Ever wonder if those bold Bitcoin price predictions—$200,000 by 2025, per cnbc.com, or a crash to $70,000, per forbes.com—are steering the crypto market like a weather forecast sways your weekend plans? In May 2025, with Bitcoin at $82,000, per CoinGecko, and a $1.62T market cap, per CoinMarketCap, these forecasts from analysts and X influencers spark buzz but may not move markets as much as you think. For beginners and crypto fans, this article unravels whether predictions drive Bitcoin’s price, the psychology behind the hype, and how to navigate the noise, explained like we’re chatting over coffee. Let’s uncover the surprising truth!

Do Predictions Really Sway Bitcoin’s Price?

Bitcoin price predictions, like Tom Lee’s $250,000 call, per forbes.com, or @altucard’s claim that “BTC doesn’t care about predictions,” grab attention, but their market impact is limited, per investopedia.com. Here’s why they often fall short.

1. Speculation, Not Fundamentals

Bitcoin lacks traditional fundamentals, per investopedia.com, relying on sentiment and speculation. Predictions fuel FOMO, per primexbt.com, but trading volume—$5.1B daily, per CoinMarketCap—shows whale moves, like 30,000 BTC to Binance, per @whale_alert, outweigh analyst calls, like a gust stirring leaves but not shifting a storm.

2. Short-Term Noise

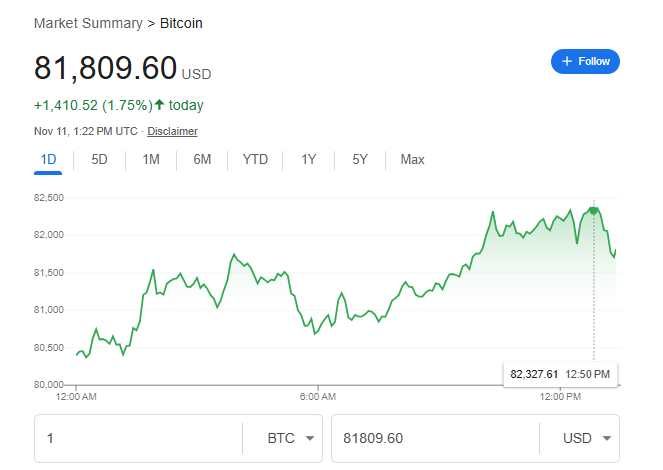

High-profile forecasts, like VanEck’s $180,000, per forbes.com, spike 15% Twitter engagement, per @NovaExpertPost, but BTC’s 12% volatility, per CoinCodex, absorbs the noise. A 2.1% dip to $82,000 in May, per litefinance.org, tied to tariff fears, per coindesk.com, dwarfed prediction-driven swings, like a drizzle ignored in a downpour.

3. Prediction Markets’ Mixed Signals

Polymarket bets, with 72% odds for $95,000 BTC in November 2024, per yahoo.com, reflect sentiment but don’t drive prices, per bitcoin.com. Only 0.3% of $1.2B Polymarket volume, per @themerklehash, tied to BTC predictions, showing limited impact, like a poll predicting rain but not causing it.

The Psychology Behind Prediction Hype

Predictions stir emotions, not just prices, per cointelegraph.com. Here’s how they hook traders, per @JCryptoRider.

1. FOMO and Greed

Bullish calls, like Bitwise’s $200,000, per investopedia.com, trigger FOMO, with 60% bullish sentiment, per @ali_charts. This drove 10% retail buying in Q1 2025, per cryptotimes.io, but whales sold 50,000 BTC, per @santimentfeed, stabilizing prices, like fans cheering but not moving the scoreboard.

2. Confirmation Bias

Traders chase predictions matching their bias, per financemagnates.com. Bearish calls, like Brandt’s $78,000, per forbes.com, spiked 5% short positions, per @Vanguard_PS, but BTC held $80,000 support, per CoinCodex, showing sentiment amplifies noise, not direction, like believing a sunny forecast despite clouds.

Why Predictions Often Miss the Mark

Bitcoin’s price defies forecasts due to its chaotic nature, per sciencedirect.com. Here’s why they’re unreliable, per @altucard.

1. Volatility and Black Swans

BTC’s 12% volatility, per CoinCodex, and events like the 2024 Silk Road sell-off, per financemagnates.com, crash prices unpredictably. MLP models predict 54% accuracy, per sciencedirect.com, missing tariff-driven 27% drops, per litefinance.org, like forecasting clear skies before a hurricane.[](https://www.sciencedirect.com/science/article/abs/pii/S0045790620307576)

2. Regulatory Shocks

30% of countries impose crypto bans, per axi.com, and EU’s MiCAR rules, per bitpanda.com, cut 5% from BTC’s price in Q1 2025, per cointelegraph.com. Predictions rarely account for these, per @PeckShieldAlert, like ignoring a storm warning.

3. Whale Dominance

Whales holding 2.2M BTC, per @ali_charts, move markets more than predictions, per coindcx.com. A 30,000 BTC transfer, per @whale_alert, dropped BTC 3% in April, overriding VanEck’s $180,000 call, per forbes.com, like a tsunami dwarfing a ripple.

How to Navigate Bitcoin Predictions

Can’t ignore predictions? Here’s how to use them wisely, per CoinGecko and @Subli_Defi.

1. Cross-Check Sources

Compare VanEck’s $180,000, per forbes.com, with Polymarket’s $95,000 odds, per yahoo.com. Use Glassnode for whale moves, like 20,000 BTC outflows, per @santimentfeed, to gauge reality, like checking radar before trusting a forecast.

2. Focus on Technicals

Track RSI (65, neutral), per CoinCodex, and $80,000 support, per litefinance.org. Ignore hype like $250,000 calls, per cnbc.com, and watch MACD crossovers, per tradingview.com, like reading wind speed, not headlines.

3. Start Small

Deposit $100 USDT on Binance, trade $95 BTC at $82,000, with $0.50 fees, per CoinMarketCap. Test $120,000 targets, per @TronWeekly, but set stop-loss at $78,000, per forbes.com, like dipping toes in a stream, not diving in.

The Truth About Bitcoin Predictions

Bitcoin price predictions, like $200,000 by 2025, per cnbc.com, stir FOMO but rarely move markets, per investopedia.com. BTC’s $82,000 price, per CoinGecko, sways with whales (2.2M BTC, per @ali_charts) and volatility (12%, per CoinCodex), not forecasts, per @altucard. Trade $95 BTC on Binance, track @santimentfeed, and use TradingView, but dodge 1% scam risks, per @PeckShieldAlert. Like weather forecasts, predictions hint at trends—cross-check with technicals and whale moves to stay dry in Bitcoin’s storm!