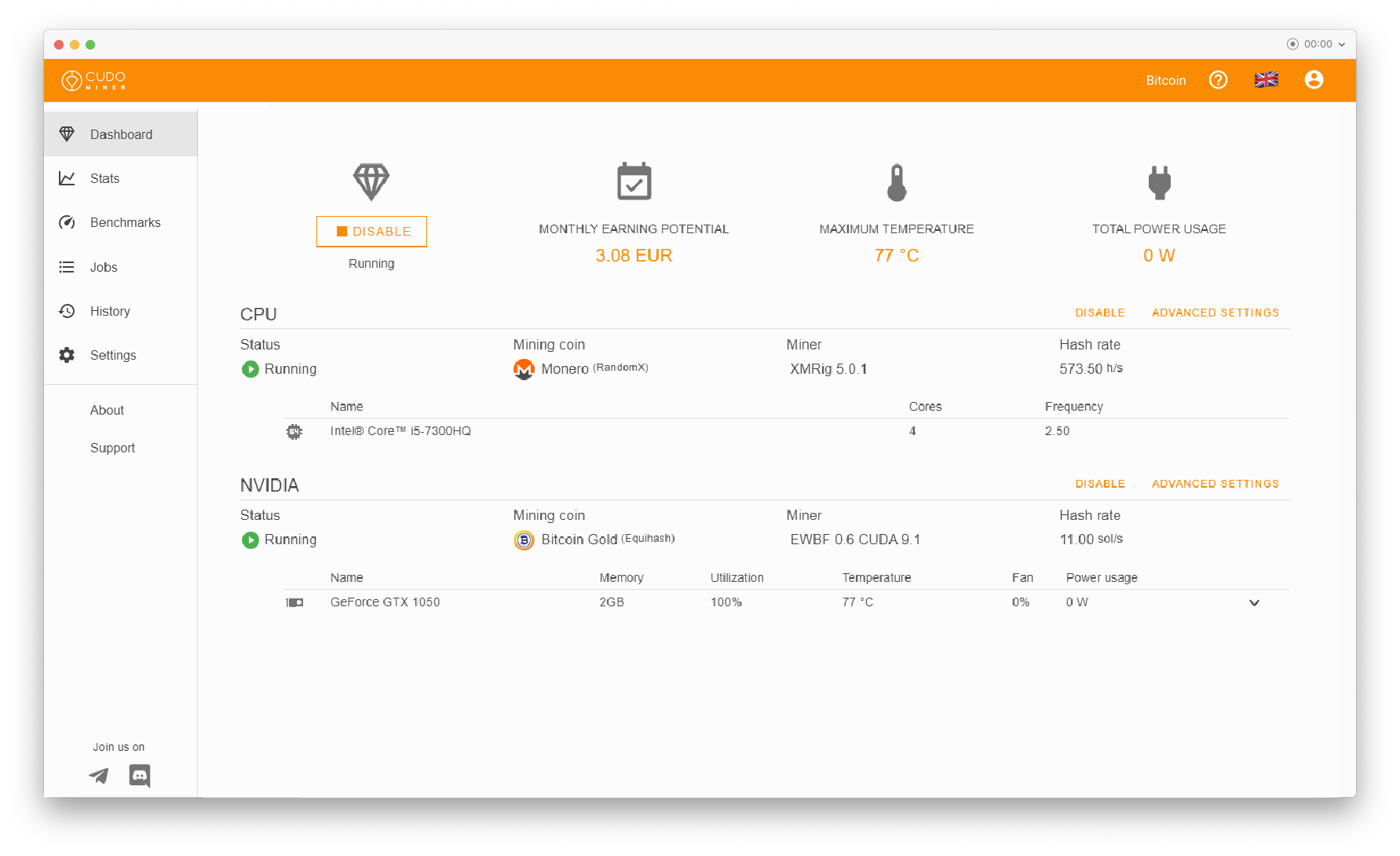

Platforms like Fleet Mining specialize in this model, often using AI to optimize operations and focus on efficient Bitcoin production. According to CoinLedger’s 2025 guide, this approach lowers barriers, allowing anyone with an internet connection to participate without technical expertise.

