Imagine a world where your everyday bets on sports events or political outcomes aren’t just casual wagers with friends, but smart investments tied to real-world results—all powered by blockchain. That’s the exciting shift Coinbase is gearing up for with its December 17 announcement, blending crypto with prediction markets and tokenized stocks to make trading more accessible and fun for everyone, from beginners to seasoned investors.

This isn’t just another update; it’s a game-changer designed to pull more people into the crypto space by merging traditional finance with digital innovation. As crypto markets face ups and downs, Coinbase’s move could spark renewed interest and stabilize engagement.

Coinbase

What Exactly Is Coinbase Unveiling on December 17?

Coinbase, the leading U.S. crypto exchange, is set to launch two major features: prediction markets and tokenized stocks. These tools aim to expand beyond basic crypto buying and selling, turning the platform into an “everything exchange” where users can trade a wider variety of assets seamlessly.

According to reports, the announcement will happen during a livestream event on December 17, 2025, highlighting Coinbase’s push to diversify amid fluctuating crypto sentiments. This comes at a time when investor interest in digital assets has cooled, with Bitcoin dipping to around $85,000 in early December—its lowest since March.

Diving into Prediction Markets

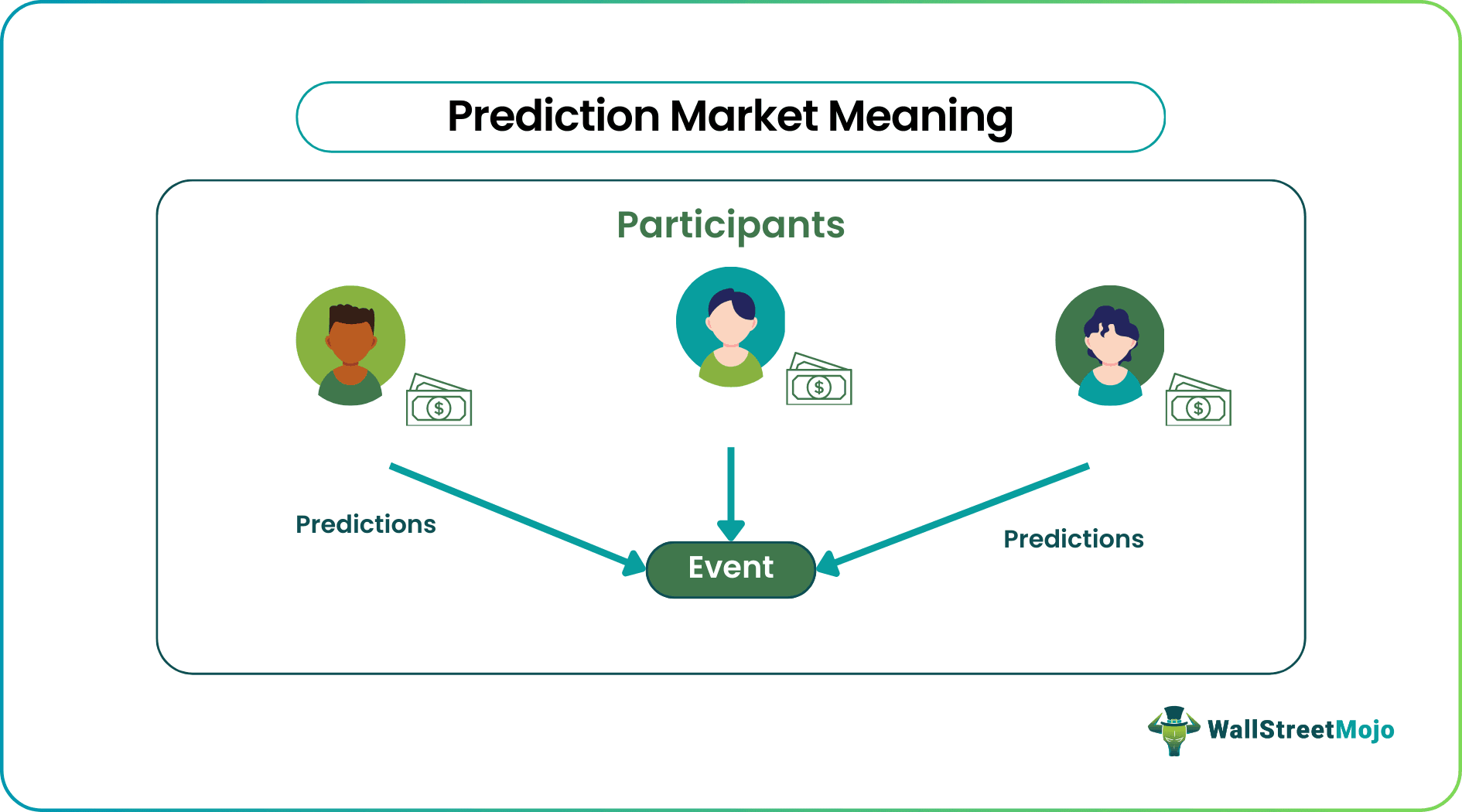

Prediction markets let users bet on the outcomes of real-world events, like elections, sports games, or even weather patterns. Think of it as a stock market for predictions: you buy “yes” or “no” shares on whether something will happen, and the market price reflects the crowd’s wisdom on the probability.

Coinbase is partnering with Kalshi, a U.S.-based prediction market operator, to power this feature. This isn’t new to finance—prediction markets have been around for years—but integrating them with crypto makes them faster, cheaper, and available 24/7. For everyday folks, it’s like turning your gut feelings into potential profits without needing a fancy degree in economics.

Prediction Market – What Is It, Examples, Types, How it Works?

Recent data shows prediction market volumes have surged by over 32% monthly, signaling growing demand for these tools as alternatives to volatile crypto trading. Coinbase’s entry could democratize this, making it easier for newcomers to engage without high barriers.

The Rise of Tokenized Stocks

