Imagine a digital coin born in the bustling world of cryptocurrency exchanges, evolving from a simple fee-saver into a behemoth worth over $118 billion—enough to rival major corporations. That’s the story of BNB, and it’s sparking big moves like Grayscale’s push for a U.S. spot ETF. But what does this mean for the average person dipping their toes into crypto? Let’s break it down step by step, exploring how BNB’s meteoric rise is reshaping investment opportunities without the hype or jargon overload.

Understanding BNB: From Humble Beginnings to a Crypto Giant

BNB, short for Binance Coin, started life in 2017 as the native token of the Binance exchange, one of the world’s largest crypto platforms. Initially, it was all about practicality—users could pay trading fees at a discount, making transactions cheaper and faster. But over time, BNB has grown into the backbone of an entire ecosystem called BNB Chain, which supports decentralized apps, smart contracts, and even gaming worlds.

This transformation isn’t just tech talk; it’s about real-world utility. Think of BNB as the fuel for a massive online marketplace where developers build everything from finance tools to virtual realities. As more people and projects flock to it, BNB’s value has skyrocketed, turning early adopters into success stories.

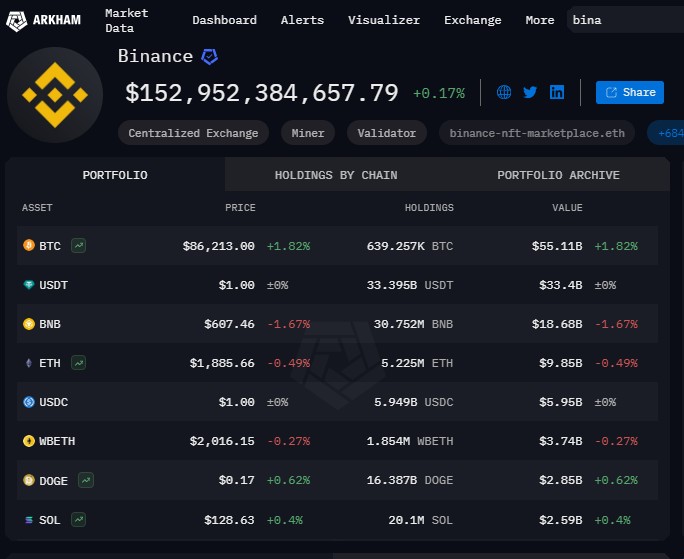

Binance Crypto Portfolio Explained

The Surge to $118 Billion: What Fueled BNB’s Explosive Growth?

Fast forward to mid-2025, and BNB hit a jaw-dropping milestone: its market capitalization surpassed $118.5 billion after reaching an all-time high price of $855.84 in July. This wasn’t a fluke; it came from a 7.4% daily surge, with the coin’s value climbing steadily amid broader market optimism. By August, it even topped $119 billion, outpacing traditional giants like Rolls-Royce in market value.

What drove this? A mix of factors: increased adoption in decentralized finance (DeFi), where users lend, borrow, and trade without banks; booming activity on the BNB Chain, with total value locked jumping over 500% in some areas; and positive crypto sentiment overall. For everyday folks, this growth signals that BNB isn’t just speculative—it’s tied to tangible uses, like powering low-cost transactions in emerging markets or enabling NFT creations.

