Picture this: the massive machinery behind Wall Street’s daily trades—handling trillions in stocks, bonds, and Treasuries—quietly shifting part of its operations to blockchain technology. On December 11, 2025, that’s exactly what happened when the U.S. Securities and Exchange Commission issued a key no-action letter to the Depository Trust & Clearing Corporation (DTCC). This isn’t a full overhaul overnight, but a carefully controlled step that could reshape how everyday investments like shares and government bonds are managed, moved, and even traded around the clock.

For regular investors, this approval signals a safer bridge between traditional finance and the digital world, potentially unlocking faster settlements and new opportunities without losing regulatory protections.

Understanding the DTCC and This Landmark Approval

The DTCC is the unsung hero of financial markets, processing quadrillions in transactions yearly and custodizing over $100 trillion in securities (source: DTCC 2025 reports via BusinessWire). Its subsidiary, the Depository Trust Company (DTC), acts as the central vault for U.S. stocks and bonds.

The SEC’s no-action letter—essentially a green light saying they won’t enforce certain rules—allows DTC to launch a tokenization service in a controlled environment for three years, starting rollout in the second half of 2026 (source: Official DTCC announcement and Bloomberg, December 11, 2025). Tokenization means creating digital versions of real assets on blockchain, backed 1:1 by the originals held in custody.

This pilot focuses on highly liquid items like Russell 1000 stocks, major index ETFs, and U.S. Treasuries—ensuring the digital tokens carry the exact same ownership rights and protections as traditional holdings.

