When you start trading cryptocurrency on platforms like Binance or Coinbase, you’ll encounter two common ways to buy or sell: limit orders and market orders. These order types determine how your trade is executed and can impact your costs and strategy. This beginner-friendly guide explains the difference between limit orders and market orders, when to use each, and tips to trade smarter in the crypto market.

What Are Crypto Trading Orders?

In crypto trading, an “order” is your instruction to an exchange to buy or sell a cryptocurrency at a specific price or under certain conditions. The two most common types are limit orders and market orders. Understanding how they work is key to making informed trades, whether you’re dealing with Bitcoin, Ethereum, or altcoins.

Orders are placed on crypto exchanges, which act as marketplaces matching buyers and sellers. Knowing the difference between limit and market orders helps you control costs and execute trades that align with your goals.

What is a Market Order?

A market order is the simplest way to trade crypto. It tells the exchange to buy or sell a cryptocurrency instantly at the current market price.

- How It Works: You choose the amount (e.g., $100 of Bitcoin), and the exchange executes the trade immediately at the best available price.

- Speed: Fastest option, usually completed in seconds.

- Price: You get the market price, which may vary slightly due to price fluctuations (called “slippage”).

Example: Bitcoin is trading at $40,000. You place a market order to buy $200 worth. The exchange fills your order at around $40,000, and you receive 0.005 BTC (minus fees).

When to Use Market Orders

Market orders are best when:

- You want to trade quickly, like during a fast-moving market.

- You’re okay with small price variations (slippage).

- You’re trading highly liquid coins like Bitcoin or Ethereum, where prices are stable.

Caution: Market orders can be costly for low-volume coins or during volatile periods, as slippage may lead to worse prices than expected.

What is a Limit Order?

A limit order lets you set a specific price at which you want to buy or sell crypto. The trade only happens when the market reaches your chosen price.

- How It Works: You specify the price (e.g., buy Bitcoin at $39,000) and the amount. The exchange waits until the market hits that price to execute the trade.

- Speed: May take minutes, hours, or not execute at all if the price doesn’t reach your target.

- Price: You control the exact price, avoiding slippage.

Example: Bitcoin is at $40,000, but you think it’ll dip. You set a limit order to buy $200 of Bitcoin at $39,500. If the price drops to $39,500, your order fills, giving you 0.00506 BTC (minus fees).

When to Use Limit Orders

Limit orders are ideal when:

- You want to buy at a lower price or sell at a higher price than the current market.

- You’re patient and okay waiting for the market to hit your price.

- You’re trading in volatile markets to avoid slippage.

Caution: If the market never reaches your price, the order won’t execute, and you might miss a trading opportunity.

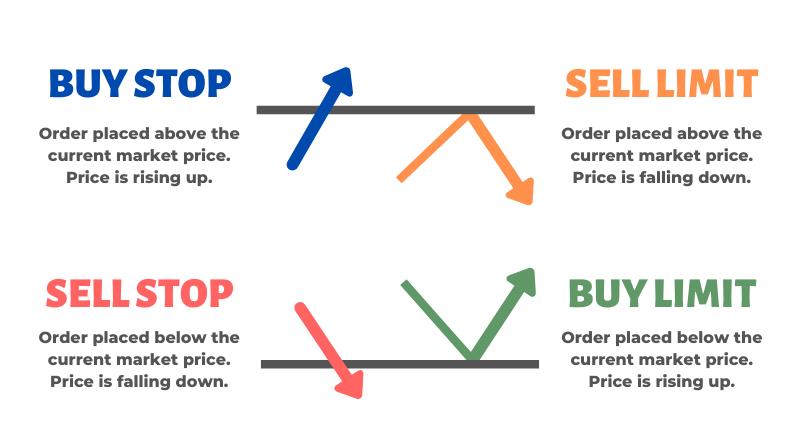

Limit Orders vs. Market Orders: Key Differences

Here’s a quick comparison to help you choose:

- Speed: Market orders are instant; limit orders wait for your price.

- Price Control: Limit orders let you set the price; market orders use the current price.

- Cost: Market orders may have slippage; limit orders avoid it but may not execute.

- Use Case: Use market orders for speed, limit orders for precision.

Most exchanges, like Binance, show both options in the trading interface. Try practicing on TradingView to understand how orders work.

How to Place Limit and Market Orders

Placing orders is easy on exchanges like Binance or Coinbase. Here’s a step-by-step guide:

Step 1: Choose an Exchange

Sign up on a beginner-friendly exchange like Coinbase (simple interface) or Binance (lower fees). Complete identity verification (KYC) and enable two-factor authentication (2FA) for security.

Step 2: Deposit Funds

Add money via bank transfer (cheapest) or card. Start with a small amount, like $50, to test trading. Funds will appear in your exchange wallet.

Step 3: Navigate to the Trading Section

Go to the “Trade” or “Buy/Sell” tab. Select a cryptocurrency, like Bitcoin (BTC) or Ethereum (ETH). You’ll see options for market and limit orders.

Step 4: Place a Market Order

Select “Market Order,” enter the amount (e.g., $100), and confirm. The trade executes instantly at the current price, and your crypto appears in your wallet.

Step 5: Place a Limit Order

Select “Limit Order,” set your desired price (e.g., buy Bitcoin at $39,000), enter the amount, and confirm. The order will stay open until the market hits your price or you cancel it.

Tip: Check the “order book” on the exchange to see current buy and sell orders, which can help you set realistic limit prices.

Tips for Using Limit and Market Orders Effectively

Here’s how to make the most of these order types as a beginner:

- Start with Market Orders: They’re simpler for your first trades, especially for liquid coins like Bitcoin.

- Use Limit Orders for Strategy: Set limit orders to buy low or sell high based on price trends or support/resistance levels.

- Watch Fees: Market orders may have higher fees due to slippage. Compare fees on exchanges like Kraken.

- Practice First: Use a demo account on Binance or TradingView to test orders without risking money.

- Monitor Volatility: Avoid market orders during wild price swings to reduce slippage.

- Stay Secure: Enable 2FA, avoid public Wi-Fi, and never share your account details.

For more trading basics, explore CoinDesk’s Learn section.

Common Mistakes to Avoid

Beginners often make these errors with orders:

- Using Market Orders in Volatile Markets: Slippage can lead to unexpected costs.

- Setting Unrealistic Limit Prices: Orders too far from the market price may never execute.

- Ignoring Fees: Frequent market orders can rack up costs, especially on high-fee exchanges like Coinbase.

- Not Canceling Old Limit Orders: Forgotten orders may execute at unwanted times.

What to Do After Mastering Orders

Once you’re comfortable with limit and market orders, take these next steps:

- Learn Charting: Study candlestick charts and indicators like RSI on TradingView to time your orders better.

- Track Prices: Use CoinGecko or CoinMarketCap to monitor market trends.

- Explore Strategies: Try dollar-cost averaging or swing trading to complement your order skills.

- Stay Informed: Follow crypto news on Cointelegraph to understand price movements.

Conclusion

Understanding limit orders and market orders is a crucial step in crypto trading. Market orders offer speed for quick trades, while limit orders give you control over price for strategic moves. By practicing on exchanges like Binance or Coinbase, starting small, and avoiding common mistakes, you’ll trade with confidence. Ready to begin? Sign up on an exchange, try a market order, and start exploring the exciting world of crypto trading today!