What Sets Fleet Mining Apart in 2025

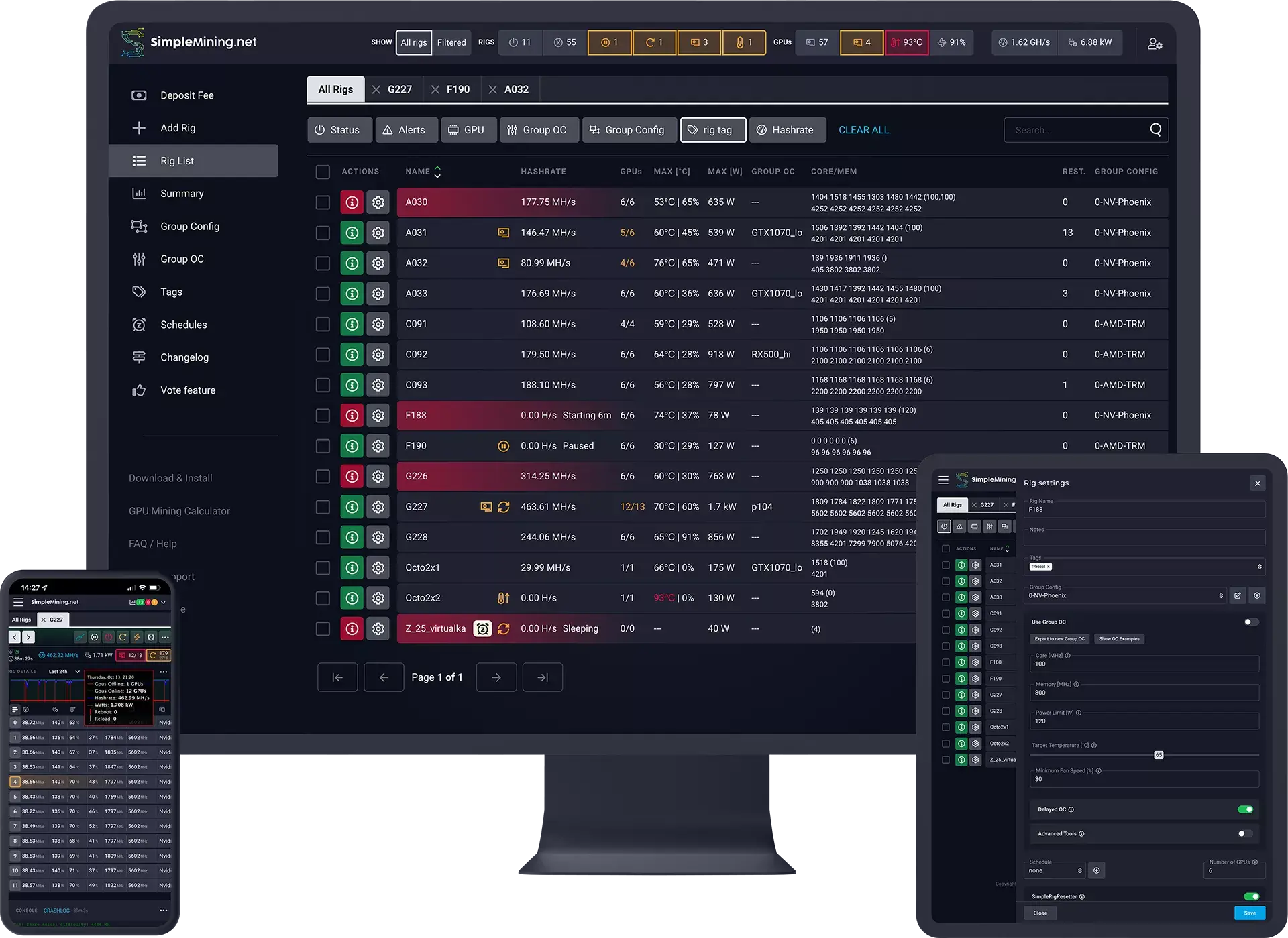

Fleet Mining has emerged as a popular choice for cloud-based Bitcoin mining, emphasizing simplicity and accessibility. Users buy contracts for hashrate, and the platform deploys it in professional facilities, often powered by renewable energy for better efficiency.

Key features include:

- Short-term and flexible contracts to match different budgets.

- Daily payouts in Bitcoin for steady income.

- AI-driven management to maximize yields amid fluctuating conditions.

Many users appreciate the low entry point—some plans start small, with bonuses for new sign-ups. As noted in recent industry overviews from CryptoNinjas, Fleet Mining stands out for its transparent dashboards and focus on user-friendly remote mining.

