Meta Description: Discover how Federal Reserve decisions shape Bitcoin, Ethereum, and global crypto prices in simple terms. Real-world examples, charts, and expert insights inside.

Introduction: Why Your Bitcoin Wallet Feels the Fed’s Pulse

Imagine checking your crypto app at 2:15 PM on a random Wednesday—only to see Bitcoin plunge 8% in minutes. You didn’t sell. You didn’t panic. But someone in a marble building in Washington, D.C., just pressed a button that rippled across the planet.

That “someone” is the Federal Reserve. And that “button”? It’s not a sci-fi weapon—it’s a press release about interest rates or liquidity.

This guide isn’t for Wall Street wizards. It’s for the pizza delivery guy holding 0.02 BTC, the teacher with an Ethereum stake, and the retiree wondering why their stablecoin yield just vanished. We’ll break down exactly how the Fed moves your money—without the jargon.

H2: What Actually Happens When the Fed “Pauses Liquidity”?

H3: The Fed’s Three Magic Levers (Explained Like You’re 12)

- Interest Rates – Think of this as the “cost of borrowing money.”

- High rates → Borrowing hurts → People sell risky stuff (like crypto) to pay loans.

- Low rates → Free money → Everyone YOLO’s into Dogecoin.

- Quantitative Easing (QE) – The Fed prints dollars to buy bonds. → More cash in the system → Stocks and crypto moon.

- Balance Sheet Runoff – The opposite: Fed shrinks its money pile. → Less cash floating around → Crypto winter vibes.

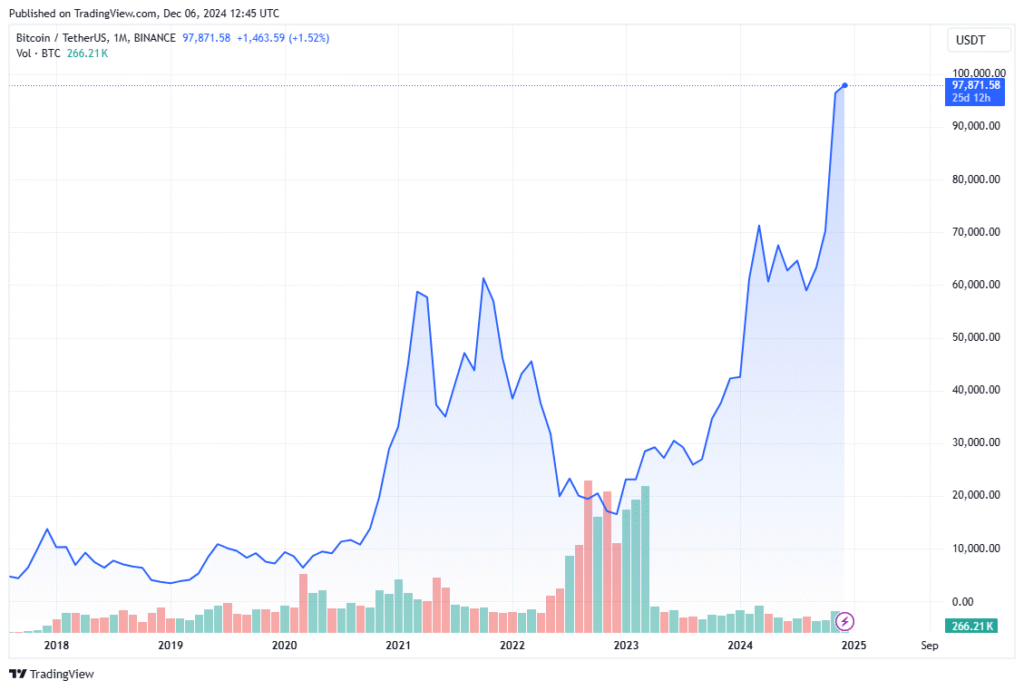

Real Example: In March 2020, the Fed unleashed $3 trillion in QE. Bitcoin? From $5,000 to $69,000 in 18 months. Source: Federal Reserve Economic Data (FRED), 2021

H2: Crypto’s Love-Hate Relationship with the Dollar

H3: Why Bitcoin Hates a Strong Dollar (But Pretends Not to Care)

Bitcoin was born to kill the dollar. Yet it dances to the dollar’s tune.

- DXY Index ↑ (strong dollar) → Foreign investors sell BTC to buy USD.

- DXY Index ↓ → Dollar weakens → Crypto becomes the “cool kid” again.

Stat: Every 1% rise in DXY correlates with a ~2.3% drop in BTC (2021–2024). Source: CoinMetrics State of the Network, Issue 214

H3: Stablecoins Aren’t So “Stable” When Rates Spike

You think USDT or USDC are safe? Think again.

- High yields on Treasury bills → Investors ditch 0%-yielding stablecoins.

- Result: Stablecoin supply shrinks → Less fuel for DeFi and trading.

H2: Reading the Fed’s Tea Leaves: 3 Signals Every Crypto Holder Must Watch

H3: 1. The Dot Plot (Yes, It’s a Real Thing)

Every quarter, Fed members draw dots on a chart guessing future rates.

- Dots shift up → Sell signal.

- Dots flatline → Hold.

- Dots down → Buy the dip.

Pro Tip: Bookmark federalreserve.gov/monetarypolicy/fomcprojtabl.htm — it’s free.

H3: 2. Powell’s Eyebrows (Half-Kidding, Half-Serious)

Watch the press conference. If Jerome Powell:

- Says “transitory” → Buy.

- Says “pain” → Hide.

H3: 3. The 2-Year Treasury Yield

Crypto tracks this bond more than Bitcoin tracks Elon’s tweets.

- Yield > 4.5% → Risk-off.

- Yield < 2% → Risk-on.

H2: Case Studies: When the Fed Broke (or Saved) Crypto

H3: 2022 – The Great Crypto Unwind

- Fed hiked rates 7 times.

- Three Arrows Capital, Celsius, FTX → Dead.

- Bitcoin: $69K → $15K.

“The Fed didn’t kill crypto. It killed leverage.” — Lyn Alden, Macro Analyst, 2023

H3: March 2023 – Banking Crisis → Fed Pivot

- SVB collapses.

- Fed launches BTFP (emergency loans).

- Bitcoin +80% in 3 months.

H2: Action Plan: What Should You Do Before the Next Fed Meeting?

| Your Risk Level | Fed Tightening | Fed Easing |

|---|---|---|

| Conservative | Move to USDC → T-Bills | Hold 20% cash for dips |

| Moderate | Reduce leverage 50% | DCA on -20% drops |

| Aggressive | Short BTC futures | Go 100% altcoins |

Never risk rent money. The Fed doesn’t send apology cards.

Conclusion: The Fed Isn’t Your Enemy—Ignorance Is

The Federal Reserve won’t tweet “Buy Bitcoin.” But its every word moves your portfolio.

Bookmark this page. The next FOMC meeting is [insert date via Fed calendar]. Set a reminder. Watch the dot plot. Check the 2-year yield.

Because in crypto, the house always wins—unless you learn to read the dealer’s cards.

References (APA Style):

- Federal Reserve Bank of St. Louis. (2024). FRED Economic Data. https://fred.stlouisfed.org

- CoinMetrics. (2024). State of the Network, Issue 214. https://coinmetrics.io

- Alden, L. (2023). Broken Money. Lysander Press.