Lido has powered Ethereum’s liquid staking for years. You deposit ETH, get stETH back (a token that grows with staking rewards), and keep using it in DeFi apps, lending platforms, or trades—no waiting for unlocks. With massive TVL, Lido helps secure the network while giving everyday holders easy access.

V3 changes the game by adding stVaults. These are customizable smart contract vaults built on Lido’s rock-solid base. You (or a project) decide things like which node operators handle your stake, what fees apply, or even if you want stETH liquidity on top. It’s still safe and decentralized, but now way more personal.

Introducing Lido V3: Ethereum Staking Infrastructure

This visual captures the essence of Lido V3: a sleek, modern drop-shaped design symbolizing Ethereum staking powered by stETH, with modular flexibility for builders and users alike.

How stVaults Actually Work in Plain English

Think of stVaults as Lego blocks for staking. Here’s the simple breakdown:

- Deposit ETH into your vault.

- Set custom rules (pick operators, adjust risks, define fees).

- Stake securely using Lido’s shared infrastructure.

- Optionally mint stETH for liquidity—trade it, lend it, or earn extra in DeFi.

- Rewards flow back based on your setup.

This modularity helps different people. Regular users might pick vaults for higher yields. Institutions love the compliance options (like deposit limits or permissioned access). Developers on Layer 2 chains can build staking products without reinventing security from scratch.

Introducing Lido V3: Ethereum Staking Infrastructure

Here’s a clear architecture overview showing how stVaults connect stakers, builders, institutions, and Lido Core—highlighting the ecosystem flow and risk-reward customization options.

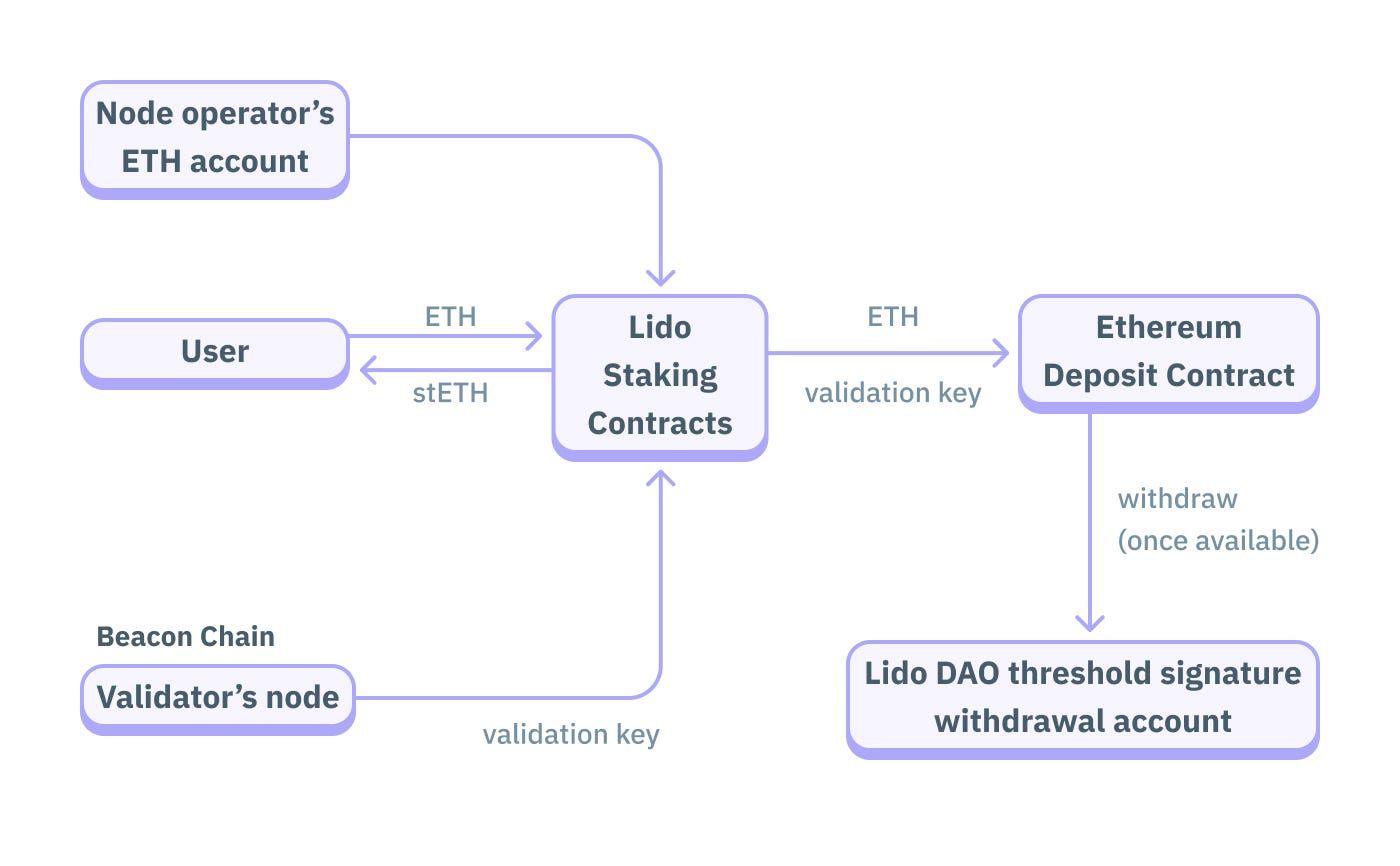

A Guide to Lido Staked ETH: stETH

For context on classic Lido staking (the foundation V3 builds on), this flowchart illustrates the basic ETH → stETH process with node operators and the Ethereum deposit contract.

The Benefits: More Control, Same Trust

Ethereum staking exploded after the Merge, but many wanted finer control without sacrificing liquidity or security. stVaults deliver that. They run parallel to the unchanged core protocol, so nothing breaks for existing stETH holders.

- Everyday stakers get access to optimized vaults (better yields, lower risks).

- Big players gain tools for regulated or enterprise-grade staking.

- Builders tap Lido’s proven validators, oracles, and liquidity pools.

The launch came after rigorous testnet phases (like Holesky) and multiple audits, as detailed in Lido’s V3 technical paper and design docs. No rushed code here—it’s built to last.

What’s Next: A Staking World That Fits Everyone

Lido V3 doesn’t ditch the simple stETH path; it supercharges it with options. Core staking stays easy for beginners, but now innovators can create specialized products—think L2-native staking, leveraged strategies, or institutional vaults.

As Ethereum grows and more people stake, flexible tools like stVaults keep things decentralized, user-centric, and innovative. If you’ve got ETH, checking out Lido V3 could open doors you didn’t know existed.

Sources: Lido official blog and V3 docs (blog.lido.fi, v3.lido.fi), technical whitepaper (hackmd.io/@lido), CoinDesk launch coverage, and ecosystem announcements.

This upgrade makes Ethereum staking feel truly customizable—secure, liquid, and ready for whatever comes next.