Ever stared at a stock ticker, wishing you could plug real-time economic headlines straight into your investment app without the middleman? Now, imagine that same feed powering smart contracts that adjust your DeFi loans based on fresh GDP numbers—automatically, securely, and at lightning speed. That’s the game-changing vibe from BNB Chain’s fresh team-up with Chainlink, announced on October 6, 2025. By piping verified U.S. economic stats like gross domestic product (GDP) and personal consumption expenditures (PCE) directly onto the blockchain, this duo is turning dusty government reports into live fuel for decentralized finance. For the average investor juggling day jobs and crypto curiosity, it’s like giving your portfolio a crystal ball tuned to Washington’s pulse. Let’s break down how this bridge between Wall Street whispers and blockchain bustle could redefine your money moves.

The Dynamic Duo: Why BNB Chain and Chainlink Make Sense Together

BNB Chain, the speedy backbone of Binance’s ecosystem, has long been a go-to for low-cost DeFi experiments—think quick swaps and yield farms without the Ethereum gas blues. Chainlink, on the other hand, is the oracle wizard, fetching off-chain data and slamming it onto blockchains with tamper-proof flair. Their October hookup? It’s Chainlink’s Data Standard unlocking official U.S. Bureau of Economic Analysis (BEA) feeds, streaming metrics straight to BNB Chain developers. No more relying on sketchy APIs or manual uploads; this is automated, audited truth serum for smart contracts.

What sparked it? BNB Chain’s push to blend real-world finance with crypto’s edge. As one of the top ecosystems by daily active users, it needed credible data to lure builders crafting everything from lending protocols to tokenized assets. Chainlink’s track record—securing over $50 billion in DeFi value—sealed the deal, ensuring BEA-sourced info hits the chain fresh and fraud-free.

Under the Hood: A Peek at the Tech Magic

At its simplest, Chainlink nodes grab BEA releases (like quarterly GDP tweaks), run them through verification layers, and broadcast to BNB Chain via secure oracles. Developers then weave this into dApps, all while keeping costs under a cent per query. It’s like upgrading from fax machines to fiber optics for economic intel.

From Reports to Riches: How U.S. Data Powers Smarter DeFi Plays

Picture betting on inflation trends without leaving your wallet app, or auto-adjusting a stablecoin’s peg to match PCE shifts. That’s the unlocked potential here. With GDP and PCE now on-chain, DeFi creators can spin up macro-tied tools that react in real time—think prediction markets wagering on Fed rate cuts or yield optimizers that hedge against growth slumps.

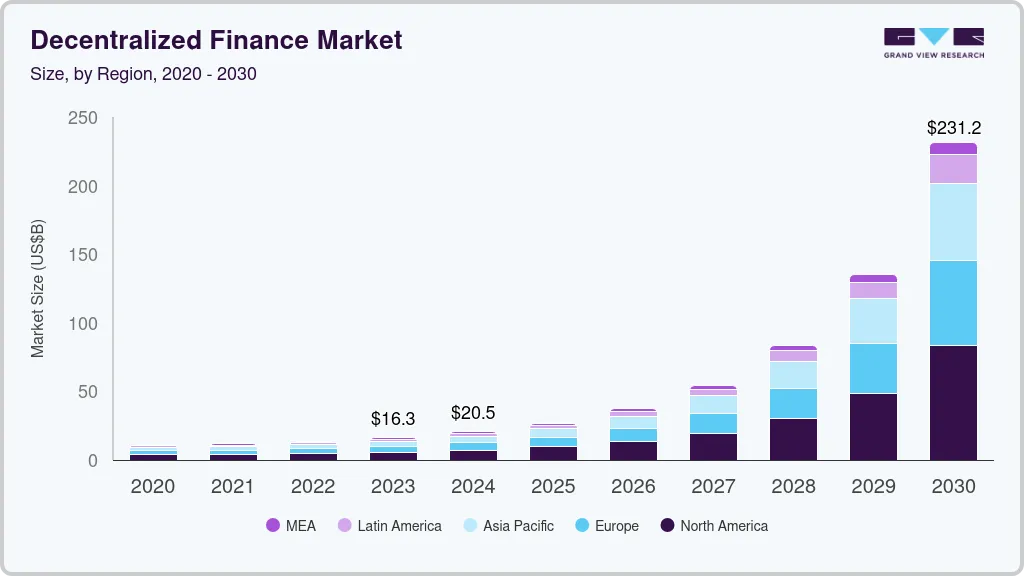

This isn’t pie-in-the-sky; it’s already brewing. Early adopters on BNB Chain are prototyping inflation-linked bonds and risk dashboards that pull BEA data to flag portfolio vulnerabilities. A Grand View Research forecast pegs the DeFi market exploding to $231 billion by 2030, with data integrations like this accelerating hybrid products that mix TradFi reliability with crypto’s openness.

Everyday Wins: Prediction Markets and Beyond

Take prediction markets: Users stake tokens on outcomes like “Will Q4 GDP top 3%?” with payouts tied to verified Chainlink feeds—no central bookie skimming the pot. Or risk management apps that scan PCE for spending signals, nudging you to rebalance before a downturn hits. These aren’t just geek toys; they’re tools for folks like you, making DeFi feel less like gambling and more like informed investing.

The Market Buzz: BNB’s Rally and What It Signals

News of the integration didn’t just ripple—it roared. BNB shot to a record $1,240 within hours, up 15% in a week, as traders bet on BNB Chain’s DeFi glow-up. Why the spike? Reliable data draws institutional eyes, promising more liquidity and fewer flash crashes for everyday users.

Looking wider, this could spark a wave of “RWA” (real-world asset) tokens pegged to U.S. benchmarks, from GDP-yield farms to PCE-adjusted loans. A Bitget analysis notes such bridges could funnel $10 billion into BNB DeFi by mid-2026, stabilizing the space for retail players. It’s a sign: Crypto’s maturing from meme frenzy to macro playground.

.

.

Why This Hits Home: Bridging the Gap for Regular Folks

If DeFi’s always felt like a black box—high yields, sure, but what’s the catch?—this integration flips the script. Verified U.S. data means transparent decisions: Borrow against expected GDP growth without wondering if the numbers are cooked. For global users, it’s a leveler, letting emerging markets tap American economic cues for better cross-border trades.

Plus, BNB Chain’s low fees (under $0.01 per tx) keep it accessible—no Wall Street wallet required. As Chainlink’s ecosystem grows, expect more chains to follow, democratizing data that once gated behind paywalls and suits.

The Road Forward: What’s Next in This Data Revolution?

As October’s “Uptober” heats up, watch for the first wave of BEA-fed dApps hitting BNB Chain testnets. Developers are buzzing about hybrid oracles blending U.S. stats with global feeds, potentially unlocking everything from climate-linked derivatives to supply chain hedges.

This isn’t just tech talk—it’s your invitation to a fairer financial frontier. Whether you’re staking for yields or building your first smart contract, BNB Chain and Chainlink are lowering the drawbridge. Dive in, but smartly: Start small, stay informed, and let the data do the heavy lifting.

Insights based on October 8, 2025, developments. DeFi involves risks like volatility and smart contract bugs—always DYOR and consult pros.