Picture this: It’s late 2025, and you’re a long-time Ripple holder watching XRP hover around $2.85 after a rollercoaster year of regulatory wins and market dips. You’ve ridden the highs of cross-border payment promises, but everyday frustrations—like clunky integrations and high fees—linger. Enter Digitap, the fresh face in crypto that’s whispering “upgrade” to folks just like you. As the global payments scene heats up toward a projected $290 trillion boom by 2030, this omni-bank project isn’t chasing hype; it’s building bridges between your wallet and the real world. For Ripple fans eyeing diversification, Digitap could be the smart pivot that turns cautious holdings into forward-thinking gains.

Decoding Digitap: The Everyday Omni-Bank for a Borderless World

Digitap isn’t another token floating in the ether—it’s a fully operational app that’s already on your phone, blending the reliability of traditional banking with crypto’s speed. Launched as the “world’s first omni-bank,” it lets users handle fiat deposits, crypto swaps, and international transfers all in one spot, without juggling multiple apps or middlemen.

Key Features That Make Life Simpler for Users

At its core, Digitap tackles the pain points of global money movement with practical tools:

- Visa-Backed Cards and Mobile Wallets: Spend $TAP or any supported crypto anywhere Visa is accepted, complete with Apple Pay and Google Pay integration for seamless tap-and-go transactions. Fees? Under 1% for remittances, a fraction of what banks charge.

- Multi-Currency Accounts and Offshore Options: Hold USD, EUR, or over 100 cryptos in one account, with instant exchanges and unlimited virtual cards for privacy-focused spending.

- High-Yield Staking: Lock up $TAP for up to 124% APR, turning passive holding into steady rewards while the platform grows.

This setup shines for freelancers wiring earnings from New York to Nairobi or small businesses dodging SWIFT delays. With the app live on iOS, Android, and desktop—downloaded by thousands already—it’s not vaporware; it’s your daily financial sidekick.

As a 2025 McKinsey report highlights, digital finance platforms like this could capture 20% of the $150 trillion cross-border market by streamlining what legacy systems can’t.

The 2025 Catalyst: Why Digitap Aligns with Banking’s Big Shift

Forget crystal balls—2025’s banking landscape is shaped by clear trends: exploding demand for instant, low-cost transfers amid rising global trade and remote work. Digitap’s presale, kicking off at $0.0125 per $TAP and already pulling in over $200,000, taps right into this wave with its fixed 2 billion token supply and deflationary buy-and-burn mechanics tied to transaction fees.

Riding the Cross-Border Payments Surge

Experts forecast blockchain could slash cross-border costs by up to 80%, unlocking $10 billion in savings for banks alone by decade’s end. Digitap positions itself at the forefront by ditching third-party dependencies—its AI routes payments via the cheapest path, whether blockchain or SEPA rails, settling in seconds. For Ripple investors, this means a project that builds on XRP’s ledger strengths but adds user-friendly layers like offshore accounts and loyalty rewards.

The buzz is real: Recent X posts from crypto watchers compare early $TAP buys to snagging XRP at pennies, predicting 20x-50x lifts as adoption ramps. In a year where stablecoins and tokenized assets go mainstream, Digitap’s omni-model could onboard the next wave of everyday users wary of pure crypto volatility.

Digitap vs. XRP: Spotting the Upgrade Path for Savvy Holders

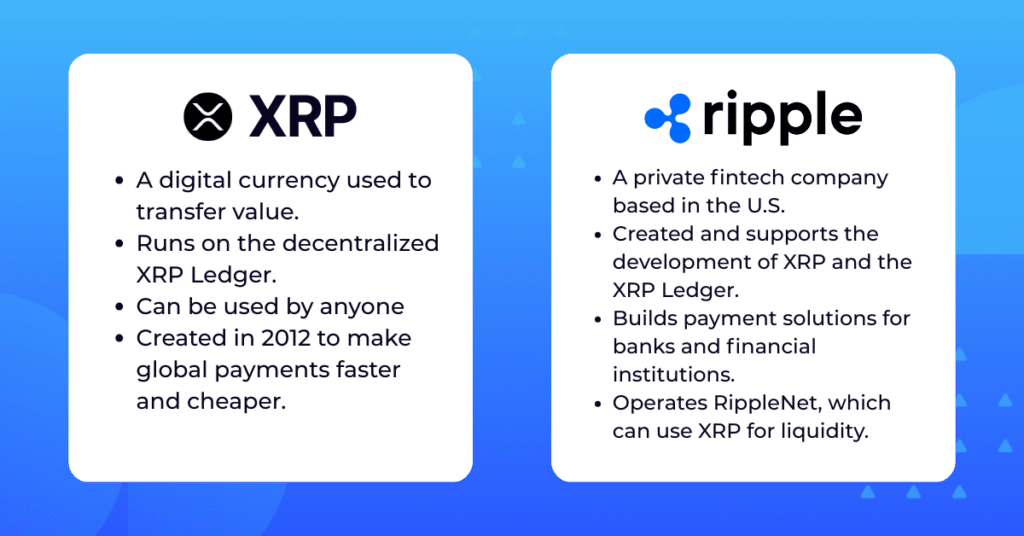

Ripple’s XRP has been a trailblazer, powering institutional transfers with lightning speed and regulatory nods. But as one veteran holder might muse, “What’s next after the pioneer?” Digitap emerges not as a rival, but as an evolution—expanding XRP’s focus on rails into a full-service hub.

Where Digitap Edges Ahead in Everyday Utility

- Accessibility Over Institutions: While XRP thrives in bank corridors, Digitap democratizes it for individuals with one-tap spending and fiat bridges, potentially outpacing XRP’s 400% yearly gains with broader retail appeal.

- Tokenomics for Long-Term Value: $TAP’s scarcity-driven model mirrors early successes like BNB, with burns fueling price pressure as the platform scales—unlike XRP’s larger circulating supply.

- Real-World Integration: Visa partnerships and mobile-first design make Digitap feel like Revolut meets blockchain, addressing XRP’s occasional UX hurdles.

Analysts at CryptoPotato note that in a “cheap money era,” projects like Digitap with live products could deliver outsized returns over established names. For you, the Ripple investor, it’s about layering in $TAP for diversification without ditching your core bet.

Navigating Risks: A Balanced View for 2025 Portfolios

No crypto tale is complete without the fine print. Digitap’s youth means regulatory twists—like evolving stablecoin rules—could slow its roll, much like XRP’s SEC saga. Adoption hinges on user trust, and while staking rewards tempt, market dips could test resolve. Yet, with a vetted team and audited smart contracts, it’s no wilder than early XRP bets.

Juniper Research underscores the upside: Blockchain’s role in payments could multiply efficiencies 3,300-fold by 2030, rewarding innovators like Digitap. For risk-averse Ripple fans, start small—perhaps allocate 5-10% of your portfolio to $TAP’s presale for that high-reward spark.

As 2025 unfolds, Digitap isn’t just potential; it’s a practical step toward banking without borders. If you’ve mastered XRP’s game, this could be your move to level up—turning global finance frustrations into frictionless wins. Keep watching the presale; the next big transfer might just be yours.