In a world where traditional savings accounts barely keep up with inflation, many everyday investors are turning to cryptocurrency staking as a smarter way to grow their money while they sleep. Imagine your digital assets working behind the scenes to secure blockchain networks—and paying you handsomely for the effort. As we head into 2026, staking has matured into a reliable passive income strategy, with platforms making it easier than ever for beginners to get started without needing technical expertise.

This guide breaks down five standout platforms that balance strong yields, user-friendliness, and security. We’ll explore what makes each one unique, current reward estimates (which can fluctuate), and tips to help you choose wisely.

What Is Crypto Staking and Why Consider It in 2026?

Crypto staking lets you lock up certain cryptocurrencies to support proof-of-stake blockchains, like helping verify transactions on a network. In return, you earn rewards—often far better than bank interest. It’s like lending your assets to the ecosystem for a cut of the profits.

By 2026, more networks have shifted to energy-efficient proof-of-stake models, driving up participation. According to data from Staking Rewards, a leading independent tracker, billions in assets are now staked globally, with average yields ranging from 3-8% for major coins. This growth reflects staking’s appeal: it’s passive, accessible, and can compound over time.

Top 5 Staking Platforms for Competitive Yields

Here are five platforms that stand out for their reliability, variety of supported assets, and attractive rewards heading into 2026.

1. Binance Earn

Binance remains a favorite for its massive selection of over 100 staking options, from Ethereum to lesser-known tokens. It offers flexible terms—no long lockups required for many—and integrates seamlessly if you already trade on the exchange.

Expected yields vary, but popular assets like Solana often see around 6-8%. The platform’s user-friendly app makes monitoring rewards straightforward, even for newcomers.

2. Kraken

Known for strong security and regulatory compliance, Kraken appeals to cautious investors. It supports staking for key coins like Ethereum, Solana, and Polkadot, with simple on-chain options and bi-weekly payouts.

Rewards are competitive and transparent—Ethereum typically hovers near 4-6%, per industry benchmarks. Kraken’s bonded staking can boost returns for those willing to commit longer.

3. Coinbase

Coinbase shines for simplicity, making it ideal for first-timers. You can stake directly from your account with just a few clicks, supporting assets like Ethereum, Cardano, and Solana.

While it takes a commission, yields remain solid—around 3-5% for Ethereum, as reported by platforms like Staking Rewards. Its educational resources help build confidence quickly.

