Imagine scrolling through your phone on a rainy afternoon, only to see your crypto portfolio turning red faster than a traffic light. That’s the scene many investors faced recently as the market took a nosedive. But amid the chaos, something intriguing happened: Tether, the company behind the popular stablecoin USDT, quietly minted $1 billion worth of new tokens and sent them onto the Tron network. This isn’t just a random blip—it’s a signal that could hint at bigger shifts in the crypto world. Let’s break it down step by step, exploring what this means for everyday folks dipping their toes into digital assets.

Understanding the Recent Crypto Dip

Crypto markets are like roller coasters—thrilling but stomach-churning. In early January 2026, Bitcoin and other major coins saw sharp declines, with Bitcoin dropping below key support levels amid broader economic jitters. Factors like regulatory news from the U.S. and global inflation worries played a role, leading to widespread sell-offs. This isn’t unusual; history shows crypto often reacts dramatically to external pressures.

To visualize the turbulence, here’s a chart showing typical cryptocurrency market fluctuations during downturns.

The Crypto Crisis – Dissent Magazine

These dips can wipe out billions in value overnight, leaving new investors wondering if it’s time to bail or buy more. But remember, volatility is crypto’s middle name—it’s what creates opportunities as much as risks.

What is USDT and Why Does It Matter?

If you’re new to crypto, USDT might sound like tech jargon, but it’s simpler than you think. USDT, or Tether, is a “stablecoin”—a digital currency designed to hold a steady value of $1, backed by real-world assets like cash and bonds. It’s like a bridge between traditional money and the wild world of cryptocurrencies, allowing people to trade without constant price swings.

Think of USDT as the oil that keeps the crypto engine running smoothly. When markets get shaky, traders often park their funds in USDT to wait out the storm. Tether issues new USDT when demand rises, injecting liquidity that can stabilize things or even spark recoveries.

For a quick look at what USDT represents, check out this image of the Tether stablecoin logo.

Tether Logo Token Usdt Stablecoin 3d Stock Illustration 2196633223 …

According to data from CryptoQuant, stablecoins like USDT account for a massive portion of crypto trading volume, often exceeding $100 billion daily. This makes them crucial for market health.

The $1 Billion Mint: What Really Happened?

On January 9, 2026, Tether’s treasury minted 1 billion new USDT tokens on the Tron blockchain, a fast and low-cost network popular for stablecoin transactions. This fresh batch was held in reserve, ready to be distributed as user demand picks up. It’s not the first time—Tether has done similar mints during past dips, like in November 2025 when another $1 billion was issued amid a market meltdown.

Why Tron? It’s efficient for large-scale transfers, handling over 50% of all USDT in circulation. This move came right as Bitcoin hit a rough patch, suggesting Tether is prepping for increased trading activity or institutional inflows.

Timing with Market Drops: Coincidence or Strategy?

History tells us these mints often align with market lows. For instance, back in October 2025, Tether and Circle (issuer of USDC) minted over $20 billion in stablecoins following a massive crash that liquidated $19 billion in positions. Such actions can act as a liquidity buffer, helping exchanges manage volatility.

Take a glance at this Bitcoin price chart to see how fluctuations often precede or follow big stablecoin issuances.

Bitcoin (BTC USD) Price Chart History Shows Room for More Losses …

Experts from CoinMetrics note that rising stablecoin supplies signal growing confidence, as they reflect real money entering the ecosystem. In simple terms, more USDT means more fuel for potential rallies.

Implications for Everyday Investors

So, what does this mean for you? If you’re holding crypto during a drop, a big USDT mint could be a positive sign. It often precedes price rebounds, as fresh liquidity encourages buying. Data from Lookonchain shows that since late 2025 crashes, over $17 billion in new stablecoins have been issued, correlating with market recoveries.

However, it’s not all upside. Critics worry about Tether’s transparency—though audits show reserves are solid, past controversies linger. For ordinary folks, the key is diversification: don’t put all your eggs in one crypto basket.

