Ever wondered how a simple app on your phone could slash the cost of sending money home by half, while putting cash in pockets across the globe? That’s the magic brewing in the remittances world, where migrant workers funnel billions back to families every year. As 2026 dawns, this market is exploding—projected to hit staggering heights amid rising migration and digital shifts. Crypto isn’t just riding the wave; it’s creating it, offering faster, cheaper transfers that sidestep clunky banks. If you’re eyeing ways to tap into this goldmine without needing a finance degree, stick around—we’ll walk through smart plays, pitfalls, and why now’s the time to jump in.

Understanding the Remittances Boom in 2026

Remittances are those lifeline payments sent by workers abroad to support loved ones back home—think a construction worker in the US wiring funds to Mexico or a nurse in the UK helping family in the Philippines. This isn’t pocket change; the global flow is massive and growing. Recent forecasts peg the market at around $132 billion in 2026, surging toward $270 billion by 2032 as migration swells and economies rebound. Other estimates push it even higher, with digital channels alone eyeing $60 billion by 2030, fueled by smartphones and fintech apps.

Why the hype? Traditional systems like banks or wire services charge hefty fees—sometimes up to 7%—and take days to clear. In emerging markets, where remittances can make up 20% of GDP, that’s a huge drag. Enter 2026’s opportunity: with global migration hitting record levels, savvy investors can back crypto solutions that cut costs to pennies and deliver funds in minutes.

How Crypto is Disrupting the Remittances Game

Crypto flips the script on old-school money transfers by using blockchain—a secure, decentralized ledger that skips middlemen. Imagine sending cash across borders like emailing a photo: instant, transparent, and low-cost. Stablecoins, pegged to stable assets like the US dollar, lead the charge, dodging wild price swings while enabling seamless swaps. In high-traffic corridors like US-to-Mexico, platforms using crypto have already processed billions, trimming fees from 6% to under 1%.

The disruption? Blockchain settles in seconds, not days, and works 24/7—no bank holidays here. For recipients in unbanked areas, mobile wallets turn phones into instant cash hubs. Risks lurk, though: volatility can bite if not using stables, and regs vary by country. Still, with digital remittances projected to snag 61% market share by 2026 (over $550 billion), the upside is clear.

With Coinbase Wallet, sending money is now as easy as sending a text

Top Crypto Picks for the Remittances Surge

Not all cryptos are created equal for remittances—focus on those built for speed, stability, and real-world use. Here’s where to look in 2026:

Stablecoins: The Safe Bet for Everyday Transfers

USDC and USDT dominate, acting like digital dollars for borderless sends. They’re backed 1:1 by reserves, making them ideal for avoiding currency crashes in places like Argentina or Nigeria. Growth? Stablecoin volumes in remittances decoupled from trading hype in 2025, hinting at mainstream adoption. Invest via exchanges or hold in wallets for yield.

Ripple (XRP): Built for Banks and Borders

XRP powers Ripple’s network, zipping funds globally in seconds at fractions of a cent. It’s partnered with banks like Santander for real pilots, targeting the $156 trillion cross-border arena by 2026. Why invest? As regs clear, XRP could capture more institutional flows.

Ripple (XRP) — Quick Introduction | by Alex Prut | The Capital …

Stellar (XLM): Affordable and Inclusive

Stellar focuses on underserved markets, enabling cheap remittances via its open network. XLM trades under a buck, making it a penny play with upside—think 13% annual digital growth to $42 billion by 2028.

For a quick compare:

| Crypto | Key Strength | 2026 Potential | Risk Level |

|---|---|---|---|

| USDC/USDT | Stability & Low Fees | High Adoption in Fintech | Regulatory Scrutiny |

| XRP | Fast Settlements | Institutional Partnerships | Legal Hurdles |

| XLM | Accessibility for Emerging Markets | Scalable Growth | Competition from Bigger Players |

These aren’t moonshots; they’re utility-driven, aligning with the $900B+ opportunity as crypto grabs 20% of cross-border share by 2030.

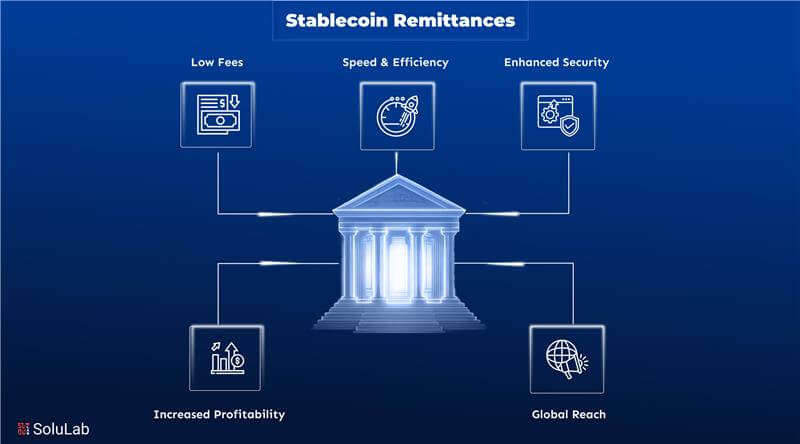

Stablecoin Remittances: A Modern Finance Opportunity for Startups

Step-by-Step: Getting Started with Crypto Investments

Diving in? Keep it simple:

- Educate Yourself: Read up on wallets and exchanges—start with user-friendly ones like Coinbase for beginners.

- Set Up a Wallet: Grab a secure app like Trust Wallet to hold stables or XRP.

- Buy In: Use fiat to purchase via apps; aim for diversified buys under 5% of your portfolio.

- Track and Hold: Use tools like CoinMarketCap; focus on long-term as remittances grow.

- Diversify Risks: Mix stables with tokens like XRP for balance.

Newbies, remember: Start small, perhaps $100, and learn as you go.

Making money on crypto rectangle infographic template. Profit …

Navigating Risks in the Crypto-Remittances Space

Crypto’s promise comes with caveats. Volatility can swing prices 10% daily, eroding value if not hedged with stables. Regulatory shifts—like new stablecoin laws—could boost or bust adoption. Security? Hacks happen, so use hardware wallets. In remittances, off-ramp issues (converting crypto to local cash) persist in rural spots.

Mitigate by: Researching compliant projects, using insured exchanges, and never investing more than you can lose. As blockchain matures, these risks should ease, especially with 2026’s expected clarity.

Looking Ahead: 2026 and Beyond

By 2026, expect crypto to claim bigger slices—stablecoins in B2B payments, XRP in bank trials, and more fintech-crypto hybrids. With remittances potentially topping $905 billion globally, early investors in utility tokens could see solid gains. Watch for CBDCs and partnerships accelerating this.

In essence, crypto isn’t just speculating—it’s solving real problems in a $900B arena. Approach with curiosity, caution, and a long view, and you might just ride the next big financial shift.