Imagine a world where your everyday banking app lets you seamlessly move money across borders in seconds, while another technology quietly powers trillions in secure transactions behind the scenes of global finance. As we look toward 2026, two standout projects in the crypto space—Chainlink and the emerging Digitap platform with its $TAP token—are capturing attention for very different reasons. One bridges blockchains to the real world; the other aims to bridge traditional banking to crypto users. Which one might shine brighter in the coming year?

This comparison breaks down their fundamentals, real-world applications, and growth potential in simple terms, helping everyday investors understand the opportunities ahead.

What Is Chainlink?

Chainlink is often called the “backbone” of decentralized applications. Launched in 2017, it solves a core blockchain problem: smart contracts can’t access real-world data on their own. Chainlink acts as a secure bridge, feeding reliable external information—like stock prices, weather data, or payment confirmations—into blockchains.

By late 2025, Chainlink secures over $95 billion in value across DeFi protocols and has enabled trillions in transactions, according to its official ecosystem data. Its native token, LINK, pays for these data services and incentivizes network participants.

Unlike many cryptos focused on hype, Chainlink’s strength lies in proven reliability and institutional trust.

What Is Digitap ($TAP)?

Digitap is a newer player, emerging in 2025 as a hybrid banking app that combines traditional finance with cryptocurrency. It offers users a single platform for holding fiat currencies, crypto, instant global transfers, and even physical or virtual Visa cards for spending assets anywhere.

The $TAP token powers the ecosystem: it’s used for lower fees, staking rewards, governance, and revenue-sharing burns (where app profits buy back and destroy tokens to reduce supply). With a fixed 2 billion token cap and a working beta app already connecting over 120,000 wallets, Digitap targets everyday users frustrated with slow cross-border payments or fragmented crypto-fiat experiences.

As of December 2025, its presale has raised millions, positioning it as a practical “global money app” for freelancers, travelers, and small businesses.

What is a blockchain oracle in crypto? | Coinbase

Key Differences: Technology and Use Cases

Chainlink’s Focus: Infrastructure for Blockchains

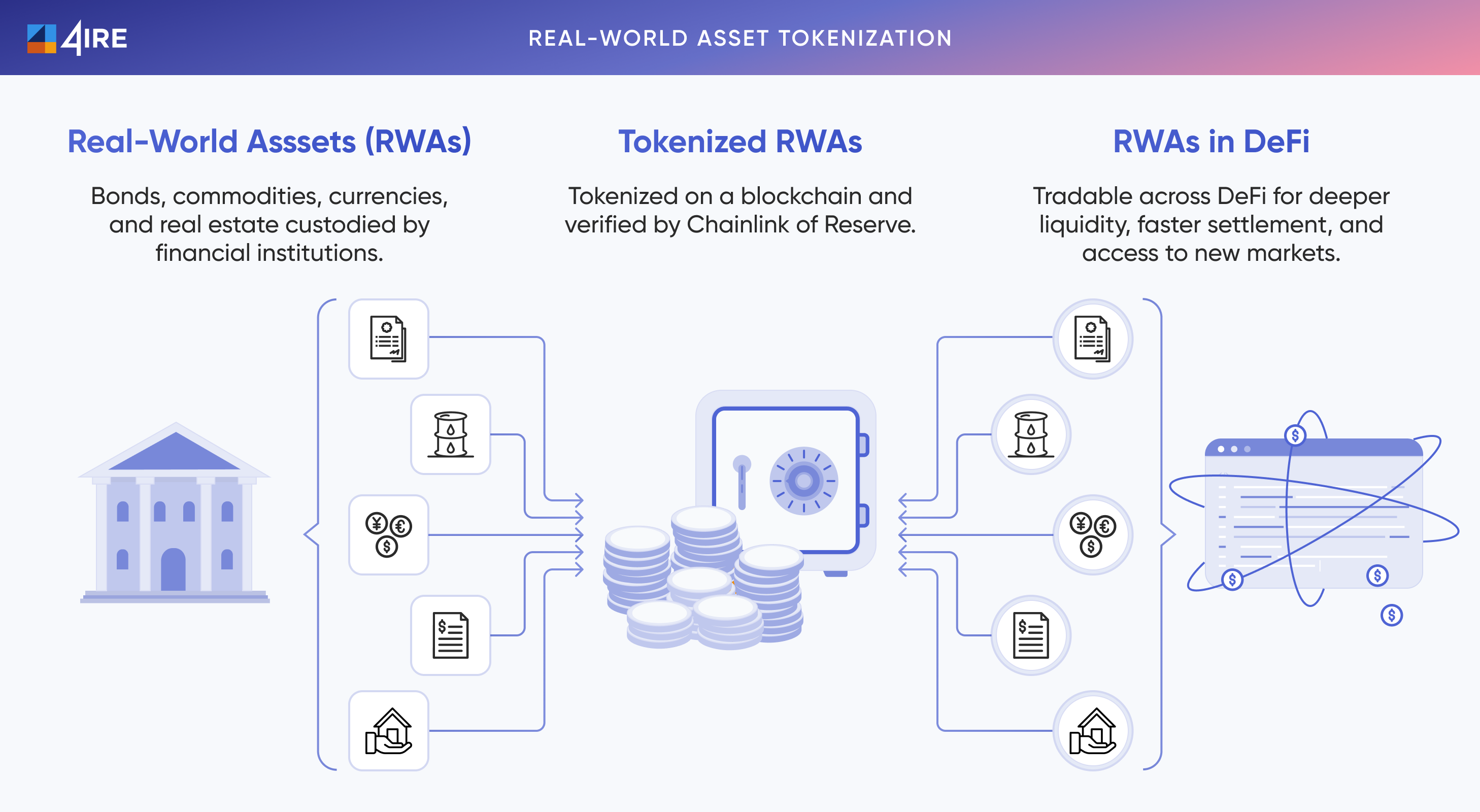

Chainlink excels in providing decentralized oracles and cross-chain tools. Its Cross-Chain Interoperability Protocol (CCIP) allows assets to move securely between blockchains, while services like Proof of Reserve verify that tokenized assets are fully backed.