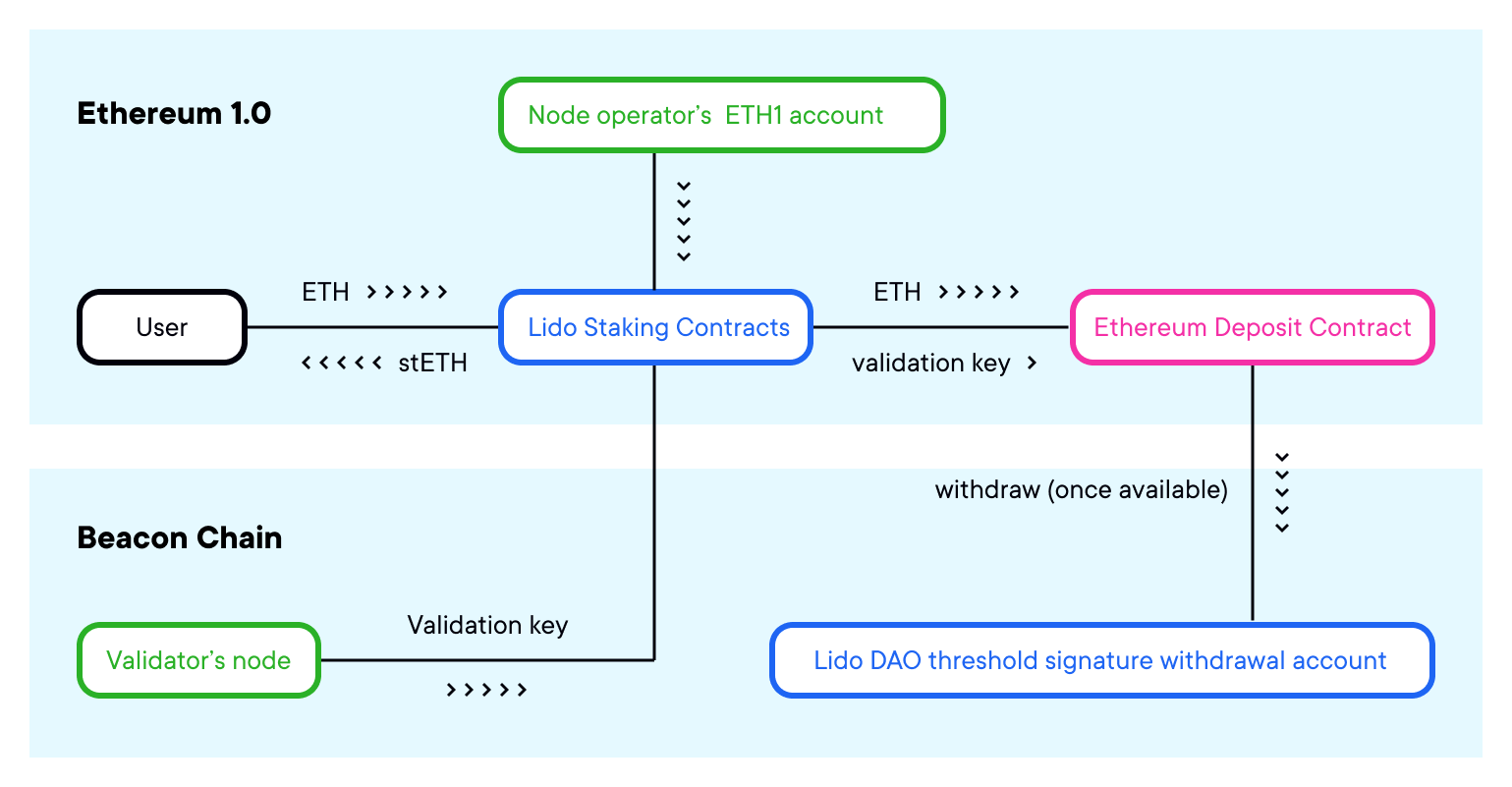

4. Lido Finance

For those wanting decentralization without the hassle, Lido offers liquid staking. Stake Ethereum or other supported chains and receive a tradable token (like stETH) that keeps earning while you use it elsewhere in DeFi.

This flexibility sets it apart, with base yields often matching or exceeding centralized options—around 3-4% for ETH. Lido’s community-governed model adds trust for advanced users.

5. OKX

OKX provides a versatile marketplace with both centralized convenience and DeFi integrations. It supports dozens of assets and often runs promotions for higher boosts.

Yields can be strong on stablecoins and majors, frequently in the 5-10% range depending on the pool. Its analytics tools help track performance easily.

Key Factors to Compare When Choosing a Platform

Look at supported coins, fees, lockup periods, and security features. Centralized platforms like Binance or Coinbase prioritize ease, while decentralized ones like Lido offer more control. Always check real-time rates on sites like Staking Rewards, as they change with network demand.

Risks to Keep in Mind

Staking isn’t risk-free. Prices can drop while assets are locked, and there’s potential for slashing (penalties) on some networks if validators misbehave. Platform hacks or regulatory changes are rare but possible. Start small and diversify.

Final Thoughts: Start Your Staking Journey Today

With yields often outpacing traditional options, 2026 could be a great time to explore staking. Pick a platform that matches your comfort level, research current rates, and remember: patience pays off as rewards compound. Whether you’re dipping in with a small amount or building a bigger portfolio, these tools make earning from crypto more approachable than ever.