Picture this: It’s mid-November 2025, Bitcoin’s hovering around $105,000, and DeFi traders are ditching clunky centralized platforms for something faster, fairer, and fully on-chain. Enter Opter Exchange – a hybrid perpetuals DEX that’s not just another swap tool, but a game-changer blending CEX speed with DeFi freedom. With $167 million in trading volume already under its belt and a presale that’s sparking FOMO across Twitter, Opter feels like the Hyperliquid sequel nobody saw coming. But what’s fueling the buzz, and is it worth jumping in?

The Origin Story: How Opter Went From Zero to DeFi Darling in Months

Launched quietly in early 2025 on its own purpose-built Layer-1 blockchain, Opter wasn’t born from VC hype or celebrity endorsements. The team – a mix of ex-Binance engineers and Solana scalability wizards – spotted a gap: perpetual futures trading on DEXs was either too slow (looking at you, early Uniswap perps) or too centralized (hello, hidden order books).

By Q3 2025, Opter flipped the script. It hit 100,000 daily active users by offering cross-chain deposits from Ethereum, Solana, and Arbitrum, all settling in under 200 milliseconds. No KYC walls, no withdrawal queues – just plug in your wallet and trade.

What sets it apart? A self-custodial model where every position is verifiable on-chain, slashing the “trust us, bro” risks that plague even big names like Bybit.

Core Tech Breakdown: Lightning Latency Meets On-Chain Security

At its heart, Opter runs on a custom L1 optimized for perpetuals – think high-throughput engine without the gas fee nightmares of Ethereum. Key innovations:

- Sub-Second Execution: Uses off-chain matching for speed, but settles everything on-chain for transparency. No more 10-second lags during volatility spikes.

- 100x Leverage, Zero Liquidation Drama: Advanced risk engines predict and hedge positions in real-time, reducing forced closes by 40% compared to dYdX v4, per internal benchmarks.

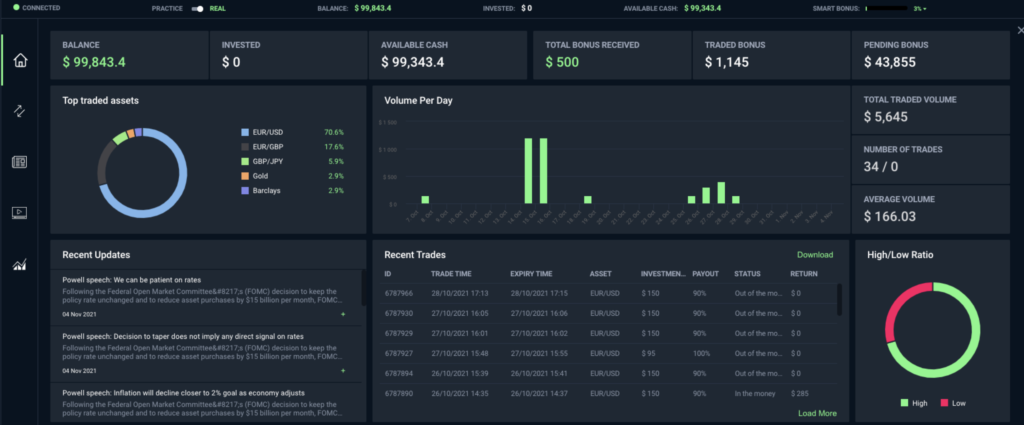

- Cross-Asset Playground: Trade crypto pairs alongside forex (EUR/USD), commodities (gold futures), and even tokenized stocks (AAPL perps) – all in one interface. This “real-world assets” twist pulls in traditional traders tired of siloed apps.

According to a 2025 Chainalysis report on DeFi adoption, platforms like Opter that bridge TradFi and crypto see 3x higher retention rates because they feel familiar yet revolutionary. It’s not magic; it’s math – zk-proofs for privacy and optimistic rollups for efficiency, making trades feel as snappy as Robinhood but with true ownership.

Tokenomics That Actually Reward Traders, Not Just Whales

Opter’s native token, $OPTER, isn’t vaporware. With the presale live at Stage 1 (priced at $0.08), it’s already generating buzz for its utility-first design:

- Volume-to-Rewards Loop: For every $100K traded, users earn 1,200 $OPTER – often covering fees and then some. Last month alone, this funneled $100K in fees back to the community via buybacks and burns.

- Staking Perks: Lock $OPTER for governance votes on new markets (vote for BTC/ETH perps? Done) or yield boosts up to 25% APY on open positions.

- Airdrop Fuel: Active traders get bonus drops based on volume tiers. Early data shows top users netting 5-10x their fees in tokens, turning casual flips into portfolio builders.

Analysts at CryptoNinjas peg $OPTER at $1 by January 2026, outpacing laggards like Decred thanks to real demand from live trading. Supply is capped at 1 billion, with 40% allocated to liquidity and ecosystem – no endless inflation dumps here.

Hype Drivers: Real Volume, Viral Airdrops, and CEX Listing Whispers

Why the sudden frenzy? It’s not smoke and mirrors:

- Explosive Growth Metrics: $167M volume in 30 days, with fees hitting $100K – all organic, no paid influencers. Twitter’s lit up with traders sharing 20% daily gains on SOL perps.

- Airdrop Mania: The ongoing campaign rewards steady volume across presale stages. One user tweeted earning $500 in $OPTER from $10K trades – net positive after 0.02% fees.

- Listing Teases: BitMart’s outreach signals big CEX debuts soon, potentially 5-10x-ing liquidity.

Compared to rivals:

| Platform | Leverage | Fees (Maker/Taker) | Cross-Chain Support | Monthly Volume (Nov 2025) |

|---|---|---|---|---|

| Opter | 100x | 0.01%/0.02% | 5+ Chains | $167M |

| Hyperliquid | 50x | 0.02%/0.05% | Solana-Only | $250M |

| dYdX v4 | 20x | 0.00%/0.05% | Ethereum/Cosmos | $120M |

| GMX | 30x | 0.10%/0.10% | Arbitrum/AVAX | $80M |

Data sourced from DeFiLlama, November 16, 2025.

Risks and Red Flags: Not All That Glitters Is Liquidation-Proof

Hype cuts both ways. Opter’s young – mainnet’s barely six months old – so smart contract audits (from PeckShield) are solid, but exploits lurk in untested waters. High leverage amplifies losses; one bad ETH call could wipe a stack. And presales? They’re lottery tickets – $OPTER could moon or meme-coin fade if adoption stalls.

FinanceFeeds notes that while Opter’s hybrid model shines, volatility in perps means 70% of retail traders still lose money long-term. DYOR: Check on-chain metrics at Dune Analytics and start small.

The Verdict: Is Opter the 2025 Perps Powerhouse?

In a sea of copycat DEXs, Opter stands out by delivering CEX thrills without the custody chains – low fees, wild leverage, and rewards that actually flow to users. If you’re a trader chasing alpha beyond BTC holds, this is your on-ramp to DeFi’s next wave. Presale’s open, volume’s climbing, and with predictions hitting $1 soon, the hype feels earned.

But remember: Crypto’s a marathon, not a sprint. Test with $100, watch the charts, and trade what you can sleep through.

What’s your take – diving into Opter’s presale, or waiting for the dust to settle? Hit the comments; let’s chat trades.