In 2025, Chainlink powered major institutional pilots, including tokenized funds with banks like UBS and ANZ (source: Chainlink Blog, 2025 updates). It’s essential for DeFi lending, derivatives, and the growing real-world asset (RWA) tokenization market, projected to reach trillions by 2030.

Digitap’s Focus: User-Friendly Banking Layer

Digitap prioritizes accessibility. It uses blockchain for fast settlements but integrates traditional rails like SEPA and SWIFT. Features include no-KYC options for basic use, multi-currency IBANs, and a smart engine that routes transfers via the cheapest, fastest path.

$TAP holders benefit from deflationary mechanics—50% of app fees go toward token buybacks and burns—creating built-in demand as adoption grows.

While Chainlink builds the pipes for finance, Digitap delivers the faucet directly to consumers.

Real World Asset Tokenization (RWA): Benefits & Guide 2025

Adoption and Partnerships in 2025

Chainlink dominates with partnerships from Swift, Mastercard, Coinbase, and Euroclear, enabling on-chain purchases and tokenized settlements (sources: Chainlink press releases and PYMNTS.com, 2025). It holds over 67% of the oracle market share.

Digitap, though younger, has a live app downloadable on major stores, with rapid presale momentum and real-user connections. Its edge is in retail adoption, appealing to non-crypto natives needing seamless fiat-crypto bridges.

Outlook for 2026: Growth Potential

Chainlink’s Trajectory

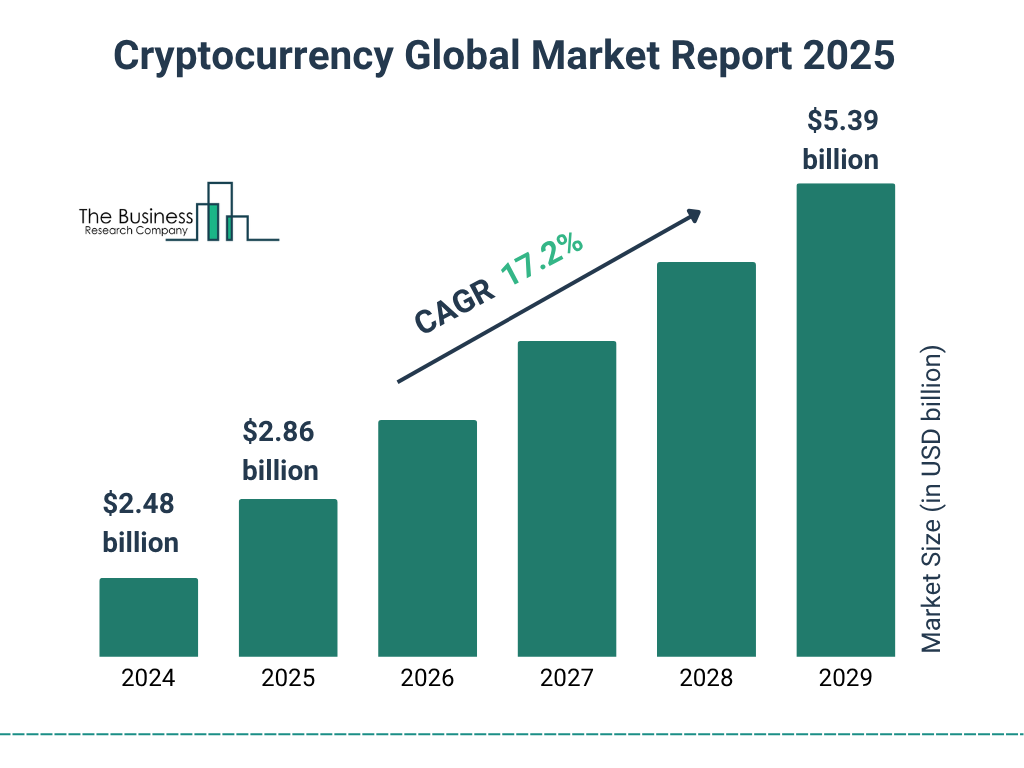

Analysts forecast LINK trading between $15–$50 in 2026, driven by RWA expansion and institutional inflows (sources: CoinCodex and TokenMetrics predictions, updated 2025). As tokenized markets merge TradFi and DeFi, Chainlink’s infrastructure could see explosive demand.

Digitap’s Trajectory

With its presale nearing completion and launch priced higher than current levels, $TAP offers early upside. Success hinges on user growth in global payments—a multi-trillion-dollar market. If it captures even a fraction, rewards and burns could drive significant value.

thebusinessresearchcompany.com

Which One for 2026?

Chainlink offers stability and proven scale for those betting on blockchain’s institutional future. Digitap appeals to those seeking practical, high-upside utility in daily finance.

Both address real needs: secure data for one, seamless money movement for the other. In a maturing crypto landscape, diversification across infrastructure (Chainlink) and applications (Digitap) could be smart. As always, research thoroughly—crypto remains volatile, but these projects stand out for tangible progress heading into 2026.