Imagine waking up to news that a single company has just grabbed a massive chunk of one of the world’s top cryptocurrencies, enough to shift market dynamics overnight. That’s exactly what happened when BitMine, a key player in the crypto space, made headlines with its bold move into Ethereum.

What Happened with BitMine’s Latest Purchase?

In a whirlwind week ending January 26, 2026, BitMine scooped up over 40,000 ETH, boosting its total holdings to a staggering 4.24 million ETH. This purchase alone added more than $117 million to its treasury at current prices, pushing the overall value to around $12.8 billion. For everyday folks dipping their toes into crypto, think of it like a savvy investor stocking up on shares during a dip—only here, it’s digital gold in the form of Ethereum.

BitMine didn’t stop at just buying; it’s been on a buying spree, adding tens of thousands of ETH week after week. This latest haul follows a pattern of strategic acquisitions, including a $98 million ETH buy at the end of 2025 to leverage tax-loss opportunities. It’s a smart play that shows how companies are treating crypto not as a gamble, but as a core asset.

Canaan Review: The Pioneer In Blockchain Hardware Solutions

Understanding BitMine’s Growing Ethereum Holdings

BitMine now controls about 3.5% of Ethereum’s total supply, which is no small feat in a network that’s the backbone of decentralized apps, NFTs, and smart contracts. To put it simply, Ethereum is like the internet’s money machine—it’s where a lot of the crypto action happens beyond just Bitcoin. Owning this much means BitMine has serious influence, potentially stabilizing prices or even driving them up during volatile times.

The company’s treasury surge isn’t random; it’s part of a broader strategy. BitMine has been staking a portion of its ETH—locking it up to help secure the network and earn rewards—which recently doubled to over 1.25 million ETH. For beginners, staking is like putting your money in a high-yield savings account, but it also supports the Ethereum ecosystem. This move signals confidence in ETH’s long-term value, especially as the crypto winter thaws.

Ethereum Images | Free Photos, PNG Stickers, Wallpapers …

Implications for the Crypto Market

This acquisition comes at a time when Ethereum is bouncing back, with prices recovering nearly 5% in a single day amid broader market optimism. For average investors, it could mean more stability in ETH prices, as big holders like BitMine act as a buffer against wild swings. However, it’s not all smooth sailing—BitMine’s stock has taken hits, dropping over 80% from its 2025 highs, wiping out billions in value. This highlights the risks: crypto is exciting, but it’s tied to real-world factors like regulations and economic shifts.

On the flip side, experts see this as a sign of maturing markets. Large institutions buying in bulk could attract more mainstream adoption, making crypto feel less like a Wild West and more like a legitimate investment option. Even amid cold market spells from U.S. economic freezes, moves like this show long-term faith in digital assets.

Will Ethereum Go Up In 2026? Ethereum Accumulation Trends

Expert Opinions and Future Outlook

Tom Lee, associated with BitMine, has been vocal about Ethereum’s potential, forecasting a price jump in 2026 as the “mini crypto winter” ends. He points to historical patterns where rallies in metals often precede surges in BTC and ETH, suggesting BitMine’s treasury could benefit big time. For everyday readers, this means if you’re holding ETH or thinking about it, watching companies like BitMine could give clues on when to buy or sell.

Looking ahead, BitMine’s strategy might inspire other firms to build crypto treasuries, potentially driving up demand and prices. But remember, crypto investing isn’t for the faint-hearted—always do your homework and consider diversifying. As the market evolves, stories like this remind us that behind the buzzwords, it’s about real value and smart decisions shaping the future of money.

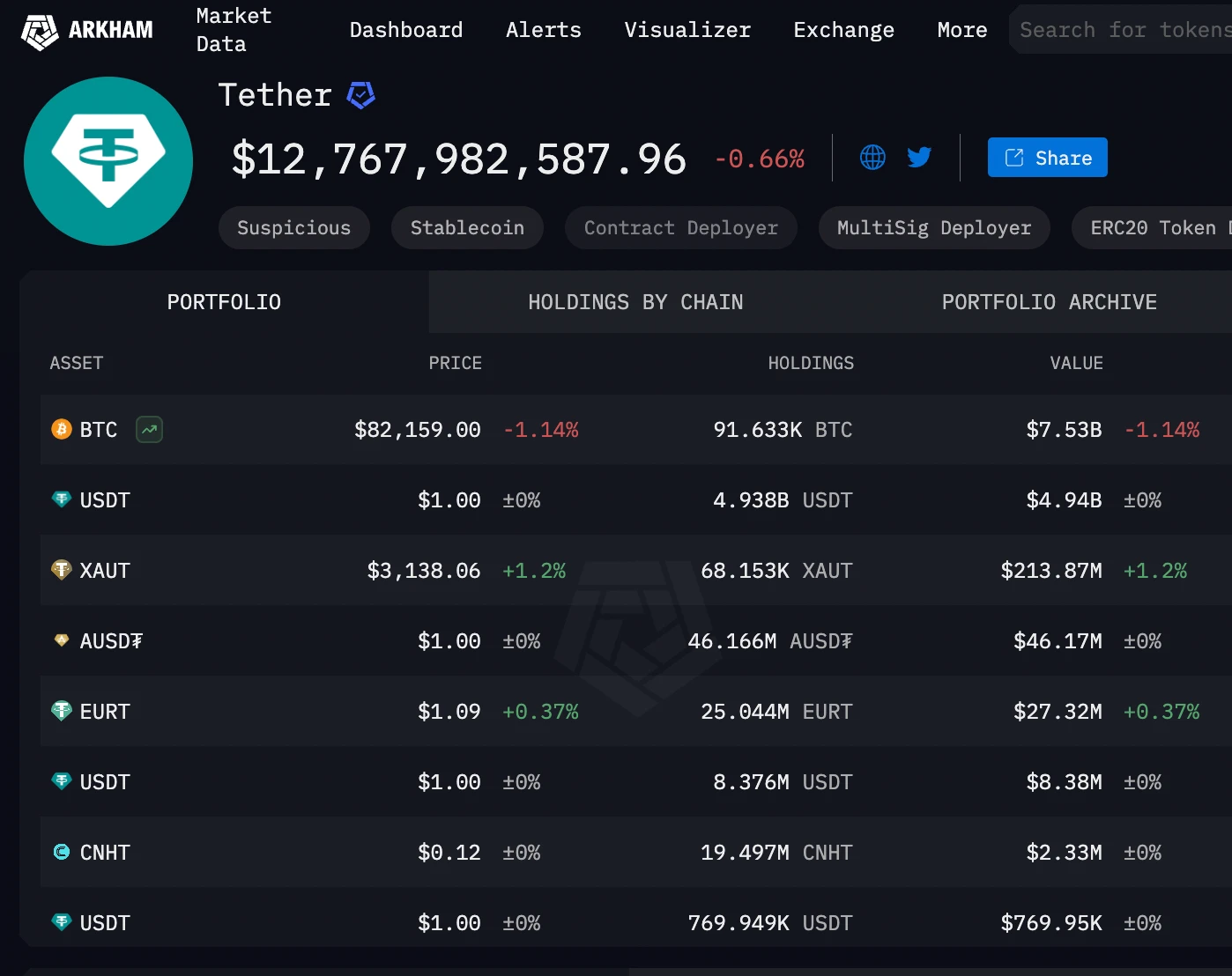

Tether Crypto Holdings | How Much Bitcoin Does Tether Own?