Forget the rollercoaster—Bitcoin’s latest climb feels more like a rocket launch, blasting past $120,000 and leaving investors buzzing with that familiar mix of excitement and “what if?” As of October 8, 2025, BTC’s 15% weekly gain has the whole market humming, pulling altcoins along for the ride. But here’s the real spark: While Bitcoin steals the spotlight, savvy folks know the true gems hide in the shadows of Ethereum, Solana, and beyond. If you’re dipping your toes into crypto without chasing every headline, these five picks stand out for their real-world grit, tech upgrades, and potential to turn heads in this “Uptober” frenzy. Let’s dive in and spot the winners before the crowd does.

Why Bitcoin’s Boom Means Altcoin Season Is Knocking

Bitcoin doesn’t just rise; it lifts the tide. With institutional cash flooding in—think BlackRock’s ETF inflows topping $2 billion last month—BTC’s momentum often sparks an “altseason” where smaller coins catch fire. A recent CoinCodex analysis of over 200 cryptos highlights how quality projects with strong tech and ecosystems thrive in these waves, potentially delivering 20-50% short-term pops. We’re talking real utility here: faster payments, smarter contracts, and ecosystems that power everything from DeFi apps to global remittances.

But timing matters. October’s historically kind to crypto (hello, “Uptober”), and with SEC ETF decisions looming for altcoins, the stage is set. These picks aren’t moonshots; they’re grounded bets on innovation that’s already proving its worth.

1. Ethereum (ETH): The Backbone of Web3 Innovation

Ethereum isn’t flashy—it’s foundational, like the operating system running your phone. As the go-to for smart contracts, DeFi, and NFTs, ETH powers a $500 billion+ ecosystem that’s only getting nimbler. The upcoming Pectra upgrade, slated for late 2025, promises even lower fees and better scalability, drawing in more developers and users.

What’s Fueling ETH’s Next Leg Up?