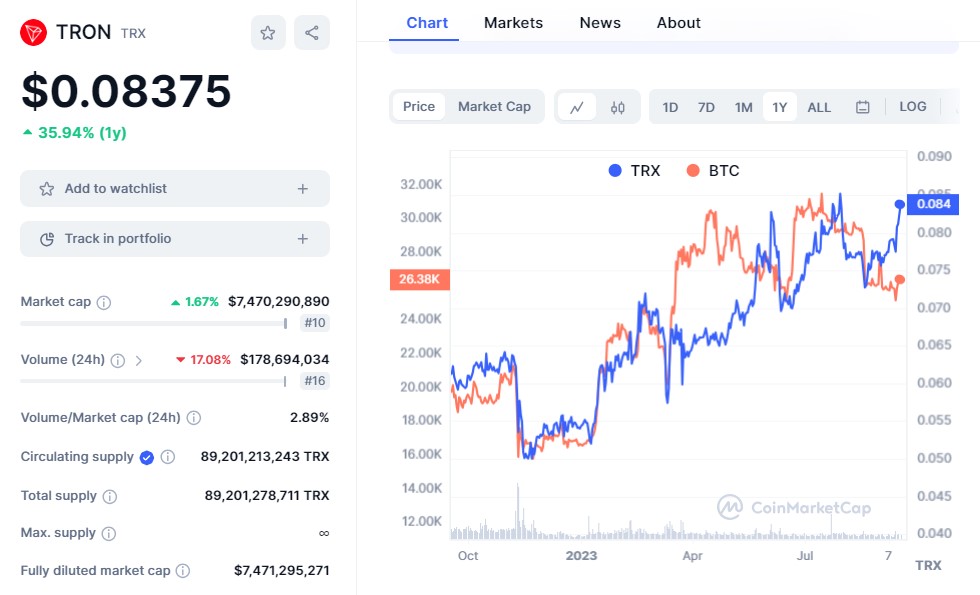

Which Cryptocurrencies To Buy in October 2023 For a Long Term

To put it in perspective, if you invested $1,000 in BNB early on, it could be worth hundreds of thousands today, thanks to this sustained expansion. But remember, crypto is volatile, so growth like this draws both excitement and caution.

Grayscale’s Bold Step: Filing for a BNB Spot ETF

Enter Grayscale Investments, a heavyweight in the crypto investment space known for turning digital assets into accessible products for traditional investors. In January 2026, Grayscale filed an S-1 registration with the U.S. Securities and Exchange Commission (SEC) for the Grayscale BNB Trust (ticker: GBNB), aiming to create a spot ETF that directly tracks BNB’s price.

Unlike futures-based ETFs, a spot version holds the actual asset, offering purer exposure without the complexities of contracts. This move follows Grayscale’s successes with Bitcoin and Ethereum ETFs, expanding their altcoin lineup. The filing, based in Delaware, allows big investors to create or redeem shares using BNB tokens themselves, making it more efficient.

Why Grayscale? They’re betting on BNB’s maturity, with the trust designed to let U.S. investors buy in through familiar stock exchanges like Nasdaq, without needing crypto wallets or navigating exchanges.

Drunk Driving & Wrongful Death Lawyer | Perkins Law Offices

Connecting the Dots: How BNB’s Growth Pushes the ETF Agenda

So, why does $118 billion matter here? It’s a threshold of credibility. When a crypto asset reaches this scale—commanding about 3% of the total crypto market— it attracts institutional eyes. BNB’s growth reflects strong ecosystem health, with surging blockchain activity and user engagement, as seen in a 26% weekly increase in related social posts.

For Grayscale, this isn’t just about riding a wave; it’s strategic. The U.S. crypto ETF market is heating up, with approvals for Bitcoin and Ether setting precedents. BNB’s rise positions it as the next logical step, especially after competitors like VanEck filed similar bids. This could trigger a breakout in BNB’s price if approved, drawing billions in fresh capital from pensions and retail investors wary of direct crypto ownership.

But challenges remain: Regulatory hurdles from the SEC, concerns over Binance’s past legal issues, and market volatility. Still, the growth narrative makes a compelling case for mainstream adoption.

What This Means for You: Opportunities and Cautions for Everyday Investors

If you’re new to crypto, a BNB spot ETF could be a game-changer. It means you could invest in BNB through your regular brokerage account, like buying Apple stock—no tech barriers. This democratizes access, potentially boosting BNB’s value further as more money flows in.

For the U.S. market, it signals maturing crypto regulations, with the overall cryptocurrency sector projected to grow amid increasing institutional interest. However, always diversify: Crypto can swing wildly, so consider it part of a balanced portfolio.

United States Cryptocurrency Market Size, Share & 2030 Growth …

In essence, BNB’s $118 billion leap isn’t just numbers—it’s proof of crypto’s evolution, paving the way for tools like Grayscale’s ETF to bridge traditional finance and the digital future. Keep an eye on SEC updates; this could be the start of something bigger for accessible investing.