Japan just made one of the biggest crypto-friendly moves in years. Starting in 2026, most individual crypto investors will no longer pay tax every time they trade one coin for another, and profits could be taxed at a flat 20 % instead of up to 55 %. If you’ve ever felt crushed by Japan’s old “miscellaneous income” rules, this is the light at the end of the tunnel.

Here’s exactly what changed, why it matters to everyday holders and traders, and what you still need to watch out for.

The Old System – Why Everyone Was Complaining

Until now, crypto profits in Japan were classified as “miscellaneous income” (雑所得). That meant:

- Tax rates from 15 % up to 55 % (national + local tax) depending on your total income

- You had to pay tax the moment you swapped BTC for ETH or used crypto to buy anything

- No loss carry-forward – one bad trade could wipe you out tax-wise even if you lost money overall

Result? Many Japanese traders moved abroad or simply stopped trading.

The Game-Changing 2025 Tax Reform (Effective 2026)

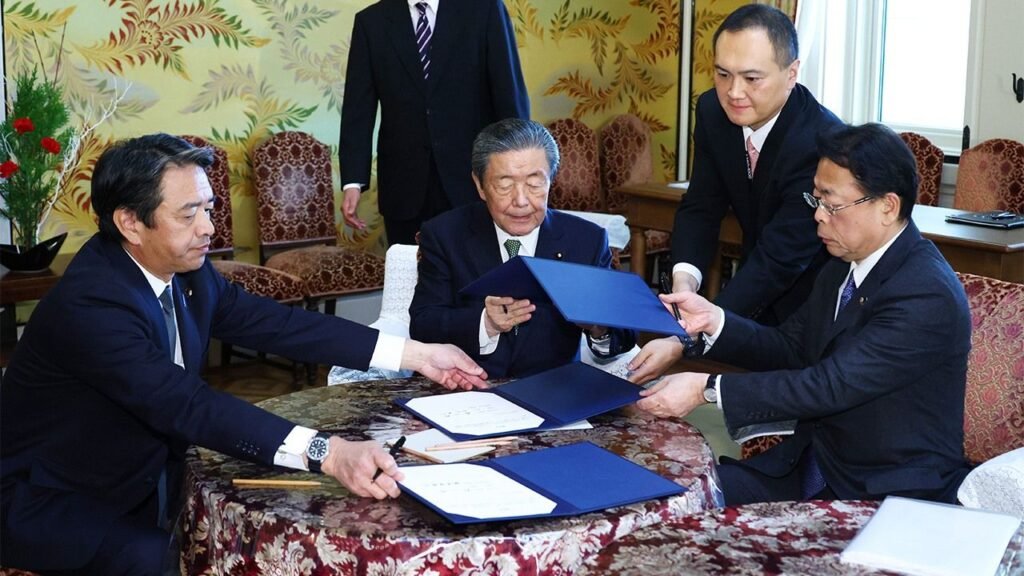

In December 2024, Japan’s Tax Commission officially approved the long-awaited reform. The new rules were written into the 2025 Tax Reform Outline published by the Ministry of Finance.

1. New “Financial Assets” Classification for Most Crypto

Most cryptocurrencies will be re-classified from “miscellaneous income” to “declaration-based separate taxation” (申告分離課税) – the same category as stocks and FX.

Key benefits:

- Flat 20 % tax rate + 0.315 % local tax → total approximately 20.315 %

- Crypto-to-crypto trades become tax-free events (only taxed when you cash out to yen)

- Losses can be carried forward for 3 years

2. NFTs and Some Tokens Stay in “Miscellaneous Income”

Not everything gets the sweet deal:

- NFTs (especially collectibles and art)

- Stablecoins that pay interest or yield

- Certain DeFi and staking rewards

These will still be taxed at your regular income-tax bracket (up to 55 %).

3. Third-Party Reporting Starts 2027

From 2027, Japanese and foreign exchanges operating in Japan must report user transactions to the National Tax Agency (NTA) – similar to the U.S. IRS system. This makes hiding impossible but also simplifies filing for honest users.

What This Means for You – Real-Life Examples

Example 1 – Active Trader 2025 (old rules): You buy 1 BTC → trade for 10 ETH → trade for SOL → cash out. You owe tax on every single trade even if you’re still down overall.

2026 (new rules): All the intermediate trades are tax-free. You only pay ~20 % when you finally sell for yen.

Example 2 – Long-Term HODLer Nothing really changes for you except the tax rate drops from possibly 45–55 % down to 20 % when you eventually sell.

Japanese salaryman happily checking crypto portfolio on phone

Remaining Pain Points (Yes, It’s Not Perfect)

- No special treatment for staking or lending rewards yet (still miscellaneous income in many cases)

- Corporate crypto holdings still taxed differently

- Foreign exchanges that don’t comply with reporting may get blocked in Japan

The Japan Cryptoasset Business Association (JCBA) is already lobbying for Phase 2 reforms in 2026 to include staking rewards in the 20 % bracket.

Timeline – Mark Your Calendar

| Date | What Happens |

|---|---|

| Dec 2024 | 2025 Tax Reform officially approved |

| Tax year 2026 | New 20 % separate taxation applies |

| 2027 onward | Exchanges start automatic reporting to NTA |

Final Thoughts – Japan Just Became Asia’s Crypto Tax Haven (Almost)

With Singapore at 0 % (for individuals), Hong Kong at 16–17 %, and South Korea still debating 20 %, Japan’s new ~20 % flat rate with tax-deferred crypto-to-crypto trades is suddenly one of the most competitive regimes in Asia.

If you live in Japan and hold crypto, 2026 is going to feel like a completely different world.

Want to read the official documents yourself? → Ministry of Finance 2025 Tax Reform (Japanese):

Save this page – you’ll want to show it to your accountant next year.

Originally published November 17, 2025 – will be updated when final legislation details are released.