Imagine turning one of cryptocurrency’s biggest disasters into a powerful shield for the future. Nearly ten years after a massive hack nearly derailed Ethereum, forgotten funds from that chaotic event are being reborn as a $220 million security powerhouse. This isn’t just recycling old money—it’s a clever community move to protect the blockchain that now underpins billions in digital value.

A Quick Look Back: The 2016 DAO Hack That Shook Ethereum

In 2016, The DAO (short for Decentralized Autonomous Organization) was an ambitious crowdfunding experiment on Ethereum. It raised about $150 million in Ether (ETH) from thousands of investors, promising a new way to fund projects without traditional bosses or banks.

But a flaw in its smart contract code let a hacker drain around 3.6 million ETH—worth tens of millions back then. The theft sparked panic: Ethereum’s young network faced an existential threat. To fix it, the community voted for a hard fork (a major code change), which split the chain. One version (Ethereum) reversed the hack and refunded most victims; the other (Ethereum Classic) kept the original rules.

Most people got their money back, but some “edge cases”—unusual or unclaimed portions—stayed locked in special contracts. Those leftover funds sat untouched for years.

The History of Ethereum And The Web3 Business Playbook

This visual timeline captures the key moments in Ethereum’s early history, including the lead-up to The DAO era and the dramatic chain split that followed the hack.

Fast Forward to 2026: Unclaimed Funds Get a New Purpose

As Ethereum grew and ETH’s price soared, those dormant assets ballooned in value. In late January 2026, longtime Ethereum supporters—including Griff Green (co-founder of Giveth and an original DAO curator)—announced they’re activating them for good.

The initiative, called TheDAO Security Fund (or DAO Security Fund), draws from:

- About 70,500 ETH from the ExtraBalance contract (unclaimed after the recovery).

- Roughly 4,600 ETH (plus some DAO tokens) in a curator multisig wallet with no clear owners.

Together, that’s over 75,000 ETH, valued at approximately $220 million at current prices. Some funds remain claimable if original owners step forward, but the bulk is now dedicated to security.

This isn’t a giveaway—it’s designed as a sustainable endowment. A large portion (around 69,420 ETH) will be staked on Ethereum’s proof-of-stake network to earn yield. That ongoing income—estimated at millions annually—will fund real-world improvements without depleting the principal.

