Step into a bustling digital marketplace in 2026, where Ethereum still powers the majority of decentralized apps, NFTs, and DeFi projects, yet whispers of faster, cheaper rivals echo everywhere. With ETH trading around $3,300 amid a slight dip, many everyday investors are asking: Can the original smart contract king hold its ground this year, or is it time to rethink putting all your crypto eggs in one basket?

Ethereum’s Position Today

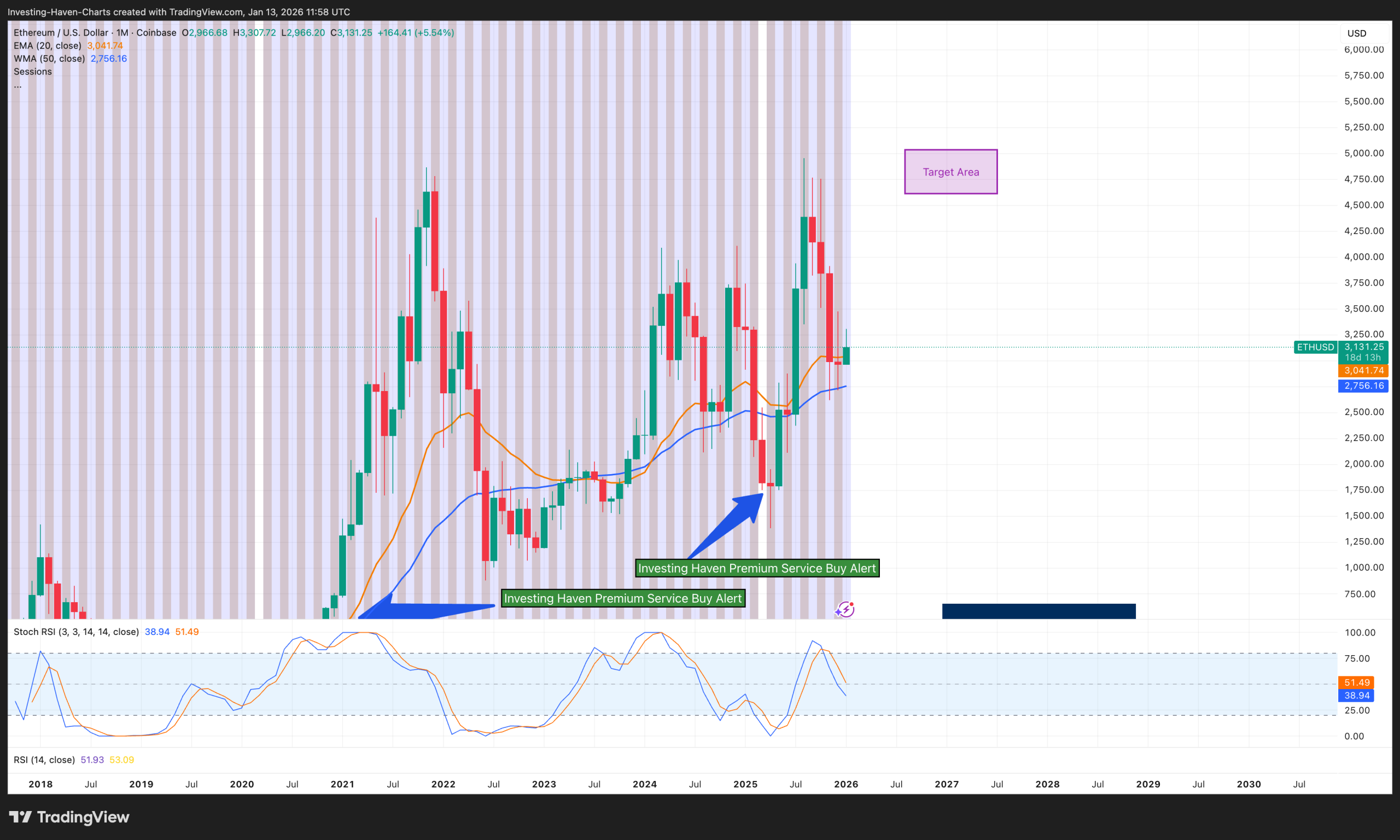

As of mid-January 2026, Ethereum’s price hovers near $3,300, reflecting a modest pullback but steady resilience after a strong 2025. This level comes after years of upgrades that have transformed the network from slow and expensive to more efficient thanks to Layer 2 solutions handling most activity.