On the flip side, tokenized stocks represent real-world shares (like Apple or Tesla) converted into digital tokens on the blockchain. This means you can trade them anytime, anywhere, without traditional stock market hours or hefty fees.

Coinbase plans to issue its own tokenized equities in-house, unlocking global liquidity and enabling round-the-clock trading. For the average person, this bridges the gap between crypto and stocks—imagine buying a fraction of a Google share with your Bitcoin holdings, all in one app. It’s perfect for those dipping their toes into investing but intimidated by Wall Street jargon.

What Are Tokenized Stocks? A Comprehensive Guide | Webopedia

Experts note that this aligns with broader trends in real-world asset (RWA) tokenization, which could attract billions in new capital by making assets more liquid and inclusive.

How These Features Supercharge Crypto Engagement

Coinbase’s strategy is all about making crypto less intimidating and more integrated into daily life. By adding prediction markets, users get a fun, low-stakes way to learn about blockchain while potentially earning rewards. Tokenized stocks, meanwhile, draw in traditional investors curious about crypto but wary of its volatility.

This dual approach could boost user retention—think of it as turning passive holders into active traders. With competitors like Robinhood and Gemini already in the mix, Coinbase is positioning itself as a one-stop shop, potentially increasing daily active users by blending entertainment with finance.

4 tips for safely investing in crypto | Fortune

From a broader perspective, as CEO Brian Armstrong envisions, this evolves Coinbase into a comprehensive financial app over the next decade, encouraging more people to explore crypto without feeling overwhelmed.

Potential Impacts and What It Means for You

For ordinary readers, this means easier access to diverse investments. No more waiting for market open times or dealing with multiple apps—everything in one place. However, it’s wise to start small, as with any investment, and understand the risks like market fluctuations.

Regulatory-wise, Coinbase is advocating for clear federal oversight through groups like the Coalition for Prediction Markets, ensuring these tools remain safe and transparent. This could set a precedent, making crypto more mainstream and trustworthy.

In summary, Coinbase’s December 17 reveal isn’t just about new products; it’s about rekindling excitement in crypto by making it relatable and rewarding. Whether you’re betting on the next big event or trading tokenized shares, this could be your entry point to a more engaging financial future. Keep an eye on the livestream for full details!