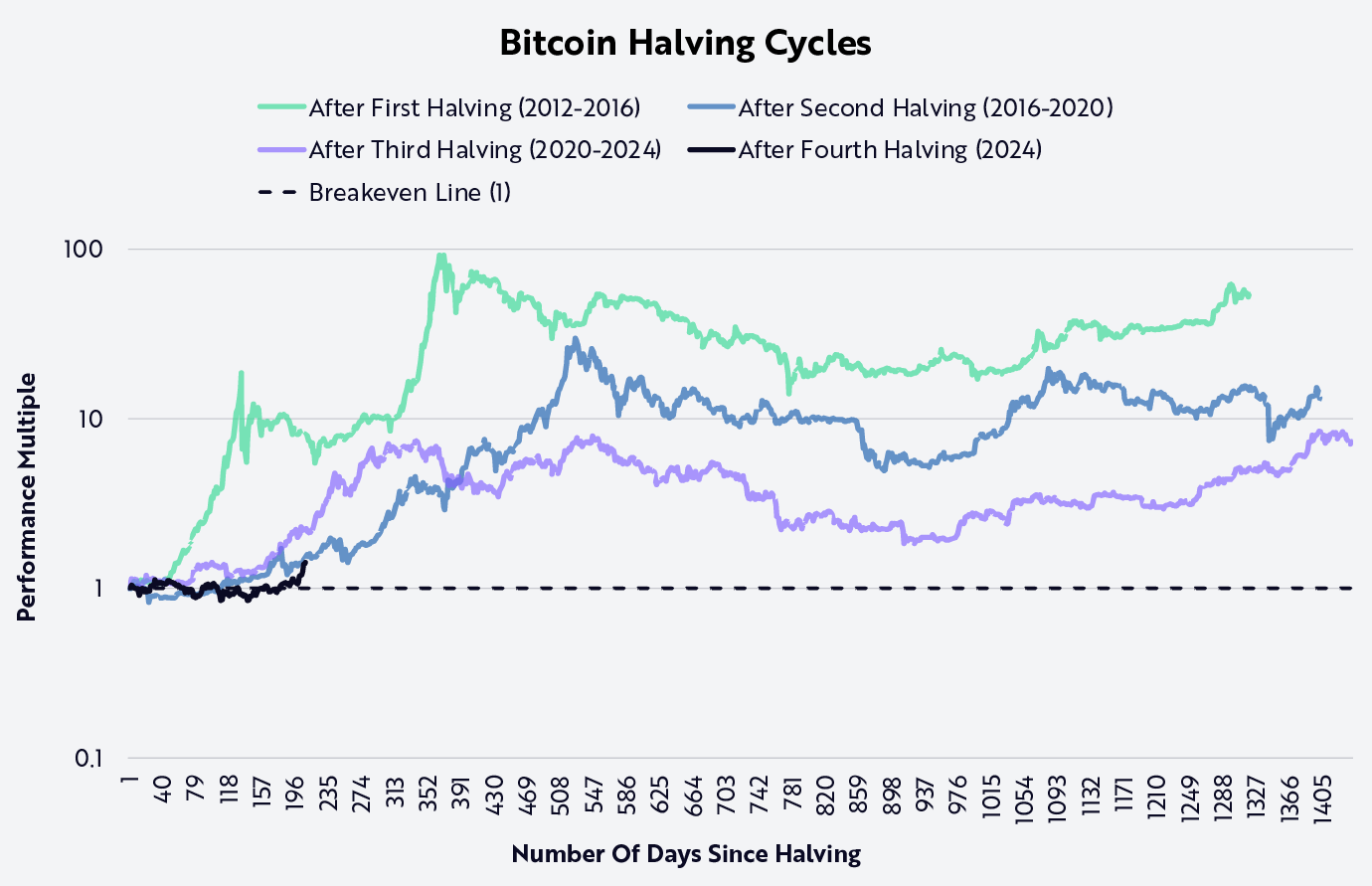

How Bitcoin Halving Impacts Cloud Mining

The 2024 Bitcoin halving cut block rewards to 3.125 BTC, making efficiency crucial in 2025. Cloud services help by pooling massive resources, spreading costs, and adapting quickly to network changes.

This event historically boosts long-term value but squeezes margins short-term—cloud platforms like those using optimized setups can navigate this better than solo miners (source: ARK Invest Bitcoin cycle analysis).