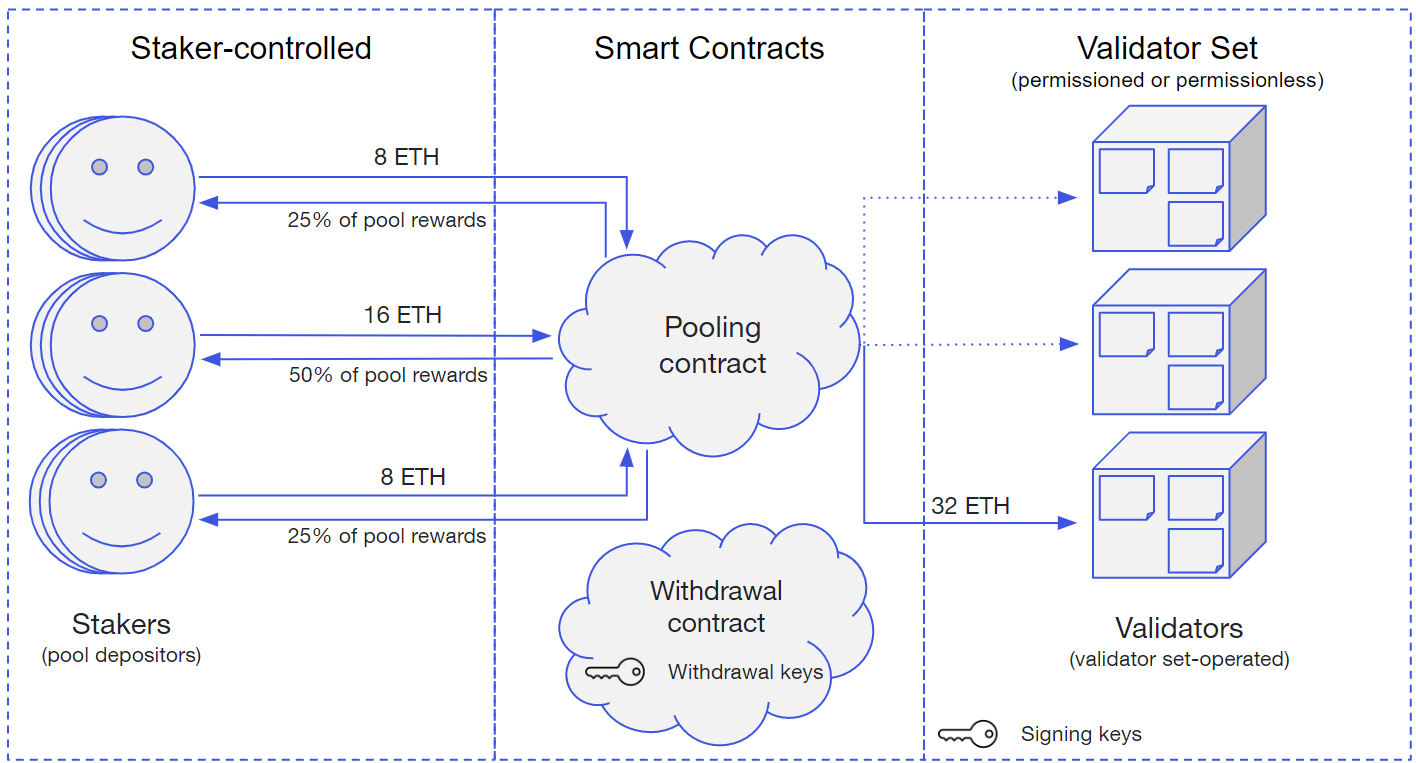

What is Staking? | Consensys

This diagram explains Ethereum staking basics: how users lock ETH, join validator sets through pools or contracts, and earn rewards that support network security—exactly the mechanism powering much of the new fund.

How the Fund Will Strengthen Ethereum’s Defenses

The goal is simple: make Ethereum safer in an era of rising hacks, sophisticated scams, and growing adoption. Key focus areas include:

- Smart contract audits and formal verification to catch bugs early.

- Wallet safety tools and user protection features.

- Incident response teams for quick fixes during attacks.

- Infrastructure upgrades and research into protocol-level security.

Funding decisions will use community-driven methods like quadratic funding, retroactive public goods rewards, and DAO-style voting—echoing the original DAO spirit but with better safeguards.

About $13.5 million from the curator wallet is earmarked specifically for grants to developers and projects.

Blockchain Security Logo Stock Illustrations – 7,936 Blockchain …

A symbolic representation of blockchain security: the lock on a cryptocurrency coin highlights how the fund aims to add strong protective layers to Ethereum’s ecosystem.

Why This Matters for Everyday Users and the Bigger Picture

For regular people dipping into crypto—whether holding ETH, using DeFi apps, or buying NFTs—this fund is a behind-the-scenes win. Stronger security means fewer headline-grabbing exploits, safer wallets, and more trust in the ecosystem.

Ethereum has come a long way since 2016. It’s now a foundation for decentralized finance, NFTs, and even real-world assets. But as the network scales, threats evolve too. By turning a painful memory into proactive protection, the community shows maturity and foresight.

As Griff Green explained in a recent interview on Unchained, this is about putting idle resources to work for Ethereum’s long-term health (source: Unchained exclusive report, January 29, 2026). Even Ethereum co-founder Vitalik Buterin has been linked to supporting similar efforts for ecosystem resilience.

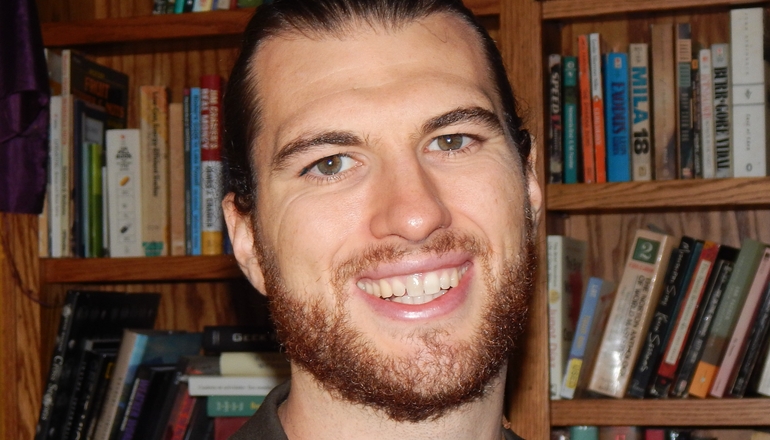

Griff Green – Videos – Elevate Festival

Griff Green, co-founder of Giveth and key figure behind TheDAO Security Fund, has long been involved in Ethereum’s community-driven projects.

What’s Next for TheDAO Security Fund?

The fund is in its early stages, with staking underway and governance mechanisms being set up. Official details are available at thedao.fund, and the community is watching closely.

This story reminds us that in blockchain, history doesn’t just repeat—it can upgrade. What started as Ethereum’s biggest crisis is now fueling its strongest defense yet.

Have questions about The DAO’s legacy or this new fund? Drop them in the comments—let’s discuss how this could shape crypto’s future.