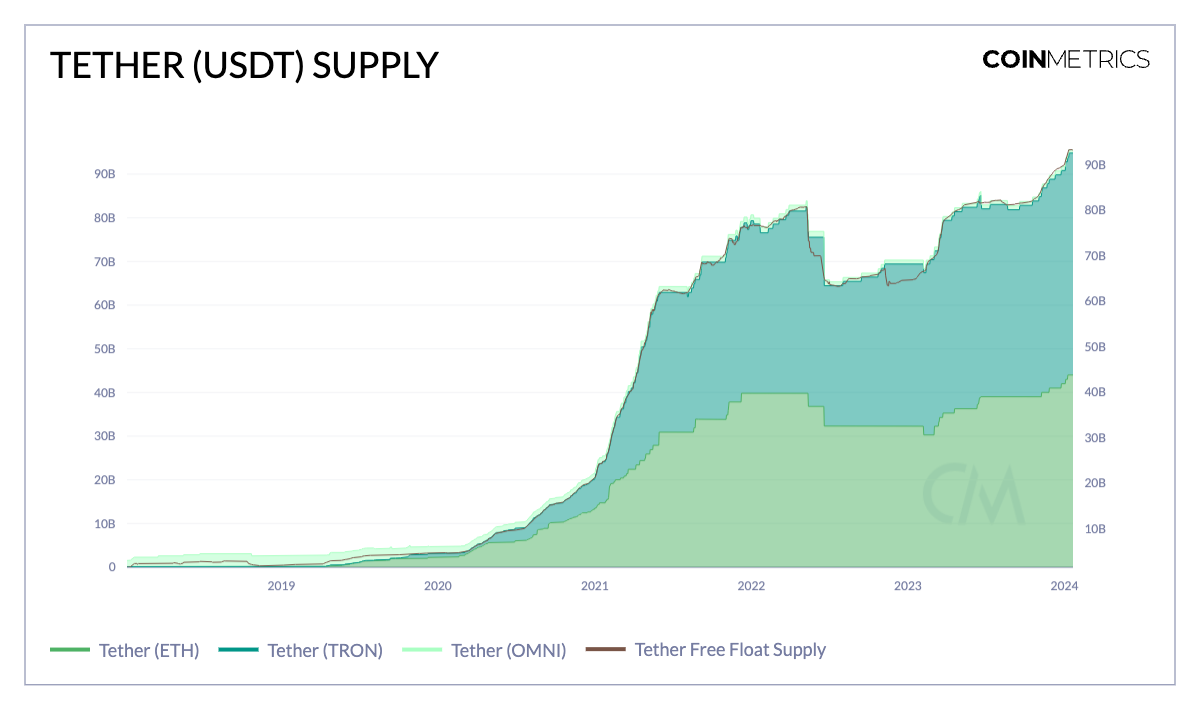

Here’s a graph illustrating USDT’s supply growth over time, highlighting spikes during volatile periods.

Tether’s Ascent: Breaking Down the Dominant Stablecoin’s Growth

In a recent X post, analysts pointed out TRON’s dominance in stablecoins, with over $82 billion in USDT issued, underscoring its role in global liquidity.

Looking Ahead: Opportunities in the Chaos

As we navigate 2026, keep an eye on stablecoin trends—they’re like weather vanes for crypto sentiment. If USDT issuance keeps up, it might signal a bull run ahead, especially with potential regulatory clarity boosting adoption.

For beginners, start small: use USDT to enter trades safely, and always research before investing. Remember, crypto isn’t a get-rich-quick scheme—it’s about understanding the underlying tech and market forces.

In the end, this $1 billion mint amid a dip reminds us that even in downturns, smart money is positioning for the next upswing. Stay informed, stay patient, and who knows? Your portfolio might just turn green again sooner than you think.