Bitcoin Cycles, Entering 2025

Pros and Cons of Cloud-Based Mining

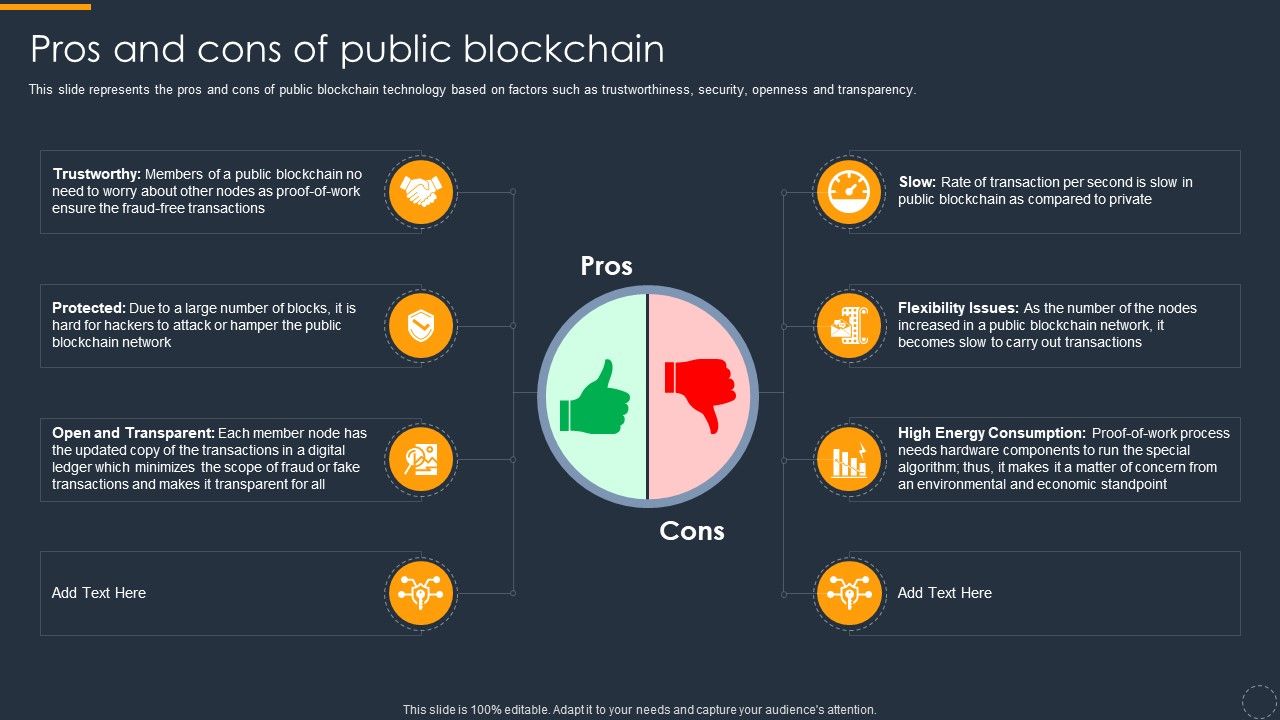

Cloud mining appeals to beginners, but it’s not without trade-offs. Here’s a balanced look:

| Pros | Cons |

|---|---|

| No hardware purchase or setup | Potential for scams—choose reputable providers |

| Low maintenance and noise-free | Lower control over operations |

| Accessible from anywhere | Profitability tied to BTC price and difficulty |

| Scalable with flexible contracts | Fees can reduce overall returns |

| Often uses efficient large-scale farms | Contracts may lock in for fixed terms |

Industry reports, such as Investopedia’s cloud mining overview, highlight convenience as the top benefit, while cautioning on risks like platform reliability.

Getting Started with Cloud Bitcoin Mining

Ready to try? Follow these straightforward steps:

- Research and select a trusted platform—check reviews, transparency, and operational history.

- Sign up with an email and verify your account.

- Choose a contract based on your budget and goals (short-term for testing, longer for potential steady returns).

- Fund it via crypto transfer.

- Monitor your dashboard for daily earnings and withdrawals.

In 2025, profitability depends on Bitcoin’s price (around highs post-halving), electricity efficiency of the provider, and network difficulty. Tools like ASIC Miner Value calculators can help estimate returns.

What is bitcoin mining? How does crypto mining work? | Fidelity

Final Thoughts on the Future of Cloud Mining

As Bitcoin matures, cloud-based options like Fleet Mining offer a practical bridge for non-experts into the mining world. They democratize access, reduce environmental strain through shared resources, and provide passive income potential.

However, success hinges on due diligence—stick to established services, start small, and view it as a long-term play. With ongoing advancements in efficiency and regulation, cloud mining could play a bigger role in how everyday investors engage with Bitcoin.

Always remember: Crypto involves risks, including volatility and potential losses. Research thoroughly and only use funds you can afford to risk.