Remember that feeling when a sudden storm ruins a perfect day at the park? That’s how crypto investors felt on October 10, 2025, when a geopolitical thunderclap from Washington sent digital assets tumbling like dominoes. In mere hours, over $19 billion vanished in liquidations as Bitcoin and its peers nosedived, marking what experts call the most brutal single-session wipeout in crypto history. But why did a trade spat between two superpowers hit your wallet so hard? This isn’t just trader talk—it’s a wake-up call about how global politics can shake everyday investments. We’ll unpack the chaos step by step, showing how words from the White House turned into market mayhem.

The Sudden Storm: What Happened in the Market

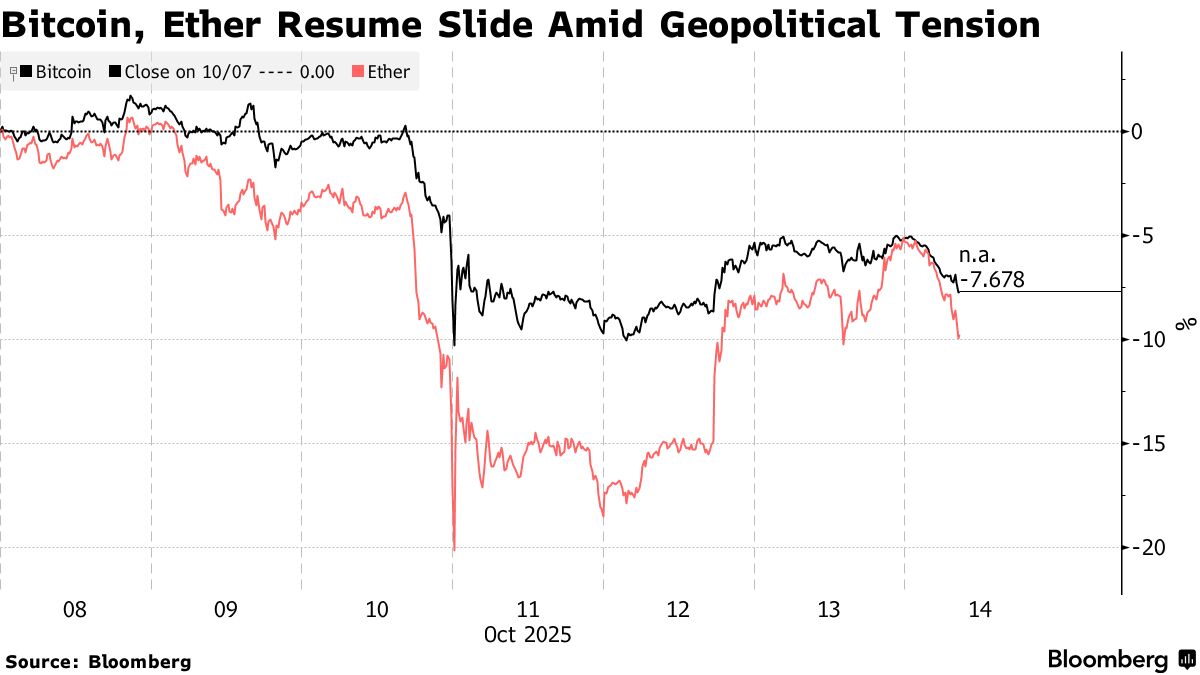

It started like any other Friday, but by the end of October 10, the crypto world was reeling. Bitcoin, the king of coins, plunged about 10% from around $122,000 to as low as $104,000, while Ethereum dropped nearly 15%, Solana cratered 25%, and XRP fell over 40%. The total market cap shed up to $150 billion, with leveraged bets—trades borrowed on margin—getting wiped out to the tune of $19 billion in liquidations. That’s more forced sales in a few hours than some entire market dips in the past.

For the average person, imagine borrowing money to bet on a stock, only for a surprise announcement to tank it, forcing you to sell at a loss. That’s what happened to over 1.6 million traders worldwide, many of whom were caught off guard by the speed of the decline. It wasn’t a slow bleed; it was a flash crash, amplified by automated trading bots that sell when prices dip too fast.

The Spark: Trump’s Tariff Bombshell

The trigger? President Donald Trump’s unexpected vow to slap 100% tariffs on all Chinese imports, escalating a simmering trade war. This came as a response to China’s moves on export controls, but it sent shockwaves through global markets. Stocks, bonds, and even gold wobbled, but crypto—seen as a “risk-on” asset—took the hardest hit.

Why does this matter? China is a manufacturing giant, and higher tariffs mean pricier goods for Americans, potential job shifts, and slower global growth. Investors panicked, pulling money from volatile assets like crypto to safer havens. Trump’s words weren’t new—trade tensions have brewed since 2018—but this 100% hike felt like pouring gasoline on a fire, especially with elections looming.

How Geopolitics Crushes Crypto

Crypto isn’t isolated—it’s tied to the broader economy. When US-China relations sour, it ripples out: Chinese firms might face restrictions, US tech stocks (big crypto holders) drop, and uncertainty breeds fear. In this case, the announcement broke crypto’s “safe-haven” myth, as it decoupled from gold and dove alongside risky tech shares.

Leverage played a villainous role too. Many traders use borrowed funds to amplify gains, but when prices fall, exchanges force sales to cover loans, creating a downward spiral. Add in weekend timing—when markets are thinner—and you get amplified chaos. For ordinary investors, this shows crypto’s youth: It’s more sensitive to news than traditional stocks, where regulations buffer shocks.

The Human Toll: Who Got Hurt and Why

Beyond numbers, real people felt the pain. Small holders saw portfolios shrink overnight, while big players like hedge funds faced massive losses. In Asia, where China influences heavily, exchanges reported record outflows. Even stablecoins wobbled slightly, though they held pegs.

Why so vulnerable? Crypto lacks the safety nets of banks—no central authority to intervene. Plus, with China’s past bans on mining and trading, any US move reignites fears of a global crackdown. Yet, for newcomers, this dip could be a buying opportunity, as history shows crashes often precede booms.

Signs of Recovery and What Comes Next

By October 13, markets clawed back some ground as Trump tempered his stance, hinting at negotiations, and China responded measuredly. Bitcoin rebounded above $110,000, proving crypto’s resilience. Analysts predict volatility ahead, especially if tariffs stick, but others see it as a shakeout of weak hands.

For you, the lesson? Diversify—don’t put all eggs in crypto. Stay informed on global news, as politics now directly sways digital wallets. If tensions ease, expect a rally; if not, brace for more turbulence.

Lessons from the Wreckage: Protecting Your Investments

This crash underscores crypto’s double-edged sword: High rewards come with high risks. Start small, use stop-loss orders to limit losses, and avoid leverage if you’re new. Follow reliable sources for updates, and remember: While US-China spats grab headlines, they’re part of a bigger picture including regulations and tech shifts.

In the end, this event might push for more mature markets, with better tools against shocks. For now, it’s a reminder that in our connected world, a tweet from D.C. can echo in your app notifications—stay vigilant, and turn knowledge into your best defense.