Introduction: A New Era for DeFi on Base

Picture a trading platform where you can swap tokens, track markets, and manage wallets—all from one sleek interface, without leaving the crypto world. In August 2025, o1.exchange raised $4.2 million to bring this vision to life on Base, Coinbase’s fast-growing Layer-2 blockchain. This funding, led by heavyweights like Coinbase Ventures, signals a major leap for decentralized finance (DeFi) on Base, offering everyday traders a powerful new tool. But what is Base Chain DeFi, and why is o1.exchange’s launch such a big deal? This article breaks it down in simple terms, exploring how o1.exchange works, its unique features, and what its funding means for the future of trading.

What Is Base Chain DeFi?

Base is a Layer-2 blockchain built by Coinbase to make Ethereum faster and cheaper, with total value locked (TVL) reaching $4.1 billion, making it the #6 blockchain for DeFi, per CoinGecko. DeFi on Base lets users trade, lend, and stake crypto using smart contracts—self-executing code that cuts out banks or brokers. Unlike centralized exchanges, DeFi platforms like Uniswap or BaseSwap let you control your funds via a wallet, offering freedom and transparency.

Why Base Stands Out

Base’s low fees (often under $0.01 per transaction) and fast processing make it a hotspot for DeFi projects. From yield farming on Beefy Finance to NFT marketplaces like Zora, Base hosts over 200 dApps, per DefiLlama. Its seamless integration with Coinbase’s ecosystem attracts both newbies and pros, fueling its rise as a DeFi hub in 2025.

o1.exchange: The First Full Trading Terminal on Base

Launched on August 19, 2025, o1.exchange is a decentralized trading platform aiming to be the “Bloomberg Terminal for Base.” Backed by $4.2 million from Coinbase Ventures and AllianceDAO, it offers a one-stop shop for traders, blending advanced tools with user-friendly design. Posts on X call it a “game-changer” for its 45% cashback and 41% referral rewards, driving viral growth.

Key Features of o1.exchange

- Fast Trades: Executes trades in one block (under 2 seconds), rivaling centralized exchanges.

- TradingView Charts: Offers enterprise-grade candlestick charts for detailed market analysis.

- Multi-Wallet Support: Manage multiple wallets with self-custody, ensuring you control your funds.

- Cross-Chain Bridging: Swap assets across Base, Ethereum, Solana, and more.

- Advanced Orders: Supports limit orders, grab orders, and TWAP (Time-Weighted Average Price) for strategic trading.

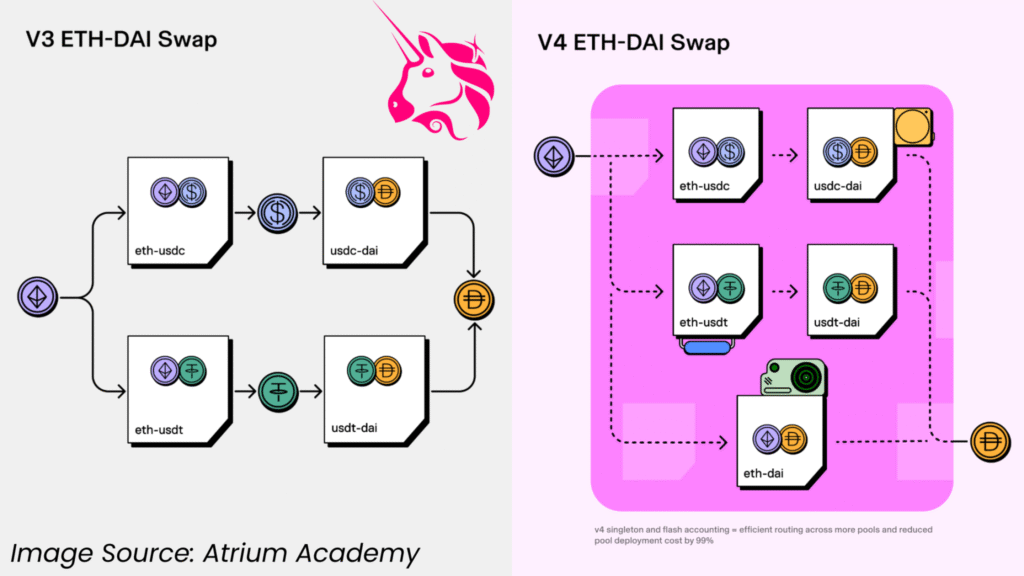

- Uniswap V4 Integration: Taps into cutting-edge DeFi liquidity pools for better rates.

