What if the key to unlocking Ethereum’s next big surge lies in a simple chart pattern that’s been quietly forming amid market ups and downs? As ETH hovers around $4,300 in early September 2025, traders are eyeing a “triple bottom” setup that’s sparking talk of a push toward $5,000. This isn’t just technical mumbo-jumbo—it’s a signal that could mean real gains for holders, driven by fresh institutional money and network upgrades. Let’s break it down step by step, no crypto wizardry required.

What Exactly is a Triple Bottom Breakout?

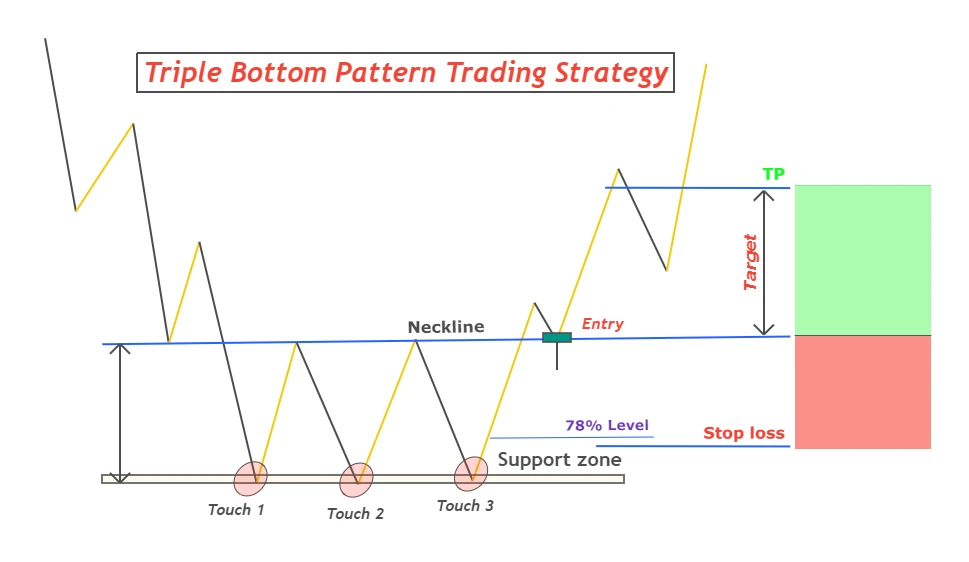

Picture a stock or crypto price dipping to the same low point three times, like a ball bouncing off the floor before finally shooting up. That’s a triple bottom in a nutshell—a bullish reversal pattern that suggests sellers are running out of steam, paving the way for buyers to take control. In trading lingo, it forms when the price hits support (the “bottom”) thrice, then breaks above a resistance line, often leading to a rally equal to the pattern’s height.

For everyday investors, this pattern is like a green light after red signals. It’s reliable in uptrends, with historical success rates around 70% in crypto markets, according to pattern studies. When it plays out, the breakout can be explosive, especially in volatile assets like ETH.

Ethereum’s Price Action: Spotting the Triple Bottom

Fast-forward to 2025: Ethereum has been testing a sturdy floor around $4,250 since mid-August, forming those three distinct lows amid broader market jitters. This triple bottom emerged after ETH pulled back from its all-time high near $4,956, creating a consolidation zone that’s got analysts excited. As of September 8, ETH trades at about $4,320, with the pattern’s “neckline” resistance sitting at $4,530—a level that’s been a tough nut to crack.

On-chain metrics back this up: Daily active addresses have climbed 12% in the past week, signaling growing user interest despite summer slowdowns. If ETH punches through $4,530 with strong volume, the measured target from the pattern’s depth points straight to $5,000, a neat 15% jump from current levels. It’s like the market saying, “We’ve hit rock bottom—time to climb.”

Key Drivers Behind the Potential Rally

What’s fueling this optimism? For starters, spot Ethereum ETFs have sucked in over $4.2 billion since launch, with big players like BlackRock leading the charge. This institutional cash isn’t just hype—it’s real demand pushing prices higher. Add in whale activity: Large holders have scooped up 150,000 ETH in the last month, betting on upside.

Network upgrades play a role too. The upcoming Prague/Electra hard fork promises faster transactions and lower fees, making Ethereum more appealing for DeFi and NFTs. Stablecoin volumes on ETH have hit $1.2 trillion annually, underscoring its role as crypto’s backbone. For regular folks, this means ETH isn’t just a speculative bet—it’s powering real-world apps like decentralized finance loans or digital art sales.

Analyst Insights: From $5,000 to Beyond

Crypto pundits are lining up with bullish calls. One trader notes that a clean break above $4,530 could trigger a “FOMO wave,” propelling ETH to $5,000 by month’s end. Others see even loftier targets: With ETF flows mirroring Bitcoin’s path, ETH might eye $6,000 or more by year-end, echoing its 2021 surge.

Historical parallels add weight—Ethereum’s 2016-2017 rally followed a similar pattern, rocketing 100% post-breakout. But it’s not all rosy; some caution that without sustained volume, the pattern could fail, leading to a retest of $4,000.

Hurdles on the Road to $5,000

No rally is guaranteed, and Ethereum faces headwinds. Regulatory scrutiny in the U.S. could dampen ETF enthusiasm, while competition from faster chains like Solana nibbles at market share. Macro factors, like interest rate hikes or stock market dips, often drag crypto down too.

Technical risks include a “fakeout”—where price teases a breakout but reverses. Watch for RSI levels above 70, which might signal overbought conditions and a pullback. For beginners, the takeaway? Diversify and don’t bet the farm—crypto’s thrills come with chills.

Wrapping It Up: Is $5,000 in Sight for ETH?

As Ethereum teeters on the edge of this triple bottom breakout, the path to $5,000 looks promising if catalysts align. Whether you’re a seasoned trader or just dipping toes into crypto, keeping tabs on resistance levels and news flow could pay off. Remember, patterns like this remind us that markets move in cycles—patience often rewards the prepared. Stay tuned; ETH’s next chapter might just be its most exciting yet.