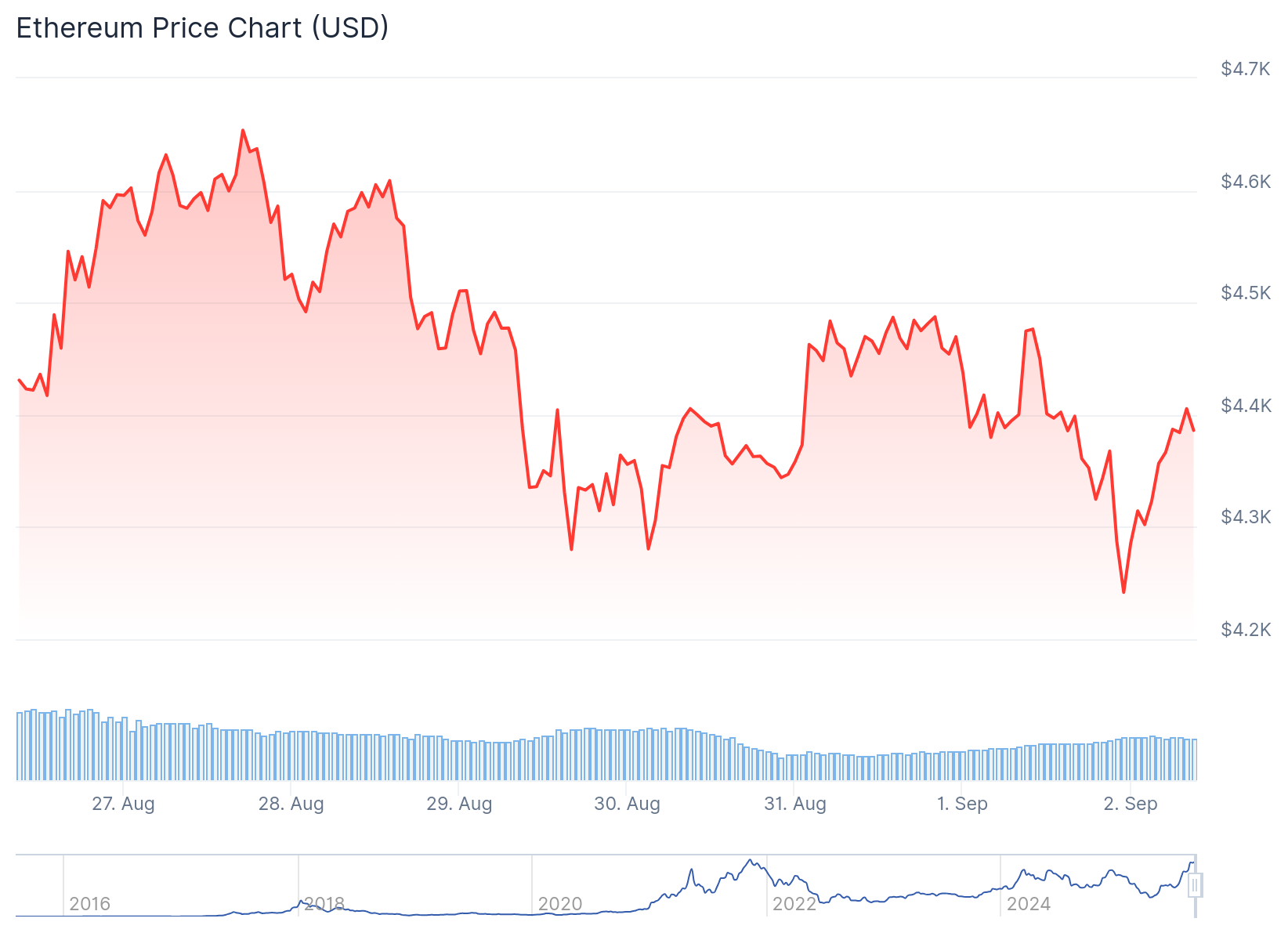

At around $4,500, ETH’s up 36% year-to-date, but analysts eye $5,500 by mid-October if resistance at $4,600 cracks. BlackRock’s ETH ETF has already funneled billions, and with Layer 2 solutions like Optimism slashing costs, it’s primed for everyday adoption. Imagine seamless global loans or digital art sales—ETH makes that happen without the hassle.

For the average investor, ETH’s a safe-ish bet in a volatile sea—diversified, battle-tested, and ready to ride Bitcoin’s coattails higher.

2. Solana (SOL): Speed Demon of the Blockchain World

If Ethereum’s the reliable sedan, Solana’s the sports car—blazing fast and cheap to run. Clocking thousands of transactions per second at under a penny each, SOL’s ecosystem exploded with DeFi hubs, meme coins, and NFT drops. The Alpenglow upgrade just cranked speeds to near-instant, making it a favorite for high-volume trading.

Why SOL Could Outpace the Pack

Trading near $230 with a $252 billion market cap, Solana’s notched 21% gains this year, and whispers of SOL ETFs could push it to $300 by month’s end. Institutions like VanEck are stacking SOL, betting on its edge in gaming and payments. Picture frictionless mobile apps or viral social tokens—Solana’s built for that digital hustle.

It’s not without hiccups (remember those outages?), but for growth chasers, SOL’s the thrill worth the ticket price.

3. Binance Coin (BNB): The Utility Powerhouse Tied to Crypto’s Giant

BNB isn’t just a token—it’s your VIP pass to the world’s biggest exchange. From slashing trading fees to unlocking exclusive launches, BNB fuels the Binance empire, now a full-fledged chain for cheap, speedy apps. Quarterly burns have trimmed supply by 20% since 2023, adding scarcity to the mix.

BNB’s Path to New Heights

Hovering at $1,320 with an $184 billion cap, BNB’s surged 87% in 2025, flirting with its all-time high. As Binance expands merchant tools and staking rewards, it’s eyeing $1,500 if altcoin hype builds. Think of it as crypto’s Swiss Army knife—versatile for traders and builders alike.

In a Bitcoin-led rally, BNB’s exchange ties make it a steady climber for portfolio builders.

4. XRP: The Cross-Border Payment Prodigy

XRP flips the script on slow, pricey wires—settling in seconds for fractions of a cent. Backed by Ripple’s network of banks and remittance firms, it’s the go-to for global money moves, with real traction in Asia and Latin America.

XRP’s Regulatory Tailwinds

At about $1.20, XRP’s poised for a rebound post-SEC clarity, with forecasts hitting $2-3 by year-end if ETF nods come through. On-Demand Liquidity tools are already handling billions in transfers. It’s like upgrading from snail mail to email for finance—efficient and borderless.

For risk-averse folks eyeing practical crypto, XRP’s enterprise focus shines.

5. Cardano (ADA): The Sustainable Smart Money Bet

Cardano’s all about doing things right—peer-reviewed research drives its upgrades, from energy-efficient staking to Africa-focused identity tools. With Voltaire governance live, ADA holders now vote on the future, blending academia with accessibility.

ADA’s Quiet Momentum

Priced around $1.50 with a growing DeFi scene, Cardano could double if ETF buzz materializes, per October outlooks. Projects in education and supply chains add real-world glue. It’s the thoughtful choice in a hype-filled market—like investing in a library that pays dividends.

Navigating the Highs: Smart Tips Amid the Hype

These picks pack punch, but crypto’s no sure thing—volatility can wipe smiles overnight. A CryptoNews report warns that while rallies average 30% in Uptober, dips hit 20% just as fast. Diversify, stake for yields, and never bet the farm. Tools like CoinMarketCap can track flows, keeping you ahead of the curve.

As Bitcoin’s roar echoes, these altcoins whisper opportunity. Whether you’re building wealth or just curious, watching them now could be your edge. What’s your first move—ETH for stability or SOL for speed? The market’s open; your call.

Insights based on data as of October 8, 2025. Crypto investments carry risk; do your homework and consider professional advice.