How Tokenization Works in This New Framework

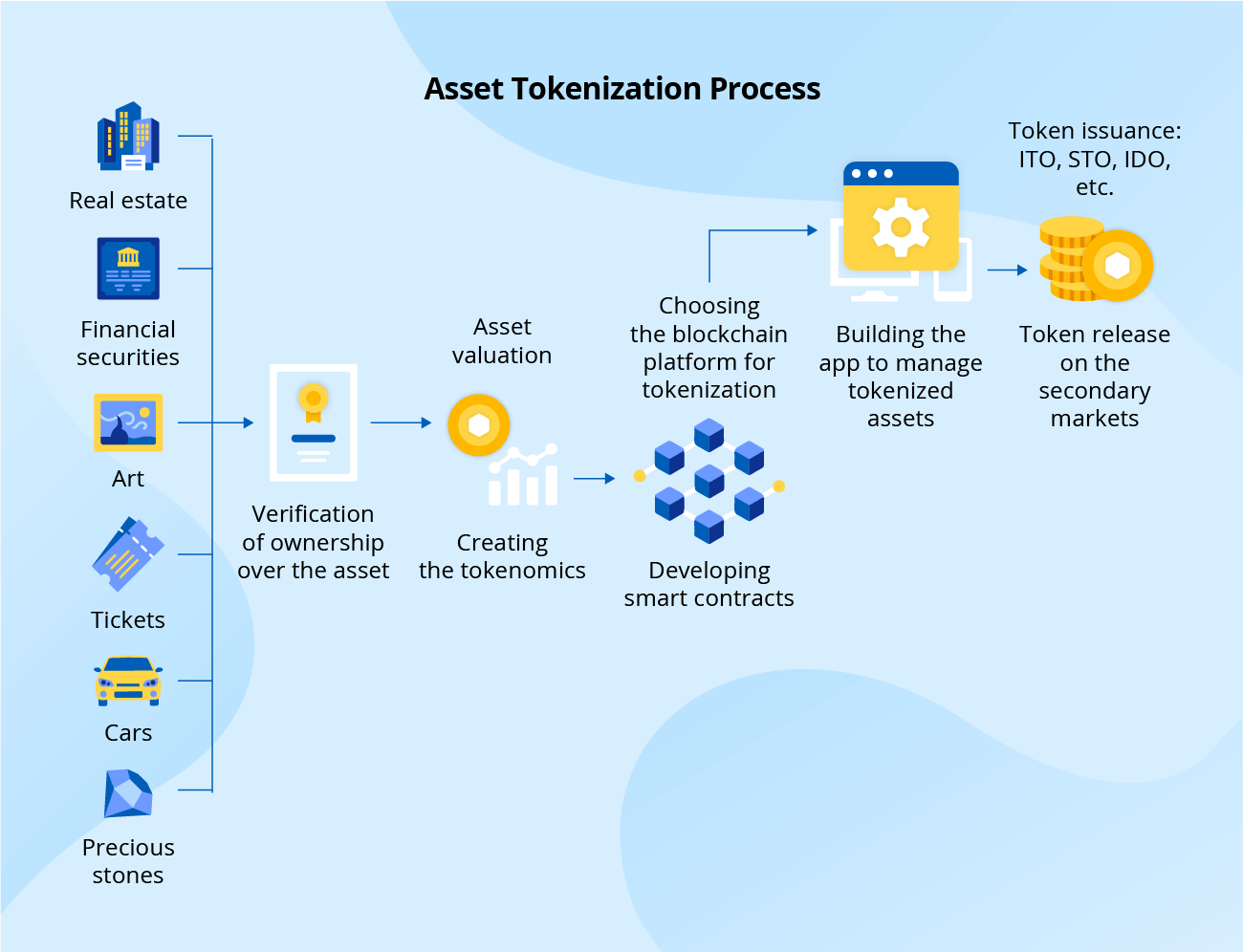

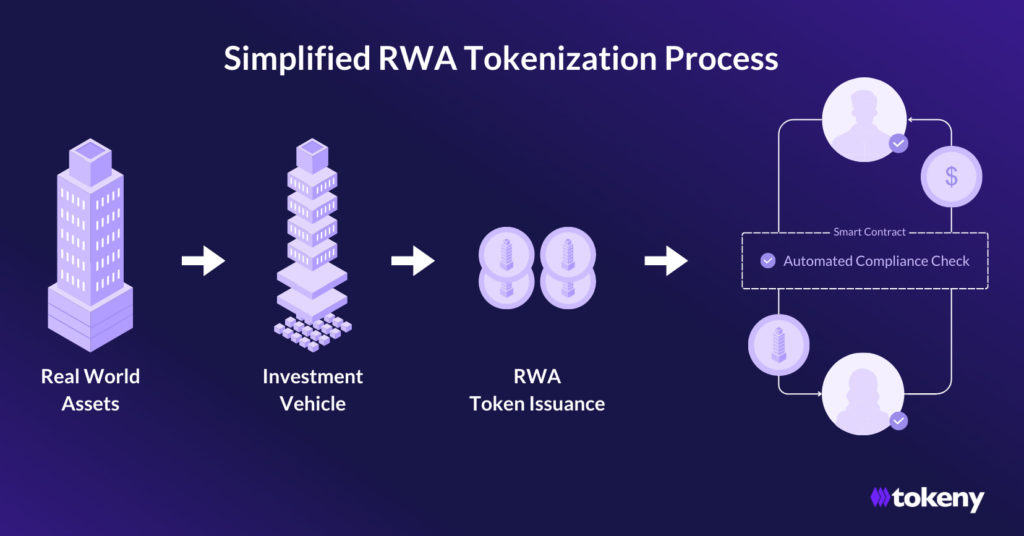

At its core, tokenization turns physical or book-entry assets into blockchain-based tokens. When a participant requests it, DTCC moves the asset to a special account and issues matching tokens to their registered blockchain wallet.

These tokens can then move across approved networks (both public and private Layer-1/Layer-2 blockchains that meet DTCC standards), enabling features like near-instant transfers. If needed, tokens can be “burned” to revert back to traditional form—no new assets are created, keeping everything tied to the real thing (source: SEC no-action letter details via DTCC press release).

Key Benefits for Everyday Assets and Investors

Faster and More Efficient Settlements

Traditional trades settle in days; tokenized ones could happen in minutes or seconds, reducing risks and freeing up capital.

Enhanced Mobility and Accessibility

Assets can move globally 24/7, without holidays or time zone barriers—great for collateral in loans or international portfolios.

Programmability and Innovation

Smart contracts could automate payments, dividends, or conditions, opening new ways to use assets like fractional ownership.

Importantly, all this happens under full regulatory oversight, with investor protections intact—no wild west risks (source: DTCC CEO Frank La Salla quoted in Reuters and Ledger Insights, December 2025).

Fintech Vs Traditional Bank: Innovations in Financial Technology

Broader Implications for the Financial World

This move bridges traditional finance (TradFi) and decentralized systems, potentially connecting regulated assets to broader ecosystems. It sets standards for which blockchains qualify, influencing the entire industry.

