You’ve been scrolling through your crypto portfolio, heart sinking as red candles dominate the screen. Bitcoin’s flirting with new highs, yet most altcoins feel stuck in a time warp—trapped way below their glory days from 2021 or earlier pumps. As of November 12, 2025, a fresh stat hits hard: 72 out of the top 100 cryptocurrencies by market cap are still nursing wounds deeper than 50% from their all-time peaks. Is this the ultimate fire sale for patient hunters, or a graveyard warning to steer clear?

This isn’t ancient history; Galaxy Research dropped the bombshell just last week, spotlighting how the post-2021 hype bubble left scars that haven’t healed despite Bitcoin’s rally. While giants like BTC and ETH hover within spitting distance of records, the rest? They’re begging the question: time to load up on discounted gems or dodge potential dead-ends?

The Stark Reality Behind the 72% Bloodbath

Pull up any major tracker like CoinMarketCap or CoinGecko today, and the numbers don’t lie. Out of the elite top 100, only 28 have clawed back to respectable levels—think new ATHs or drops under 30%. The other 72? They’re languishing 50-95% off peaks, victims of overinflated launches, token unlocks flooding supply, and faded narratives from the last bull frenzy.

Galaxy’s chart paints a brutal picture: Mid-tier players like Filecoin (FIL), Internet Computer (ICP), and The Graph (GRT) are down a gut-wrenching 80-95%. Even former darlings Polkadot (DOT), Avalanche (AVAX), and Cardano (ADA) hover 70%+ below highs. It’s not just numbers—it’s billions in evaporated value, with over 3.7 million tokens “dead” since 2021, including 1.8 million flops in Q1 2025 alone.

Why So Many Coins Are Still Hurting Deeply

Blame it on the cycle’s cruel math. The 2021 mania saw projects launch with sky-high valuations on hype alone—think meme coins and unproven Layer 1s. Fast-forward: Unlocks dilute supply, rugs pull the rug, and real utility fails to materialize. As Taiki Maeda from HFA Research mapped out, recovery paths favor BTC dominators first, leaving alts in the dust until liquidity floods back.

Overhyped Launches and Token Floods

Easy platforms like pump.fun birthed millions of tokens with zero staying power. Result? 52% of all post-2021 creations are ghosts, dragging down survivors.

Faded Narratives in a BTC World

Sectors like gaming, AI agents, and metaverses promised the moon but delivered crumbs. Meanwhile, Bitcoin’s ETF inflows and dominance (nearing 59%) suck oxygen from the room.

Macro Hangovers

Post-Trump euphoria faded with thin liquidity and AI stock wobbles spilling over, wiping recent gains.

The Bargain Hunter’s Case: Hidden Opportunities?

Flip the script—deep discounts scream “buy low” for contrarians. History rhymes: Post-2018 crashes birthed 2021’s monsters. Coins down 80%+ often 10-100x in the next wave if fundamentals hold.

- Undervalued Utility Plays: Chains like Solana (if recovered) or underrated DeFi protocols could explode with real adoption.

- Institutional Teasers: Spot ETFs for alts (XRP, SOL filings) hint at incoming billions.

- Cycle Timing: Analysts like those at CoinDesk see altseason brewing late 2025 as BTC cools.

