Imagine waking up to a notification from your crypto exchange: “New EU tax rules in effect—your trades are now reportable.” For millions of everyday investors across Europe, this isn’t sci-fi—it’s the reality unfolding in 2026. The European Commission has fired off formal warnings to 13 member states, urging them to lock down crypto tax loopholes before they widen further. If you’re dipping your toes into Bitcoin or Ethereum, this could mean the difference between smooth sailing and a tax audit storm. Let’s break it down simply, step by step, so you can stay ahead without the jargon overload.

These actions spotlight Directive (EU) 2023/2226, better known as DAC8, which amps up the EU’s tax-sharing toolkit to include digital assets. It’s like giving tax officials a high-definition view of your crypto wallet, ensuring gains from trades or staking get taxed fairly—just as they do for traditional investments.

Regulatory Shifts in Crypto in 2025

The Wake-Up Call: Why Is the EU Cracking Down Now?

Picture this: Crypto’s wild ride has minted fortunes overnight, but it’s also created shadowy corners where taxes slip away unnoticed. In January 2026, the Commission dropped its latest “infringements package,” slapping letters of formal notice on 12 countries—Belgium, Bulgaria, Czechia, Estonia, Greece, Spain, Cyprus, Luxembourg, Malta, the Netherlands, Poland, and Portugal—for dragging their feet on DAC8 implementation. Add in a separate nudge to another nation on overlapping rules, and you’ve got 13 under the spotlight.

These aren’t slaps on the wrist; they’re a two-month countdown to tweak national laws or risk escalated enforcement, like court referrals. The goal? Plug the gaps in cross-border tax data sharing that let evasion thrive. As the Commission puts it, full rollout is “essential for boosting tax transparency” and keeping the playing field even for all investors.

Future of Money – Part 2 – Foreign Policy

Unpacking DAC8: The New Rules Shaking Up Your Crypto Game

At its core, DAC8 isn’t out to ban or burden crypto—it’s about visibility. Before this, many trades zipped across borders like ghosts, invisible to tax radars. Now, Crypto-Asset Service Providers (CASPs)—your go-to exchanges like Kraken or local wallets—must play detective and bookkeeper.

Starting January 1, 2026, they’ll gather:

- User basics: Name, address, tax ID, and residency.

- Transaction tea: Dates, types (buys, sells, swaps), volumes, and euro-equivalent values.

- Annual handoff: Data funneled to home tax offices, then swapped EU-wide by September 2027 for 2026 activities.

This mirrors the OECD’s global Crypto-Asset Reporting Framework (CARF), a blueprint for 50+ countries to sniff out hidden digital wealth. For the average Joe or Jane holding a few hundred euros in crypto, it’s a nudge to treat it like any side hustle income—not a secret vault.

Blockchain in Finance | 2024

Everyday Compliance: Your No-Sweat Roadmap to Staying Legal

Don’t panic—complying isn’t rocket science, especially if you’re not a whale trader. Think of it as organizing your sock drawer before company arrives. Here’s a beginner-friendly blueprint tailored for the EU crypto crowd:

Step 1: Decode Your Country’s Crypto Tax Lingo

Rules aren’t one-size-fits-all. In Germany, staking rewards might count as income; in France, they’re often capital gains. Hit up your national tax site’s crypto section (like Germany’s BZSt or Spain’s AEAT) for the lowdown. Pro tip: Most spots tax gains at 15-45%, depending on your bracket.

Step 2: Log Everything Like a Pro

Every swap on Uniswap? Jot the date, fiat value, and fees. Free apps like CoinTracker or a Google Sheet do the heavy lifting—export CSVs from your exchange for auto-magic.

Step 3: Pick Platforms That Play by the Rules

Opt for MiCA-licensed spots (post-2024 EU crypto law). They’ll auto-report, sparing you paperwork. Dodgy offshore apps? Risky—they could freeze your funds if flagged.