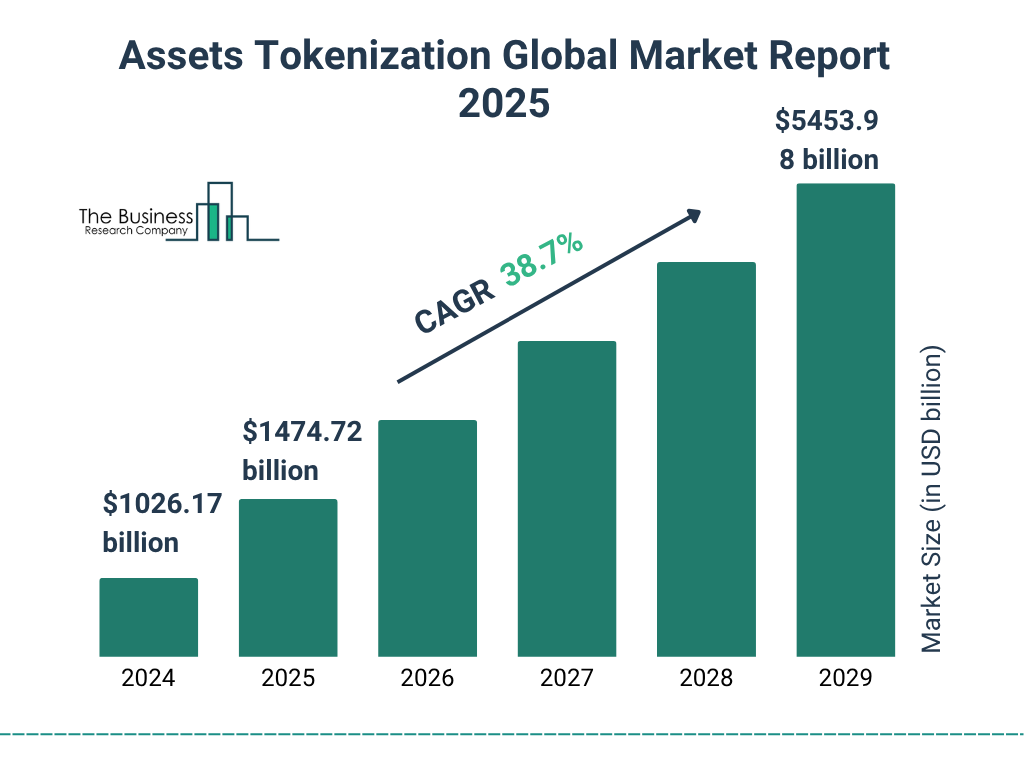

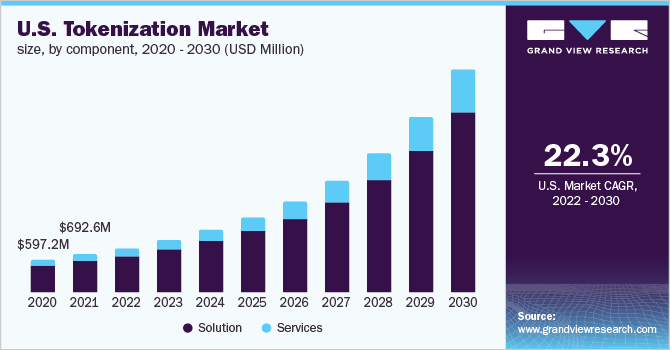

For ordinary people, it could mean lower costs, quicker access to investments, and more inclusive markets over time. Analysts see this as a foundation for tokenized assets growing into a multi-trillion-dollar space (source: Industry projections referenced in CCN and BanklessTimes reports).

thebusinessresearchcompany.com

Looking Ahead: A Gradual but Transformative Shift

The DTCC’s service will expand thoughtfully, with quarterly reports to the SEC ensuring safety. While not every asset tokenizes tomorrow, this approval paves a regulated path forward—making blockchain tools more mainstream for stocks, bonds, and beyond.

For investors, it’s a sign that digital innovation is coming to core markets in a secure way. Keep an eye on updates as the pilot unfolds; it could change how we think about owning and trading assets in the years ahead.