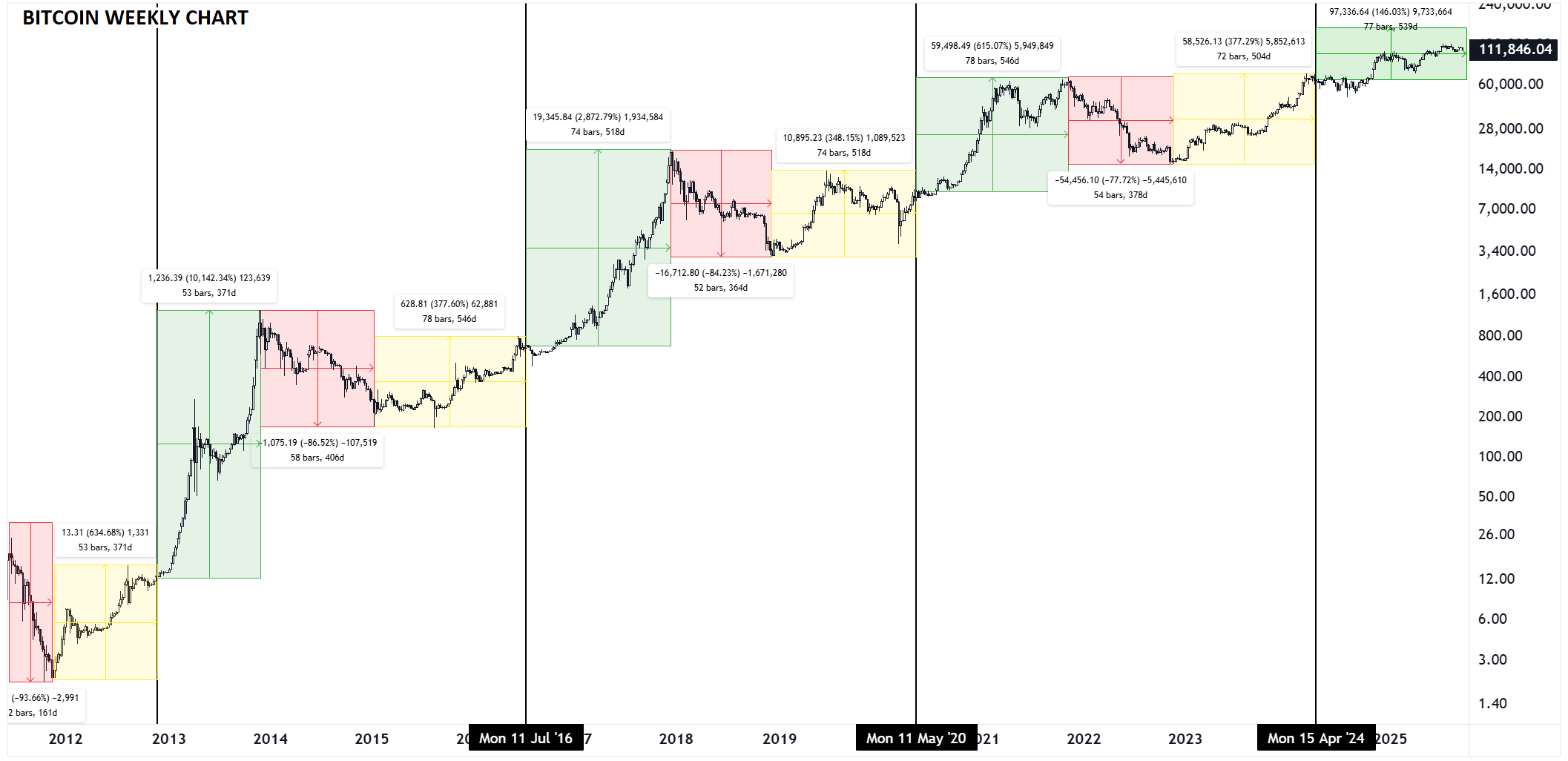

As one TradingView chart shows halving cycles, we’re mid-phase—dips precede parabolic legs.

The Trap Warning: Why Caution Rules

Not every beaten-down coin rebounds. Traps abound:

Permanent Impairment

Rug pulls, abandoned dev teams, or regulatory hammers (hello, SEC) turn discounts into zeros.

Liquidity Black Holes

Low-volume alts trap funds—can’t sell without tanking price further.

Opportunity Cost

Parking in 90% losers while BTC or fresh narratives (AI, RWAs) moon? Painful FOMO.

Experts at Bloomberg warn: If tech stocks crack, crypto follows deeper.

Spotting Bargains vs. Avoiding Traps: Your Playbook

Research beats hype:

Green Flags for Bargains

- Strong dev activity (GitHub commits)

- Growing TVL/users

- Upcoming catalysts (upgrades, partnerships)

Red Flags for Traps

- Heavy unlocks ahead

- Dying volume/socials

- No real-world use

Tools like CoinGecko’s ATH tracker or DefiLlama help scan.

The Million-Dollar Question in November 2025

These 72 battered warriors split the crypto crowd: Bargain bin for legends-in-waiting or traps disguised as deals? Truth? A mix—selective dipping in proven survivors could pay off huge when altseason ignites. But blind buying the dip? Recipe for more pain.

Dollar-cost into quality, stay diversified, and watch BTC dominance like a hawk. The market’s whispering opportunities amid the wreckage—listen closely, act wisely, and this “trap” might just spring into your biggest win yet. What’s your take—loading up or laying low? The cycle’s far from over.