The $4.2M Funding: What It Means

The $4.2 million funding round, announced on August 19, 2025, is a big vote of confidence in o1.exchange and Base’s DeFi potential. Led by Coinbase Ventures and AllianceDAO, the investment will enhance platform features, boost liquidity, and attract more users, per PANews.

Strategic Backing

Coinbase Ventures, tied to Base’s parent company, brings credibility and strategic alignment. AllianceDAO, a top crypto incubator, has a track record of backing high-potential startups like dYdX. This duo signals o1.exchange’s aim to dominate Base’s trading infrastructure.

Fueling Growth

The funds will:

- Expand trading tools, like AI-driven analytics and automated strategies.

- Deepen integrations with Base protocols like Uniswap V4 and BaseSwap.

- Support the 45% cashback and 41% referral programs to onboard retail and pro traders.

X users like @CryptoRank_VCs praise the funding as a sign of Base’s growing DeFi ecosystem, with potential for o1.exchange to rival giants like Uniswap.

Why o1.exchange Matters for Everyday Traders

For the average person, o1.exchange makes DeFi trading less intimidating and more rewarding. Here’s how:

Easy Access

You don’t need a finance degree to use o1.exchange. Its intuitive interface, similar to Coinbase, lets beginners trade tokens or track portfolios with ease. For example, Jake, a 27-year-old retail worker, earned $50 in cashback trading $200 worth of tokens in a week.

High Rewards

The 45% cashback on trading fees is unmatched, letting you keep nearly half the fees you pay. The 41% referral share encourages inviting friends, boosting earnings. These incentives, per BitcoinEthereumNews, aim to make o1.exchange a go-to for cost-conscious traders.

Secure and Transparent

With self-custody wallets and MEV (Miner Extractable Value) protection, o1.exchange minimizes risks like front-running. Its on-chain analytics provide real-time data, empowering informed decisions.

Risks to Consider

DeFi trading isn’t risk-free, and o1.exchange is no exception. Here’s what to watch for:

Volatility and Losses

Crypto markets are wild, and Base tokens can swing 10-20% daily. Trading with leverage or chasing rewards can amplify losses, as noted by Investopedia. Always invest what you can afford to lose.

Smart Contract Risks

While o1.exchange uses audited contracts, bugs or hacks are possible in DeFi. A 2024 CoinDesk report on DeFi hacks stresses the importance of sticking to well-audited platforms like o1.exchange.

Regulatory Uncertainty

DeFi’s borderless nature raises questions about compliance. The SEC may tighten rules on tokenized assets or trading platforms, per OneSafe. Consult a financial advisor to stay compliant.

How to Get Started with o1.exchange

Ready to try o1.exchange? Follow these steps:

- Set Up a Wallet: Use MetaMask or Coinbase Wallet to connect to Base. Fund it with ETH or USDC via Coinbase or a bridge like Axelar.

- Visit o1.exchange: Go to the platform’s website and connect your wallet.

- Claim Rewards: Sign up for the 45% cashback and claim the OG Trader badge, as shared by @luxxysol on X.

- Start Trading: Try simple swaps or advanced orders like TWAP. Start with small amounts to test the platform.

- Stay Safe: Enable two-factor authentication and avoid sharing private keys.

The Future of Base Chain DeFi with o1.exchange

o1.exchange’s launch and funding mark a turning point for Base, which is evolving into a DeFi powerhouse. With over 200 dApps and $4.1 billion in TVL, Base is closing the gap with Ethereum and Solana, per DefiLlama. o1.exchange’s tools, like TradingView charts and Uniswap V4 integration, position it to capture traders seeking speed and savings. As Base grows, expect more platforms to follow, offering yield farming, lending, and NFT trading.

Conclusion: Trading Smarter on Base

o1.exchange’s $4.2 million funding and innovative features make it a standout in Base Chain DeFi. Its fast trades, generous rewards, and user-friendly design open DeFi to everyone, from casual traders to pros. While risks like volatility and regulation loom, the platform’s audited contracts and Coinbase backing build trust. Whether you’re swapping tokens or chasing cashback, o1.exchange offers a fresh way to engage with Base’s booming ecosystem. Dive in, start small, and explore the future of decentralized trading.