Step 4: File Like Clockwork

Come tax season, slot crypto earnings into your return’s “other income” or “capital gains” box. Tools like Koinly spit out ready-to-submit forms. Unsure? A €100 consult with a crypto-savvy accountant beats fines any day.

Step 5: Eyes on the Horizon

Bookmark EU tax updates. With the 13 nations’ response window closing soon, expect national tweaks by spring 2026.

This routine keeps you audit-proof and lets you focus on the fun part: growing your portfolio.

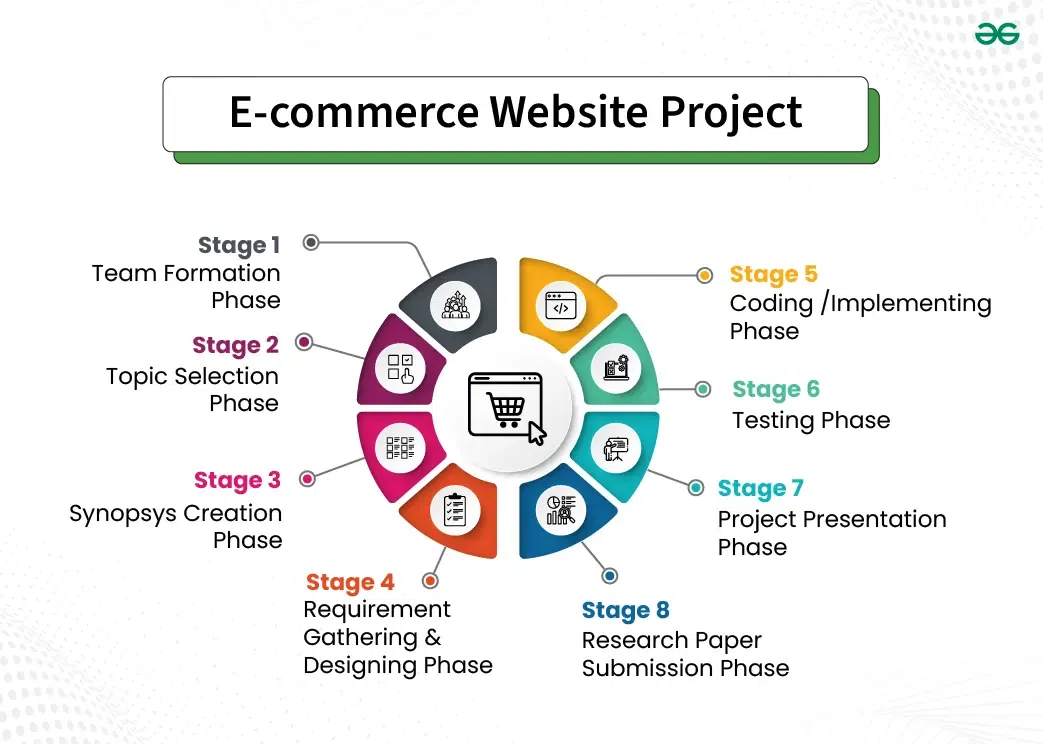

E-Commerce Website Project in Software Development – GeeksforGeeks

The Bigger Picture: Fair Play for a Thriving Crypto Scene

Zoom out, and DAC8 isn’t just a tax trap—it’s a trust booster. By syncing with MiCA’s market safeguards, the EU aims to weed out bad actors while welcoming legit innovation. Experts from the OECD predict this could rake in billions in lost revenue, funding everything from green energy to social nets.

Sure, privacy fans grumble about the spotlight, but clearer rules could lure more institutional cash, stabilizing prices for all. For small holders, it’s a reminder: Crypto’s gone mainstream, so treat it that way. Get compliant now, and you’ll surf the next bull run worry-free.

(References: European Commission’s January 2026 Infringements Package; Directive (EU) 2023/2226; OECD Crypto-Asset Reporting Framework.)

Ready to future-proof your crypto habits? Start with one log today—your future self (and tax bill) will thank you.