Think of Ethereum as the reliable old town square—crowded, trusted, and full of activity, even if newer neighborhoods offer quicker shortcuts.

Ethereum (ETH) Price Prediction – Forecast 2026 2027 2028 – 2030 …

Institutional interest remains high, with staking hitting record levels and more companies exploring Ethereum-based tools for real-world finance. For ordinary people, this means ETH continues to serve as a core holding for those betting on the future of decentralized tech.

Price Trends and Market Sentiment

Recent charts show ETH consolidating after volatility, with analysts eyeing potential breakouts if key support holds. Unlike the wild swings of past cycles, 2026 feels more mature—driven by real usage rather than hype alone.

Here’s Why Ethereum Price Will Hit $4k By End of Jan 2026

Upcoming Upgrades That Could Strengthen Ethereum

Ethereum isn’t standing still. Developers are gearing up for major updates like Glamsterdam (expected early 2026) and Hegota later in the year, focusing on better scalability, privacy, and data handling through innovations like PeerDAS and zkEVMs.

These changes aim to make the network faster and more affordable without sacrificing security. In plain terms, it’s like upgrading a busy highway with new lanes and smarter traffic signals—keeping Ethereum competitive for everyday use.

The Rising Competition: A Real Threat?

Newer blockchains like Solana and Sui are gaining traction, offering lightning-fast speeds and lower fees that attract gamers, payment apps, and high-volume users. Solana, in particular, has led gains early in 2026, while Sui pushes boundaries in gaming and NFTs.

Ethereum still dominates DeFi and institutional adoption, but the gap is narrowing. This shift forces investors to consider: What if a faster chain steals market share?

Ethereum Images – Free Download on Freepik

Why Diversification Matters More Than Ever

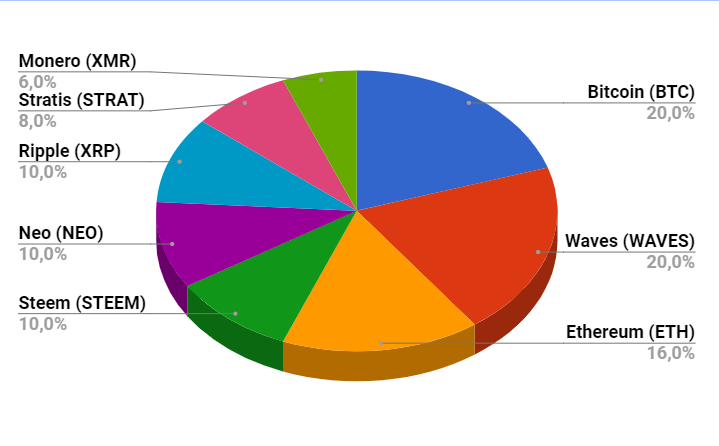

No single crypto is a sure bet. Spreading investments reduces risk—if Ethereum faces delays or competition heats up, other assets can cushion the impact. Experts recommend allocating 40-60% to large-caps like Bitcoin and Ethereum, with the rest in mid-tier projects or emerging ones.

It’s similar to not betting your entire savings on one stock—diversification helps you sleep better at night.

How To Diversify Your Crypto Portfolio

Simple Steps to Build a Balanced Portfolio

- Start with the big two: Keep a solid portion in BTC and ETH for stability.

- Add variety: Include Layer-1 competitors like Solana or Sui for growth potential.

- Explore niches: Look at real-world assets (RWAs) or stablecoins for steadier returns.

- Rebalance regularly: Check your mix every few months to stay aligned with goals.

This approach keeps things straightforward for beginners while giving room for upside.

How to Diversify Your Crypto Portfolio? | Fastex

What the Future Might Hold for Ethereum

Optimism abounds. Forecasts range from $4,000-$5,000 by year-end to as high as $7,500 if upgrades deliver and institutions pile in. Ethereum’s strong fundamentals—vast developer community, Layer 2 ecosystem, and staking rewards—position it well for continued relevance.

Yet the challenge remains: Maintain dominance or adapt to a multi-chain world? For most people, the answer lies in balance—holding Ethereum while diversifying to capture broader opportunities.

In 2026, Ethereum remains a cornerstone, but smart investing means looking beyond one name. By understanding the landscape and spreading your bets wisely, you can navigate the crypto journey with more confidence and less stress.